The upper house of Japan’s National Diet passed the revised Payment Services Act (PSA) on Friday, resulting in big changes ahead for enterprises dealing with crypto. The new category of “intermediary business” alleviates the need for middleman companies in Japan to register as exchanges, but the bill has other implications, some of which bring stricter rules and greater centralization. Originally submitted to the Japan Diet back in March, the amendments to the Payment Services Act passed on Friday, and are being praised as pro-crypto. Perhaps drawing the most attention is the establishment of a new category of “intermediary business,” meaning businesses who introduce or act as liaisons between exchangers and users. Such groups will no longer have to register as an exchange with the government’s regulator, the Financial Services Agency (FSA). A separate registration, with relaxed rules, will be introduced for these intermediaries.

Image: Chihiro Sakai.

Image: Chihiro Sakai.

What’s in the new law: Stablecoins, intermediary businesses, emergency outflow barriers

Under FSA discussion since November last year, the amended Payment Services Act is being cited by regional media as likely removing barriers for gaming companies and others that want to do business related to cryptocurrency and digital assets. Interest from Mercari, SBI Securities, and Monex Securities has already been reported regarding registering as an “intermediary business.” Some key changes to the act are as follows:

- Creation of “intermediary” businesses with relaxed registration rules.

- Creation of a separate registration system for exchanges.

- New ability to issue a legal order requiring overseas-based crypto firms to hold assets in Japan to prevent outflows in case of bankruptcy.

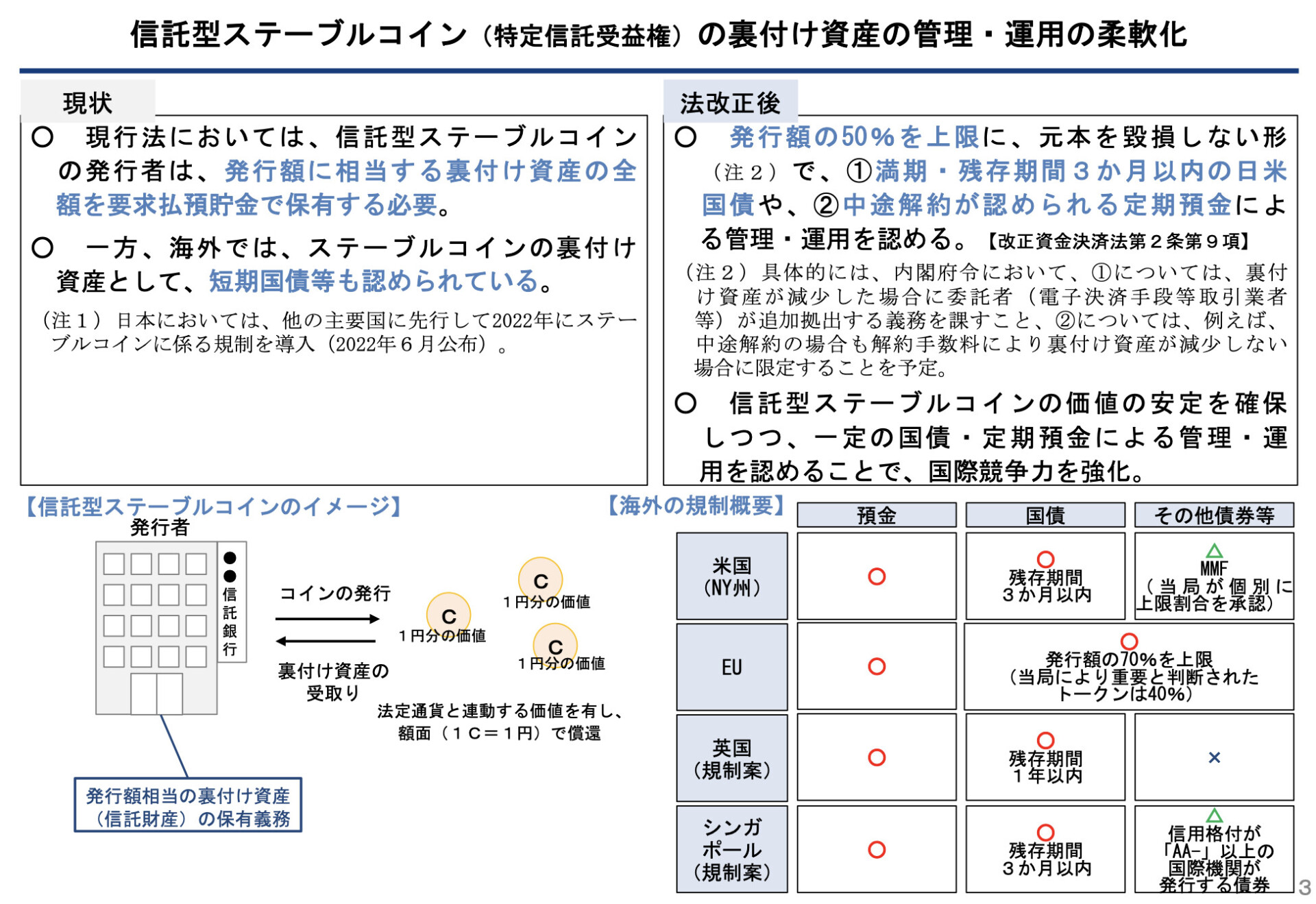

- “Trust-type” stablecoin backing assets can now be held partially (up to 50%) in low-risk investments like government bonds, instead of being 100% backed in fiat by the issuer.

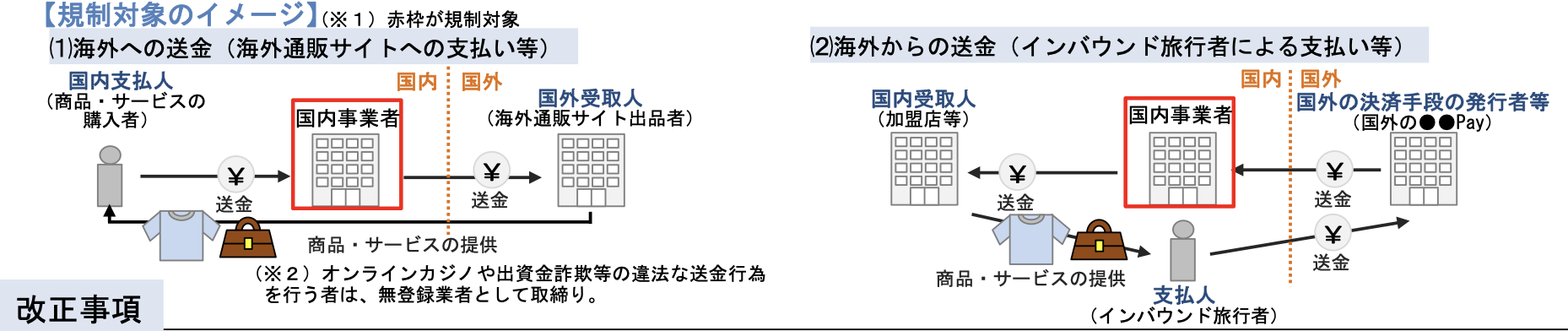

- Stricter rules for businesses deemed overseas “collection agencies” providing e-commerce services.

FSA chart detailing changes to trust-type stablecoin regulations. Source: FSA.

FSA chart detailing changes to trust-type stablecoin regulations. Source: FSA.

The amended law, set to take effect within one year, essentially cements strict AML/CFT requirements and rules for registered exchange operators and e-commerce collection agencies, eases entry to the regulated crypto ecosystem for liaison businesses (which must be under the supervision of a registered operator), prevents overseas exchanges from running off with Japanese users’ money, and helps banks issue stablecoins more easily.

Centralization, stricter rules — Drifting further from Satoshi

While it’s understandable that gaming enterprises and others are happy to hear the news of the amendment’s success, and removal of barriers to entry, Tokyo and Japan-based adherents to Satoshi Nakamoto’s original idea of separation of money and state will see the law as a nothing-burger. Or a poison apple, more accurately. Massive banks can now issue stablecoins more easily, leveraging state credit, while overseas, permissionless markets and competitors are further targeted as threats. As Coinpost reported in 2022 of a Mitsubishi UFJ working group focused on stablecoins: “The aim is to put a stop to the current situation in which funds are flowing mainly into overseas stablecoins, including through investment in overseas Web3 (decentralized app) projects, use of major NFT markets, and even cover trading in cryptocurrency exchanges.”

Businesses that handle money deemed cross-border “collection agencies” involved with activities such as e-commerce can also be regulated under the revised PSA. Source: FSA.

Businesses that handle money deemed cross-border “collection agencies” involved with activities such as e-commerce can also be regulated under the revised PSA. Source: FSA.

Crackdown on foreign payment agents deemed cross-border “collection agencies,” such as those involved with e-commerce, is a slippery slope. The FSA notes it will not go after low-risk activities or require registration from low-risk intermediaries, while threatening a crackdown on online casinos and fraud, noting that “Those who conduct illegal remittances, such as online casinos and investment fraud, will be subject to regulation as unregistered businesses” under the new amendment. As with all legislation, arbitrary political interpretation allows for endless abuse. Previously, cross-border collection agencies were not required to register as a funds transfer business with the state. Now, they must rely on the FSA’s assurances only, in a state of relative limbo. Fortunately for the advocates of peer-to-peer, permissionless transactions, no matter what the new regulations bring, use of actual crypto — not regulated, bank-issued stablecoins — remains one path toward economic freedom and peace in Japan, in a time of a faltering yen, rice shortages, and mainstream monetary malaise.