The 2 finest performing exchange-traded funds (ETFs) within the U.S. each made leveraged bets in opposition to ether and racked up mind-blowing returns in consequence.

The 12 months of the ETH Brief: How Bearish Traders Are Raking in ETF Earnings

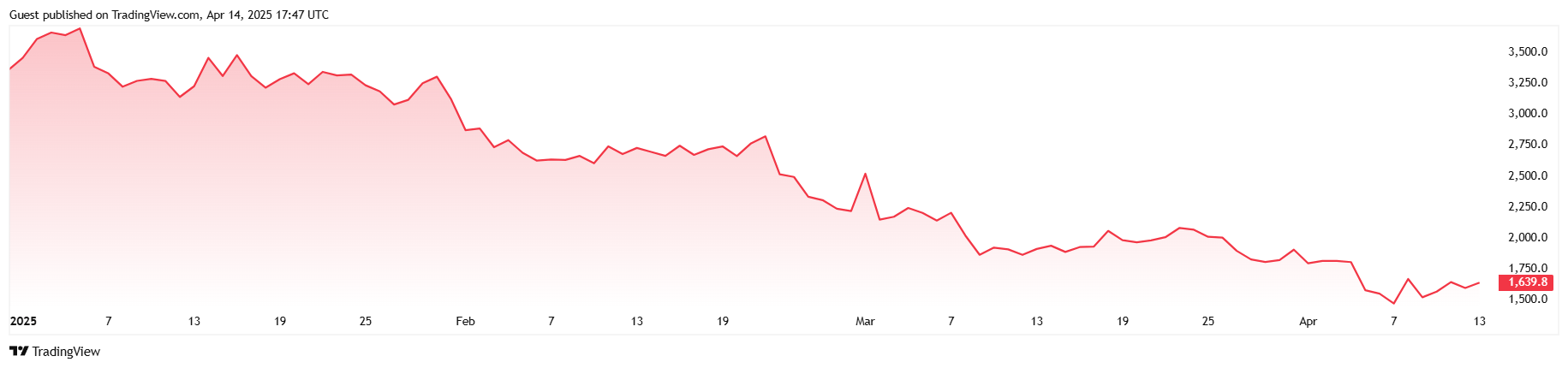

Ethereum’s ether ( ETH) has had a tough yr, nosediving virtually 51% since January. Savvy buyers have taken benefit of the cryptocurrency’s demise, investing within the Proshares Ultrashort Ether ETF (ETHD) and reaping a year-to-date (YTD) return of virtually 250%, based on Bloomberg ETF analyst Eric Balchunas.

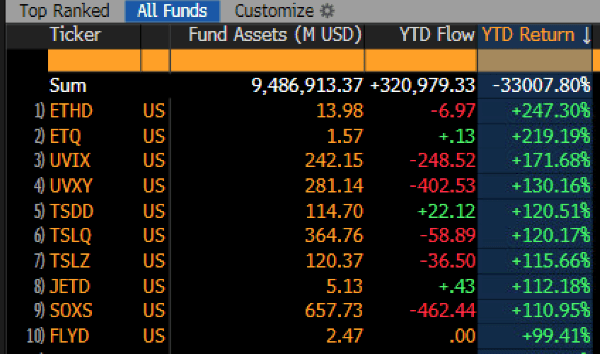

(A listing of the best-performing ETFs up to now in 2025 / Eric Balchunas on X)

(A listing of the best-performing ETFs up to now in 2025 / Eric Balchunas on X)

The fund belongs to a category of high-risk funding autos that make leveraged bets on the worth of an underlying asset. The Proshares ETHD is designed to return double the inverse efficiency of Bloomberg’s Ethereum Index each day. This yr, that technique has meant that as ether tanks, ETHD rises at twice the speed of the cryptocurrency’s depreciation.

(The value of ETH from the start of 2025 to current / Buying and selling View)

(The value of ETH from the start of 2025 to current / Buying and selling View)

So as to add insult to damage, one other leveraged ETF, the T-REX 2X Inverse Ether Every day Goal ETF from Rex Shares, which operates in the same method to ETHD besides that it goes quick on spot ether as an alternative of the Bloomberg index, has additionally seen its YTD returns undergo the roof at roughly 220%, making it the second finest performing ETF within the U.S. up to now this yr. In different phrases, shorting ETH has been a profitable technique for American ETFs, no less than for now.

“The perfect performing ETF this yr is the -2x Ether ETF ETHD, up 247%,” Balchunas defined in a Friday put up on X. “Quantity two is the opposite -2x Ether ETF,” he added. “Brutal.”