Over the previous month, the stablecoin market has swelled over $200 billion, and two fiat-backed tokens have skilled eye-catching expansions. Ethena’s yield-generating stablecoin, USDE, has grown quickly, now approaching 6 billion in provide. In the meantime, Regular’s USD0 provide has crossed the 1 billion threshold.

Ethena’s USDE and Regular’s USD0 Shake Up a $204B Stablecoin Market

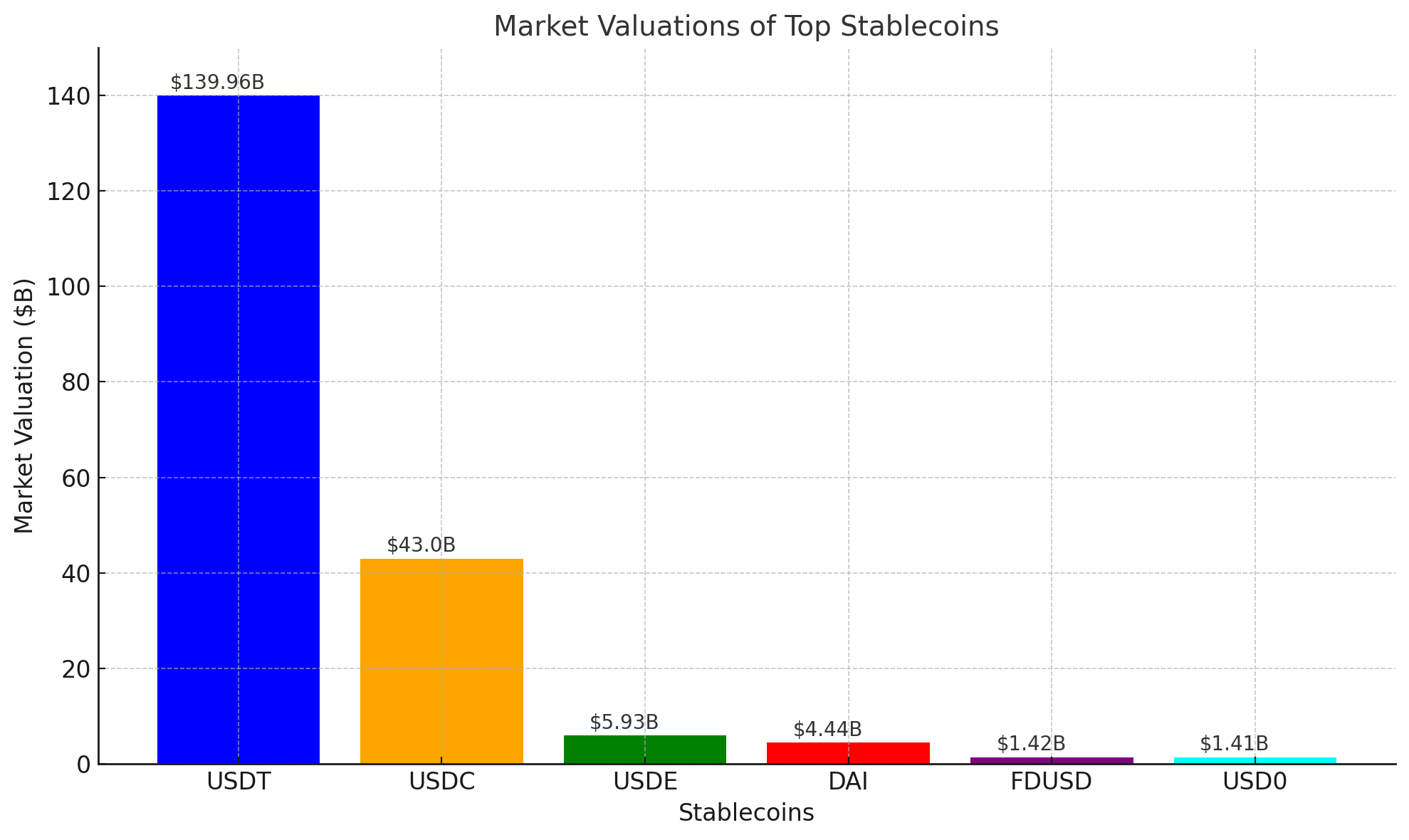

December has been a whirlwind for cryptocurrencies. Bitcoin (BTC) smashed data, surging previous $108,000 to set a brand new all-time excessive on Dec. 17. A couple of days afterward Dec. 22, defillama.com stories the stablecoin market worth has reached $204 billion. Whereas tether (USDT) and usd coin (USDC) provides gained 7.4% and 12.6% respectively, Ethena’s USDE and the newcomer USD0 by Regular emerged as standout performers within the ever-growing stablecoin enviornment.

Ethena’s USDE, a yield-bearing stablecoin, attracts consideration with its attractive annual proportion yield (APY), usually touted at 30%. Nevertheless, as of Sunday, the ethena.fi web site lists a extra modest 12% APY, reflecting frequent fluctuations. USDE’s capacity to generate returns by staking ETH and using delta-hedging methods has cemented its standing as a standout participant within the stablecoin sector. Presently, USDE boasts a market valuation of $5.93 billion, incomes it the title of the third-largest stablecoin by market worth.

Prime six stablecoins by market cap on Dec. 22, 2024.

Prime six stablecoins by market cap on Dec. 22, 2024.

Information reveals that USDE’s provide expanded by a powerful 61.3% since Nov. 22, 2024, whilst a wave of latest yield-bearing stablecoins entered the scene. In the meantime, Ethena’s governance token, ENA, has confronted challenges, dropping over 30% of its worth from its peak—a drop that some interpret as reflecting considerations over the protocol’s stability, governance, and administration of funding charges. Regardless of these hurdles, USDE’s provide continues to develop steadily.

Shifting focus to a different rising star within the stablecoin world, a newcomer has climbed into the highest ten fiat-backed crypto tokens. Regular usd (USD0) has seen a jaw-dropping 246% provide improve over the previous 30 days, courting again to Nov. 22. Created by Regular Labs, an organization based in 2022 by Pierre Particular person, Adli Takkal Bataille, and Hugo Sallé de Chou, USD0 owes its launch to a profitable $7 million funding spherical and extra commitments.

As of Sunday, Dec. 22, USD0 has reached a powerful market valuation of $1.41 billion, surpassing opponents like Paypal’s PYUSD. This achievement locations USD0 because the sixth-largest stablecoin by market valuation, with its fast rise largely fueled by rising adoption in decentralized finance (defi).

The fast enlargement of USDE and USD0 highlights a shifting urge for food within the stablecoin enviornment, the place innovation and utility drive adoption. As yield-bearing mechanisms achieve traction, buyers could more and more prioritize protocols providing tangible returns. Nevertheless, with rising competitors and fluctuating governance metrics, sustaining consumer belief and sustaining progress will seemingly decide the long-term success of those promising tasks.

This aggressive surge amongst stablecoins hints at a rising maturation of decentralized finance (defi), the place protocols should steadiness innovation with stability. As market valuations climb, the strain to deal with governance considerations and evolving consumer wants will solely intensify. For buyers and builders alike, the problem can be navigating this dynamic market whereas making certain sustained progress and resilience in an ever-evolving crypto house.