Key Insights

- Shiba Inu value surged 33% in Could, breaking above $0.00001575 and confirming a bullish reversal above the 38.2% Fibonacci degree.

- Over 516 Trillion SHIB had been purchased between $0.000016–$0.000019, creating a serious resistance zone held by 116K addresses.

- Open curiosity in SHIB derivatives rose 19% to $249M, whereas day by day buying and selling quantity fell 25% to $311M, signaling contemporary positioning.

Shiba Inu (SHIB) value has proven indicators of a development reversal, sparking curiosity throughout crypto markets. After a number of months of sideways motion, the token broke key resistance ranges, resulting in elevated hypothesis.

Merchants are watching intently as SHIB maintains momentum above essential help zones. With bullish technical alerts forming, some analysts consider the value could also be concentrating on the $0.000081 mark, a zone close to its all-time excessive.

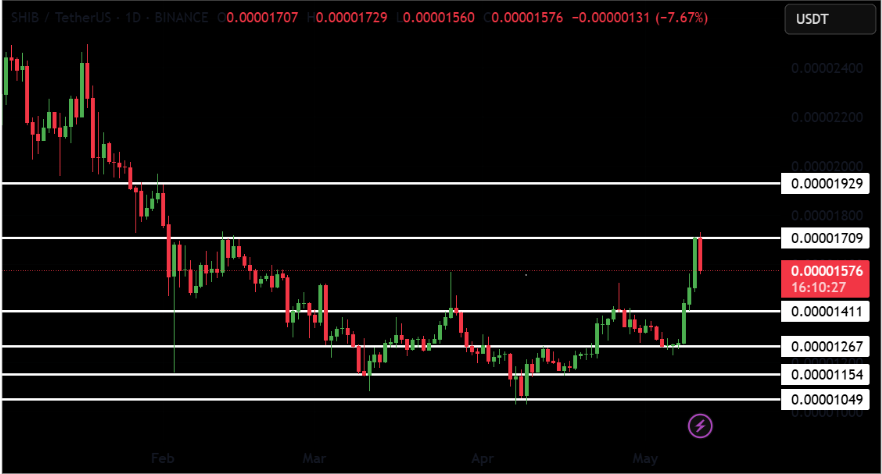

Breakout from Consolidation Strengthens Bullish Momentum

Shiba Inu lately moved above a multi-week resistance degree at $0.00001411. This breakout was supported by a sequence of sturdy bullish candles, with growing quantity and value dimension. The token briefly examined the $0.00001709 zone earlier than settling close to $0.00001576, which merchants now see as a possible help degree.

The value motion suggests a shift in sentiment, as consumers proceed to carry above the earlier resistance. This space is now being monitored as a brand new help zone, whereas the following goal stays close to $0.00001929. Analysts from CryptoGuru famous, “The transfer above $0.00001411 confirms SHIB is out of its extended accumulation section.”

Supply: X

Supply: X

Beneath the present ranges, merchants are watching helps at $0.00001411, $0.00001267, and $0.00001154. These ranges are thought of a part of a staircase sample, which might point out a continued upward motion in the event that they maintain throughout market pullbacks.

On-Chain Information Reveals Potential Promoting Strain at Key Zones

On-chain metrics from IntoTheBlock present that over 516 trillion SHIB had been purchased at costs between $0.000016 and $0.000019. This vary is now a vital resistance space, with over 116,000 pockets addresses holding SHIB bought at these costs.

As SHIB approaches this zone, promoting might happen from long-term holders who wish to exit their positions at break-even ranges. Many of those tokens had been acquired throughout the 2021 and early 2022 value peaks, suggesting that holders could also be seeking to recuperate losses.

Nevertheless, if SHIB can push by way of this vary, the following cluster of curiosity lies between $0.000019 and $0.000024. Round 178 trillion SHIB are held at a mean price of $0.000022 by over 136,000 addresses. This cluster might act as one other resistance space, however a break past it might gasoline additional value restoration.

Shiba Inu Coin Worth Technical Indicators Sign a Potential Prolonged Rally

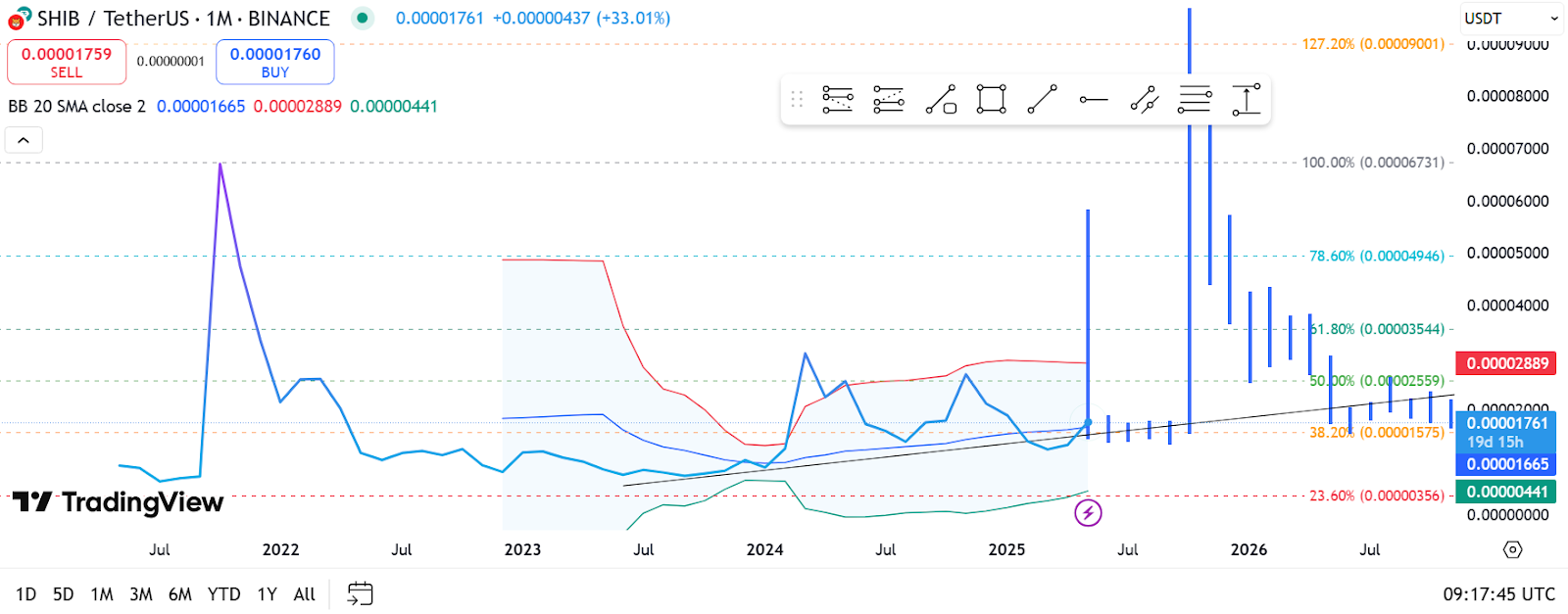

The present month-to-month candle exhibits greater than 33% development in Could, pushing SHIB above the 38.2% Fibonacci retracement degree of $0.00001575. This degree is seen as a essential level in measuring potential value restoration from the bear market lows.

If the value sustains momentum, analysts are watching the 50% and 61.8% Fibonacci ranges at $0.00002559 and $0.00003544. These ranges are intently related to long-term development reversals. The 100% Fibonacci degree close to $0.00006731 and the 127.2% extension at $0.00009001 symbolize doable future targets.

Supply: TradingView

Supply: TradingView

Bollinger Bands, a volatility indicator, are additionally starting to develop after a chronic squeeze. The higher band is approaching $0.00002889, which aligns with the important thing Fibonacci resistance ranges. This tightening and enlargement sample is usually related to upcoming massive value actions.

Derivatives Market and Dealer Sentiment Present New Curiosity

In response to Coinglass, the open curiosity within the derivatives of SHIB elevated greater than 19% to $249. These developments point out that regardless of that part of merchants is liquidating their positions, a big a part of it’s opening new ones on the backdrop of expectation of value wild swings.

The present lengthy/brief ratio stands at 0.9146 and which means there’s a small desire of bearing brief positions. Merchants on OKX are bullish at a 2.13 ratio whereas prime merchants on Binance additionally desire bullishness in each accounts and positions indicating elevated optimism of the key stakeholders.

Supply: CoinGlass

Supply: CoinGlass

Liquidation knowledge reveals blended exercise. Over the previous 24 hours, $489.91K in SHIB positions had been liquidated $284.61K from longs and $205.29K from shorts. If help zones close to $0.00001576 maintain and consumers overcome resistance at $0.000019, SHIB could transfer towards $0.000022 or $0.000035, with the $0.000081 degree nonetheless in view as a long-term goal.