Yesterday, MANTRA (OM) suffered a staggering 90% crash, and it’s nonetheless spiraling down at the moment. Most notably, OM charts and indicators appear as unhealthy because the 2022 Terra LUNA collapse, if not worse.

OM’s RSI is hovering close to excessive oversold ranges, and indicators replicate there’s barely any shopping for exercise. When LUNA collapsed, a lot of merchants purchased the crash for a short-term pump. However, even this appears unlikely for MANTRA, based mostly on present charts.

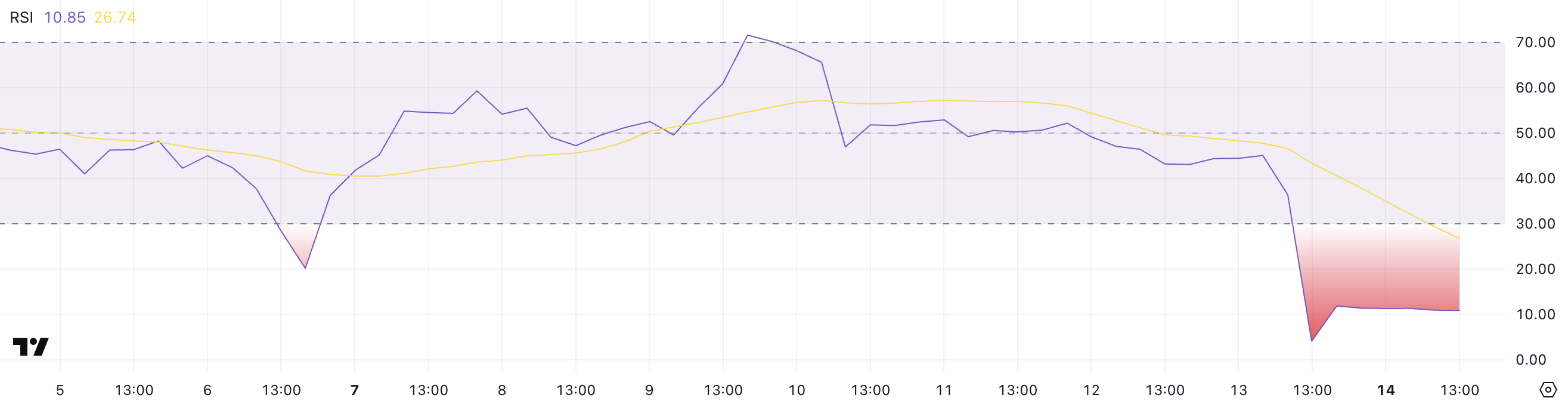

OM RSI Reached Ranges Beneath 10

After crashing greater than 90% in a matter of hours, some merchants could also be eyeing MANTRA’s OM token as a possible “purchase the crash” alternative.

Nonetheless, the Relative Power Index (RSI) tells a unique story—OM’s RSI plummeted from 45 to 4 in the course of the collapse and has solely barely recovered to 10.85.

The RSI is a momentum indicator that measures the pace and magnitude of value adjustments on a scale from 0 to 100. Sometimes, values beneath 30 point out oversold circumstances, whereas ranges above 70 counsel the asset is overbought.

OM RSI. Supply: TradingView.

OM RSI. Supply: TradingView.

Regardless of bouncing from excessive lows, OM’s RSI has hovered round 10.85 for a number of hours, signaling that only a few patrons are stepping in to assist the value.

This lack of follow-through shopping for stress exhibits that sentiment stays closely bearish, and merchants will not be but assured sufficient to build up the token—even at these steeply discounted ranges.

Lately, speaking to BeInCrypto, analysts warned about Mantra’s potential lack of true on-chain worth.

OM is doubtlessly establishing for additional draw back or a protracted interval of stagnation because the market waits for a catalyst or clearer restoration alerts.

Mantra DMI Reveals Shopping for Exercise Is Virtually Non-existent

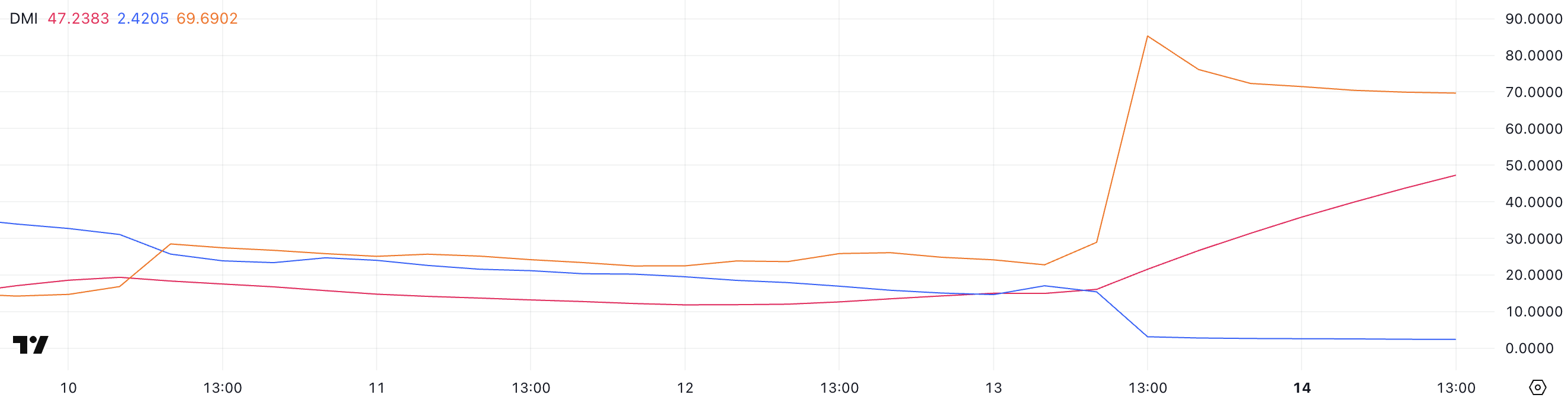

Mantra’s DMI (Directional Motion Index) chart clearly exhibits intense bearish momentum. The ADX, which measures the power of a pattern no matter path, is presently at 47.23—nicely above the 25 threshold and displaying no indicators of weakening.

The -DI, which tracks promoting stress, has decreased from its peak of 85.29 to 69.69, indicating that whereas the panic sell-off could also be slowing, it stays dominant.

In the meantime, the +DI, which measures shopping for stress, has dropped from 3.12 to simply 2.42, highlighting an entire lack of bullish response to the collapse.

OM DMI. Supply: TradingView.

OM DMI. Supply: TradingView.

This imbalance reveals that though the worst of the instant promoting could also be over, just about no significant shopping for exercise is stepping in to assist OM’s value.

The truth that +DI stays extraordinarily low suggests merchants are nonetheless avoiding the token, hesitant to purchase even after a large low cost.

So long as this dynamic continues—robust pattern power, excessive promoting stress, and near-zero shopping for stress—OM is more likely to keep below extreme bearish stress, with any restoration try extraordinarily unlikely except sentiment shifts dramatically.