Pepe fails to interrupt above the 50-day EMA, tumbling again to a key trendline. Will it bounce or crash to $0.0000050?

As Bitcoin drops beneath $84K, provide strain on meme cash will increase sharply. Among the many prime meme cash, DOGE, SHIB, and PEPE have pulled again between 3% and 5% over the previous 24 hours.

Pepe, the frog-themed meme coin, is all the way down to $0.0000070, dropping bullish momentum amid mounting promoting strain. With a possible downswing looming, is Pepe on the verge of plunging to $0.0000050?

Pepe Value Nears Retest of Damaged Falling Wedge

Failing to maintain the bullish breakout from a falling wedge sample, Pepe has taken a bearish flip. The value couldn’t climb above the 50-day EMA, which has acted as dynamic resistance since late March.

Pepe Value Chart

The current bullish try topped out at a 7-day excessive of $0.0000077 earlier than going through robust rejection. Because the 50-day EMA carries heavy provide strain, Pepe’s worth motion has shaped long-wick candles.

At the moment, the decline from the dynamic resistance line suggests a potential retest of the falling wedge’s damaged resistance trendline. This presents a possible reversal alternative for optimistic merchants and traders, if the retest holds.

With bullish momentum fading, the MACD and sign strains are nearing a unfavorable crossover. If confirmed, this technical sign may counsel an extra bearish extension.

Hackers Accumulating Pepe?

5 new wallets have just lately acquired 611 billion Pepe tokens value $4.28 million at present discounted costs, all inside the previous 24 hours.

Nonetheless, the funding supply of those wallets is elevating eyebrows. Every was funded with ETH withdrawn from Twister Money, a decentralized cryptocurrency mixer, 15 days in the past.

This results in a urgent query: Are hackers shopping for Pepe?

5 wallets spent $4.28M to purchase 611B $PEPE prior to now 8 hours.

All 5 wallets withdrew $ETH from #Twister ~15 days in the past—probably linked to a hacker.

Are hackers shopping for $PEPE?

Deal with:

0x5D058264e34e27eE1b4f852216Dc4AFC7c320e25

0x53abA3F792d6c8097a7169C8916B1C3f7975f5ed… pic.twitter.com/8yUdFsUBVA— Lookonchain (@lookonchain) April 16, 2025

Will Lengthy Liquidations Drive Pepe Right down to $0.0000050?

Amid heightened volatility, Pepe has seen a -5.37% drop in open curiosity, now standing at $281.25 million. Curiously, the volume-weighted funding price has flipped constructive, reaching 0.0063%.

One of many key drivers of the constructive funding price is the rise in lengthy positions. Over the past 12 hours, lengthy positions rose from 46.99% to 49.2%, bringing the Lengthy/Quick Ratio near impartial at 0.9685.

Pepe LongShort Ratio Chart

Pepe LongShort Ratio Chart

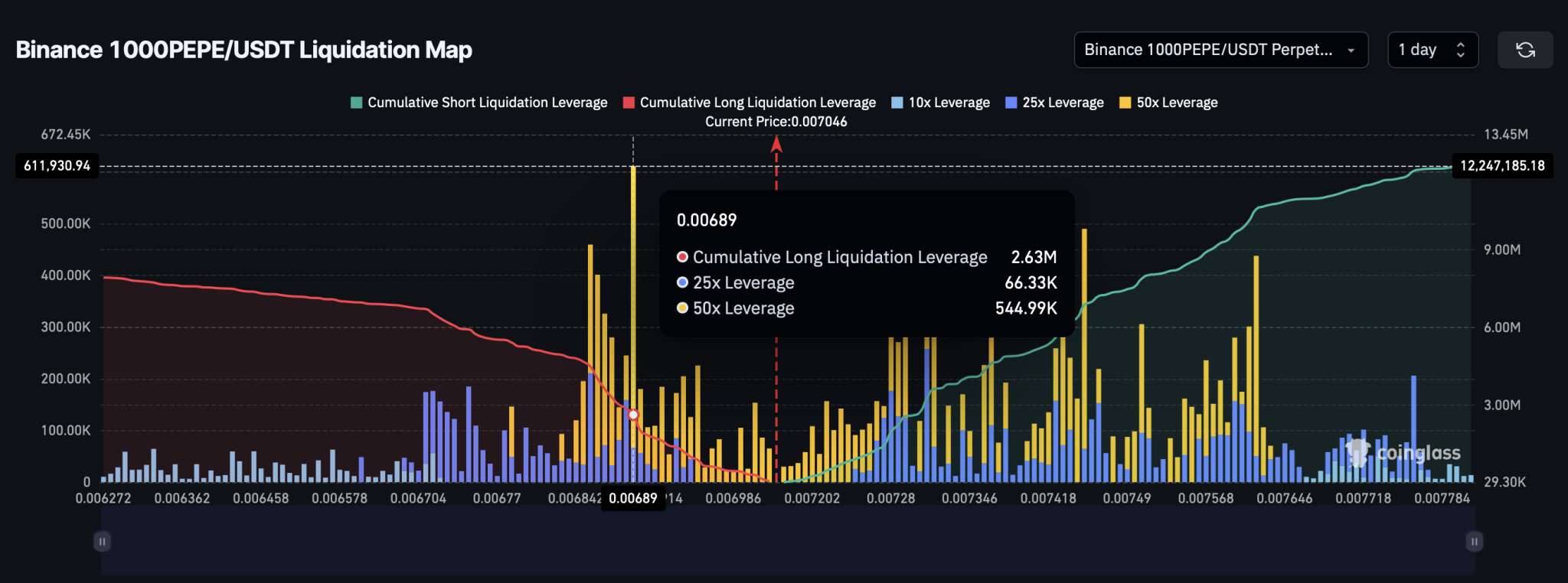

Lengthy positions at the moment dominate at 55.9%, reflecting rising bullish sentiment for Pepe. Nonetheless, if the downtrend continues and the value hits $0.00000689, an enormous $2.63 million in lengthy liquidations may shake out many patrons.

Pepe Liquidation Map

Pepe Liquidation Map

Pepe Value Targets

With elevated worth volatility and a broader market pullback, meme coin costs could proceed to slip. Within the brief time period, Pepe will probably retest the damaged resistance trendline close to $0.0000062.

Ought to this occur, a spike in lengthy liquidations may drag the value down additional to $0.0000050. Nonetheless, from an optimistic standpoint, a profitable post-retest bounce may propel Pepe again towards the 50-day EMA, close to $0.0000078321.