The crypto market has rallied broadly, Thursday, thanks to 2 huge updates: President Donald Trump has introduced a 90-day pause on tariffs (besides on China), and the U.S. SEC approval of choices buying and selling for Ethereum spot ETFs. Ethereum (ETH) has gone up by almost 18% within the final 24 hours, now buying and selling above $1,600. Bitcoin (BTC) has additionally risen by 8%.

This new-found optimism rapidly introduced on the discuss of an “altcoin season,” when altcoins rally outperforming Bitcoin.

Others like XRP, Cardano (ADA), Avalanche (AVAX), and Chainlink (LINK) are additionally displaying spectacular positive factors between 8% to 9%. Solana (SOL), Dogecoin (DOGE), and TRON (TRX) have jumped round 6% as properly. This surge comes as the overall crypto market cap hits $2.59 trillion, with altcoins outpacing Bitcoin’s day by day positive factors.

Nevertheless, Bitcoin dominance is at the moment over 63%, and when stablecoins are added, that quantity jumps to greater than 72%. This implies a lot of the cash in crypto proper now continues to be in Bitcoin and stablecoins — not altcoins.

Associated: SEC Approves ETH ETF Choices; Worth Eyes $1700 Resistance Take a look at for April 11

Why Do Some Analysts Count on an Alt Season Now?

Timing could be key. A DeFi researcher has predicted that the subsequent huge altcoin season might begin round April 10. That’s as a result of up to now, altcoin rallies have often began a few yr after every Bitcoin halving.

Supply: CryptoNobler

Supply: CryptoNobler

The analyst additionally stated this could be “the final actual probability to purchase altcoins at low costs earlier than they surge.” Intriguingly, altcoin seasons up to now have lasted about 90 days—the identical as Trump’s tariff pause.

Associated: Crypto Ignores Commerce Battle: Markets Rally Regardless of China’s 84% Tariff Hit on the US

Bitcoin Dominance Nearing Historic Ceiling

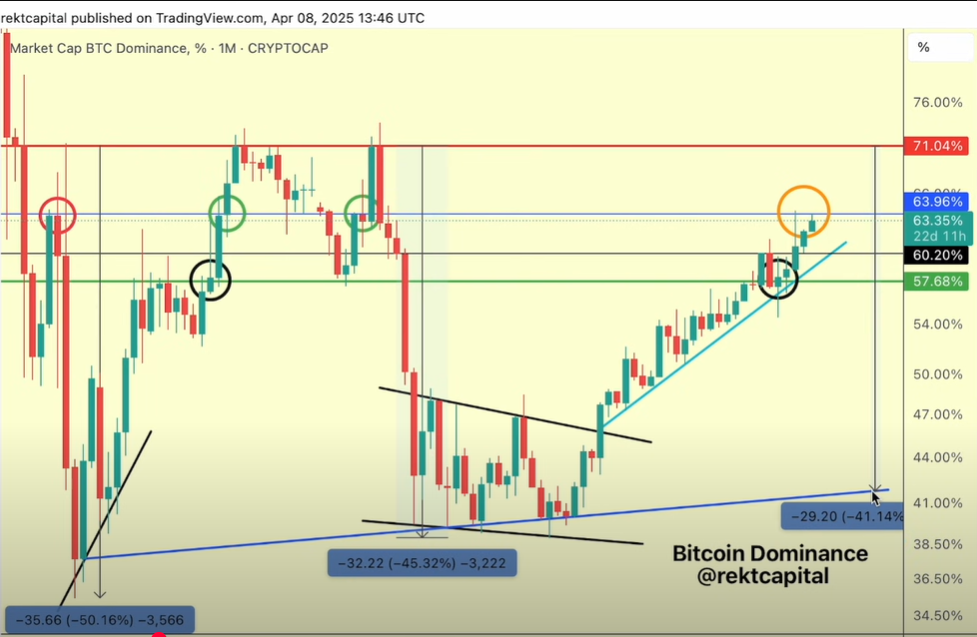

In response to Rekt Capital, Bitcoin’s dominance is at the moment in a robust uptrend, hovering round 64%. Traditionally, when Bitcoin dominance reaches excessive ranges after which begins to say no, altcoin rallies usually comply with.

Rekt Capital defined that earlier cycles noticed Bitcoin dominance fall from peaks by 50% to 45%, which set the stage for enormous altcoin runs. Even a smaller drop this time—all the way down to 38% or 41%—might nonetheless pave the best way for an altcoin season.

Does the Altcoin Market Cap Chart Look Bullish?

Evaluation of the overall altcoin market cap (excluding Bitcoin) presents one other potential clue. The full altcoin market cap noticed a 61% pullback, which is much less extreme in comparison with previous rejections of 69% and 85%.

Rekt Capital interprets this milder decline to recommend that resistance is weakening and a breakout above the $425 billion degree may very well be on the horizon.

Supply: RektCapital

Supply: RektCapital

For now, Bitcoin continues to dominate market sentiment. However as its dominance nears the 71% mark—an space that traditionally caps its management—analysts consider altcoins might quickly have their second within the highlight.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.