Identified for its long-term volatility and for lacking out on the 2024 bull market since early March, Terra Traditional (LUNC) is as soon as once more drawing consideration as the subsequent U.S. courtroom listening to involving Terraform Labs co-founder Do Kwon approaches on April 10.

LUNC’s decline could be traced again to Might 2022, when the Terra ecosystem collapsed after its algorithmic stablecoin USTC misplaced its greenback peg and fell beneath $0.01.

The incident worn out an estimated $60 billion in market worth, triggering widespread panic throughout the digital asset house. The collapse of Terra is extensively considered a significant catalyst for the extended ‘crypto winter’ that adopted.

But, regardless of main setbacks and ongoing authorized fallout, the undertaking persists, stored alive largely by its devoted group.

Group burn efforts persist, however worth influence stays modest

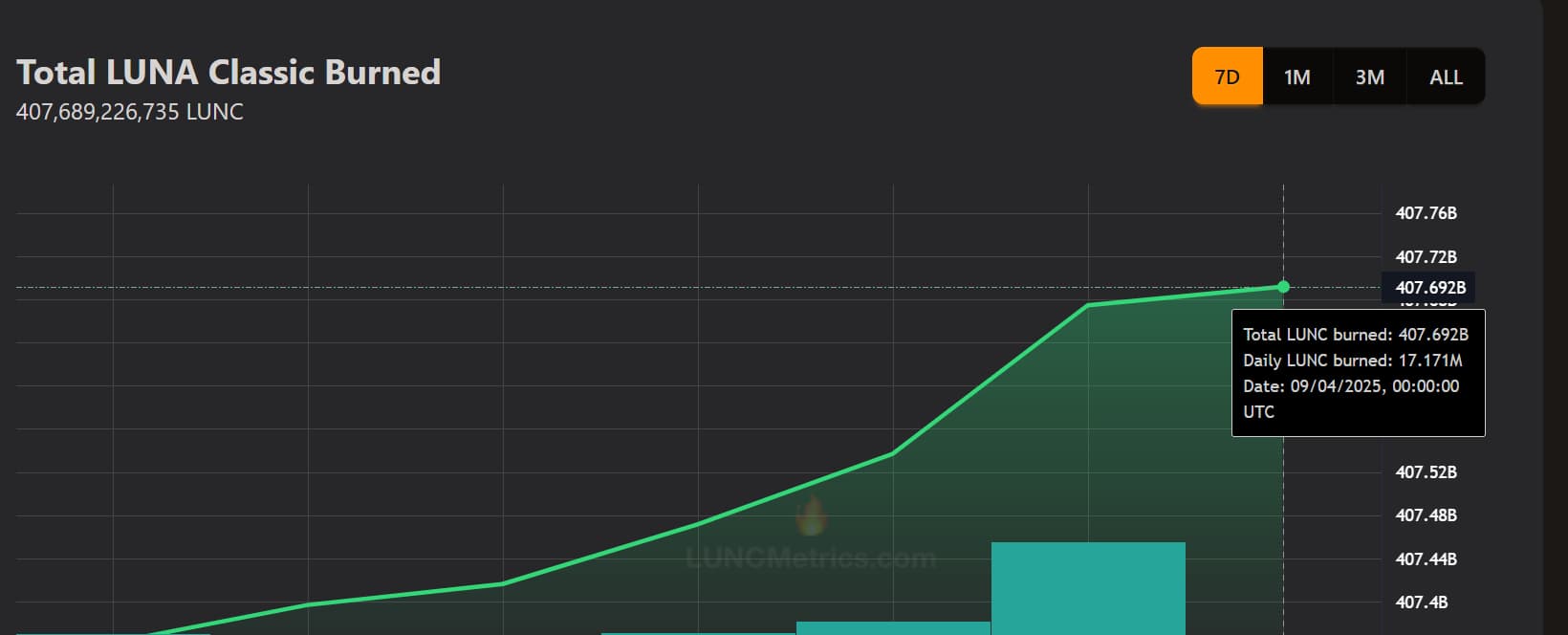

A part of this ongoing effort has centered round a community-led token burn mechanism, geared toward lowering the token’s oversupply and boosting long-term worth.

Information exhibits that over 407.68 billion LUNC tokens have been burned thus far, together with 17.17 million tokens on April 9 alone.

Nonetheless, the influence on worth has been modest. On the time of writing, LUNC was buying and selling at $0.0000555, reflecting a 1.46% every day acquire and a modest 1.17% improve in market capitalization to $303.27 million.

Furthermore,in a bid to deal with the aftermath of the collapse, Terraform Labs launched its Crypto Loss Claims Portal on March 31, 2025, permitting collectors to file claims till April 30.

This course of is a part of a structured wind-down that started after Terraform Labs filed for chapter and settled with the U.S. Securities and Change Fee (SEC).

That stated, whereas Terra Traditional just isn’t technically useless, LUNC is barely alive. Its worth efficiency stays weak, volatility is excessive, and the deflationary token burns haven’t but offset the psychological and monetary harm attributable to its collapse.

Featured picture through Shutterstock