Many retail traders use predictive instruments to make their funding methods in at this time’s unstable world monetary panorama. One instrument that has gained widespread consideration lately is the Benner Cycle.

This financial forecasting chart is over 150 years outdated. Many consider it has precisely predicted main monetary crises because the mid-Twenties. Nonetheless, latest financial developments are placing that perception to the check.

When Does the Benner Cycle Predict a Market Peak?

Samuel Benner suffered heavy losses in the course of the 1873 disaster. Afterward, he started finding out financial patterns and revealed a guide documenting asset worth rises and falls. In 1875, he wrote Enterprise Prophecies of the Future Ups and Downs in Costs, introducing the Benner Cycle.

This cycle doesn’t depend on complicated mathematical fashions from quantitative finance. As a substitute, Benner based mostly it on the worth cycles of agricultural items, which he noticed by means of his personal expertise.

On the finish of his findings, Benner—then a farmer—left a notice: “Positive factor.” Almost two centuries later, that notice is resurfacing and gaining curiosity once more.

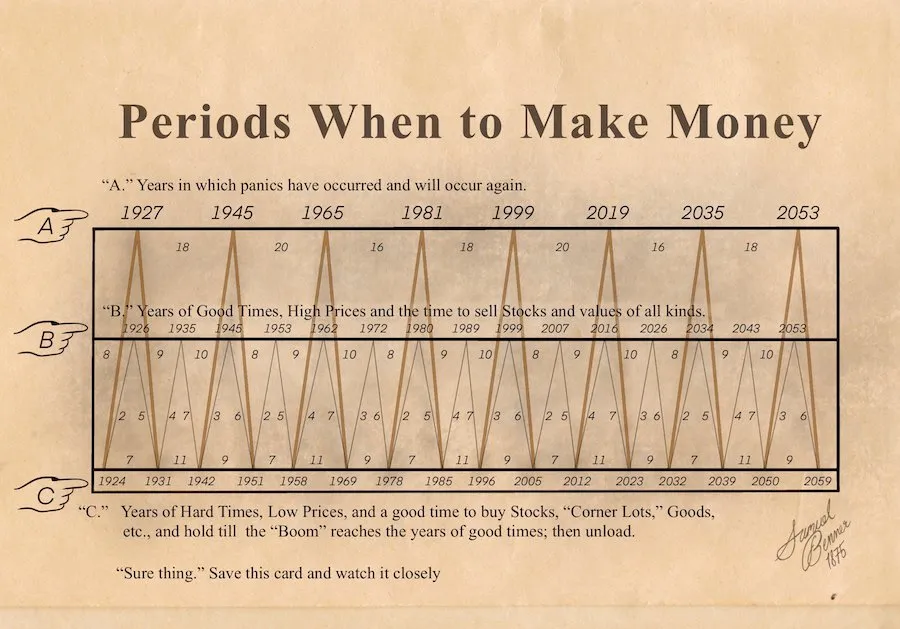

Benner Cycle. Supply: Enterprise Prophecies of the Future Ups and Downs in Costs

Benner Cycle. Supply: Enterprise Prophecies of the Future Ups and Downs in Costs

Utilizing his farmer’s perspective, Benner believed that photo voltaic cycles considerably impacted crop yields, which in flip influenced agricultural costs. From this concept, he created a market prophecy.

Within the Benner chart:

- Line A marks years of panic.

- Line B signifies growth years, that are good for promoting shares and belongings.

- Line C highlights recession years, which are perfect for accumulation and shopping for.

Benner mapped his forecast to 2059, regardless that fashionable agriculture has modified dramatically within the almost 200 years since.

In line with Wealth Administration Canada, though the cycle doesn’t predict precise years, it has intently aligned with main monetary occasions—such because the Nice Melancholy of 1929—with solely minor deviations of some years.

Investor Panos famous that the Benner Cycle efficiently forecasted a number of key occasions: the Nice Melancholy, World Conflict II, the Dot-Com bubble, and the COVID-19 crash. The chart additionally means that 2023 was a main 12 months to purchase, and 2026 will mark the market’s subsequent main peak.

“2023 was the perfect time to purchase in latest instances and 2026 could be the perfect time to promote,” Panos emphasised.

Retail traders within the crypto market share this chart broadly, utilizing it to help bullish situations for 2025–2026.

“Benner’s cycle suggests a market peak round 2025, adopted by a correction or recession in subsequent years. If it holds true, the speculative hype in Crypto AI and rising tech may intensify in 2024–2025 earlier than a downturn,” Investor mikewho.eth predicted.

Perception within the Benner Cycle Faces Rising Challenges

Regardless of the rising reputation, perception within the Benner Cycle is beneath stress attributable to latest financial developments.

On April 2, President Trump introduced a controversial new tariff plan. International markets reacted negatively, opening the week deep within the pink.

The market actions on April 7 had been so extreme that some dubbed it “Black Monday” over the notorious inventory crash in 1987. On April 7, the entire crypto market cap dropped from $2.64 trillion to $2.32 trillion. Though a restoration has began, investor sentiment stays deeply fearful.

As well as, JPMorgan lately elevated its chance of a world recession in 2025 to 60%. This shift was triggered by the financial shock brought on by the newly introduced tariffs on Liberation Day. Goldman Sachs additionally raised its recession forecast to 45% over the subsequent 12 months—the very best degree because the post-pandemic period of inflation and price hikes.

Veteran dealer Peter Brandt criticized the Benner chart in a submit on X (previously Twitter) on April 7, 2025.

“I have no idea how a lot I’d belief this. In the end I have to cope with solely the trades I enter and exit. One of these chart is extra distracting than something for me. I can not go quick or lengthy this particular chart, so it’s all lala land for me,” Peter commented.

Nonetheless, regardless of issues a couple of recession and market conduct contradicting the Benner Cycle’s bullish outlook, some traders consider in Samuel Benner’s prophecy.

“Market prime in 2026. That offers us yet another 12 months if historical past decides to repeat itself. Sounds wild? Positive. However keep in mind: markets are extra than simply numbers; they’re all about temper, reminiscence, and momentum. And generally these quirky outdated charts work—not as a result of they’re magical, however as a result of sufficient of us consider they do!” — Investor Crynet stated.

Search Developments For The Key phrase “Benner Cycle”. Supply: Google Development

Search Developments For The Key phrase “Benner Cycle”. Supply: Google Development

In line with Google Developments, search curiosity within the Benner Cycle peaked over the previous month. This displays a rising demand amongst retail traders for optimistic narratives, particularly amid fears of heightened financial and political instability.