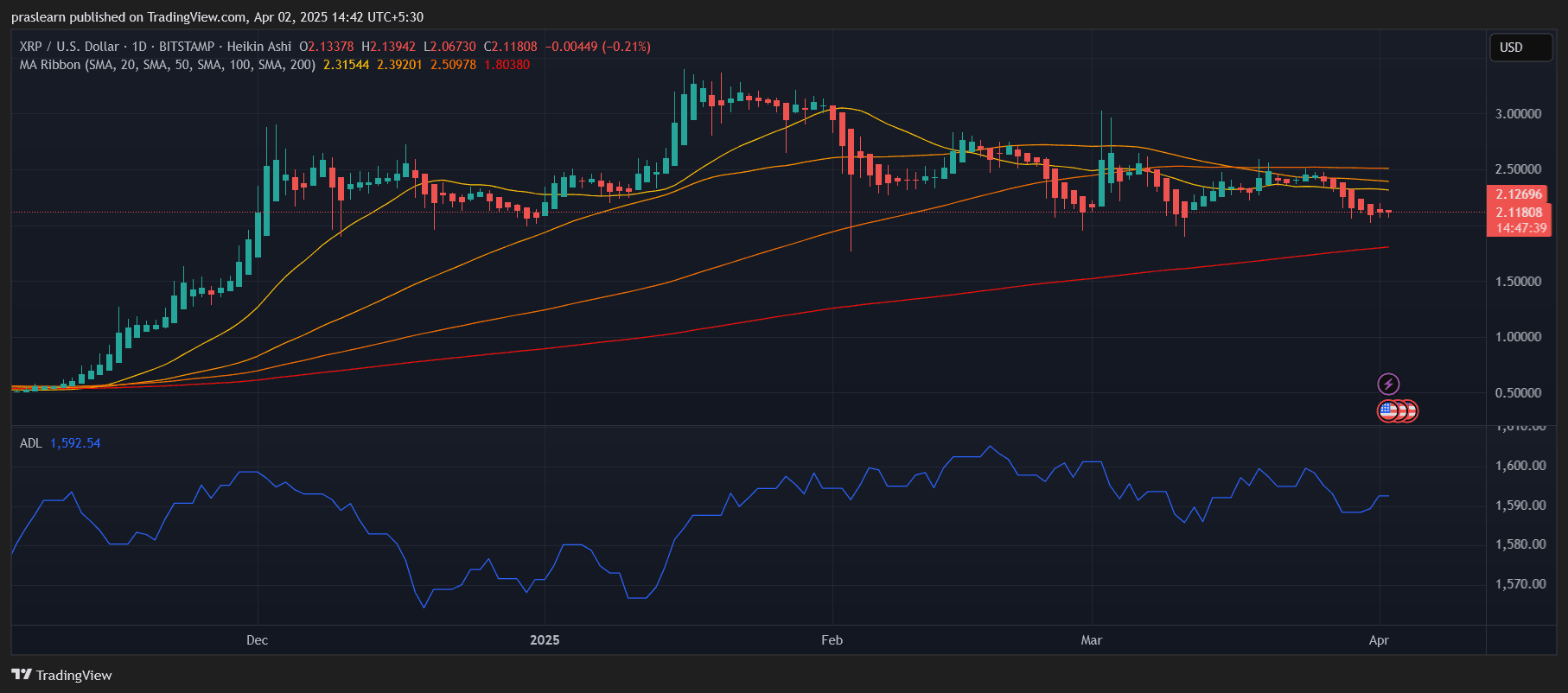

Ripple’s XRP has been shifting with noticeable hesitation not too long ago, struggling to reclaim its earlier bullish momentum. As of April 2, 2025, the each day chart reveals a tightly squeezed value zone simply above a vital help layer, hinting at a possible explosion — both upward or downward. This evaluation dives deep into XRP’s present construction utilizing Heikin Ashi candles, a number of shifting averages, and the Accumulation/Distribution Line (ADL) to foretell what may come subsequent for this main altcoin.

XRP Information As we speak: Is XRP Gearing Up for a Main Reversal or Simply Drifting Decrease?

XRP/USD Day by day Chart- TradingView

XRP/USD Day by day Chart- TradingView

The XRP/USD each day chart (Heikin Ashi format) showcases a fading bullish momentum transitioning right into a gradual, grinding downtrend. Heikin Ashi candles are significantly helpful right here as a result of they clean out volatility and expose the underlying development power extra clearly than conventional candles. The current sequence of smaller-bodied pink candles suggests weak promoting strain, slightly than a heavy sell-off — a clue that the market may simply be cooling, not collapsing.

Including to the bearish bias, XRP has constantly traded under the 20-day and 50-day Easy Shifting Averages (SMAs) for the previous few weeks, displaying that short-term momentum has turned towards the bulls. The 100-day SMA is performing as mid-range resistance, whereas the 200-day SMA — nonetheless far under — might act as the ultimate line of protection earlier than a deeper drop ensues.

What Are the Indicators Telling Us?

The chart employs a MA Ribbon with 20, 50, 100, and 200 SMAs to gauge development power. Right here's what they reveal:

- 20 SMA (2.315) and 50 SMA (2.392) are actually above the worth, confirming a short-term bearish construction.

- 100 SMA (2.509) can also be overhead, reinforcing resistance.

- 200 SMA (1.803) remains to be under value and will present sturdy help if XRP drops additional.

This layered resistance construction signifies that XRP value would want important bullish quantity to interrupt out cleanly above $2.40 once more.

The Accumulation/Distribution Line (ADL), at present hovering round 1,592, reveals a flattening trajectory. This means neither sturdy accumulation nor distribution is going on — an indication of uncertainty amongst buyers. For bulls to take again management, we would want to see an increase within the ADL, confirming good cash is shopping for the dip.

Will XRP Maintain Its Floor or Fall to the 200-Day SMA?

XRP Value is hovering simply above the $2.11–$2.13 zone, which aligns carefully with the Heikin Ashi help space and the early March lows. This help is fragile — a decisive break under might set off a retest of the 200 SMA round $1.80, which might be a key psychological and technical degree. On the upside, bulls must reclaim the $2.40 zone to even take into consideration regaining upward momentum.

XRP Value Prediction: What Comes Subsequent?

Given the present construction, XRP seems to be coiling for a bigger transfer. If bulls defend the $2.10–$2.00 help and quantity returns, XRP might try a breakout towards $2.50, and if momentum builds, retest $2.85–$3.00 highs from earlier this 12 months. Nevertheless, if promoting strain will increase and the 200 SMA fails to carry, we might see a drop towards $1.60–$1.50, forming a deeper consolidation vary for Q2.

XRP Information As we speak: Remaining Ideas

XRP value is at a crossroads. The symptoms level to a slowing bearish development with impartial accumulation indicators — which means an enormous transfer is probably going brewing. Control the 200 SMA and look ahead to a decisive breakout above the 50-day SMA earlier than turning bullish. Till then, warning is warranted, and swing merchants might discover range-bound alternatives whereas long-term holders watch the $2.00 mark like a hawk.