The Grayscale XRP Belief is about to finish this 12 months 2024 with a whopping 300% acquire as a consequence of XRP’s spectacular positive aspects in November and December.

As 2024 attracts to an in depth and the Christmas festivities enter full swing, crypto traders have many causes to be cheerful. That is notably true for institutional traders in XRP.

Grayscale XRP Belief Traders See Large Positive aspects

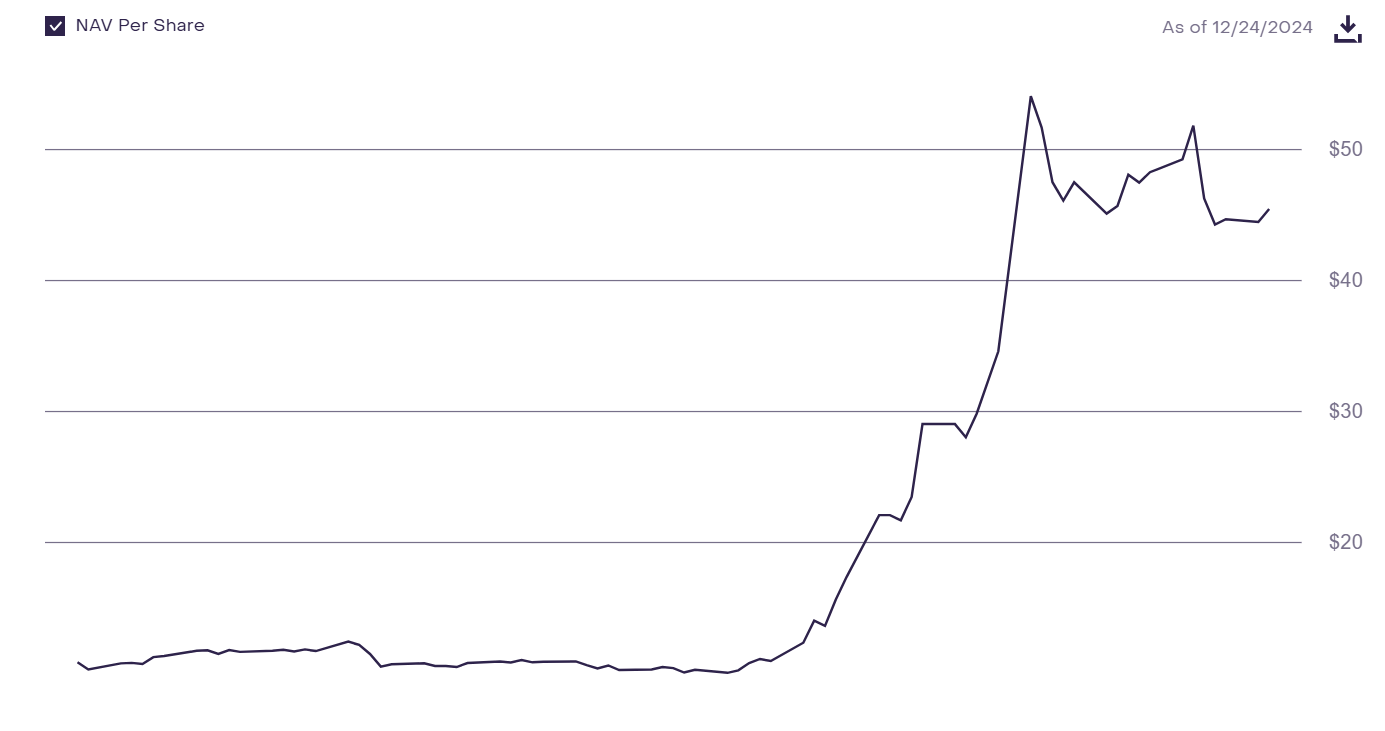

Early traders in Grayscale’s XRP Belief will possible be smiling to the financial institution this vacation. The product, which re-launched in September 2024, appears to be like set to finish the 12 months with a share worth acquire of over 300% since inception, surging from $10.85 to $45.46 on the time of writing.

Curiously, most of XRP’s positive aspects that mirrored within the XRP belief share worth have come inside the previous month primarily as a consequence of Donald Trump’s election victory, which has sparked a wave of pro-crypto sentiment amid guarantees made to the business on the marketing campaign path.

Chart exhibiting Grayscale XRP Belief share worth efficiency since inception Supply Grayscale

Chart exhibiting Grayscale XRP Belief share worth efficiency since inception Supply Grayscale

On the similar time, many imagine that the regulatory cloud that has lengthy shrouded the asset could also be dissipating. For context, XRP has been on the heart of an SEC lawsuit from 2020 alleging that Ripple, one of many mission’s major builders, broke securities legal guidelines via its sale of the asset.

Following a partial court docket victory in July 2023 and the upcoming change of the SEC guard, many are optimistic that the asset will proceed to realize extra readability, a lot in order that it might quickly get spot exchange-traded funds (ETFs) to broaden entry for establishments, doubtlessly resulting in billions in capital influx.

Spot XRP ETFs Coming Quickly?

Not too long ago, controversial crypto influencer Ben “Bitboy” Armstrong recommended that the positive aspects recorded by Grayscale’s XRP Belief might play a job in pushing XRP ETFs over the end line quickly. The view comes because the positive aspects could bolster investor confidence within the asset, including to the various elements driving the ETF push.

A minimum of 4 asset managers have already thrown their hats within the ring to launch spot XRP ETFs. These potential issuers embrace Canary Capital, 21Shares, Bitwise, and WisdomTree.

With the latest ETF software coming in November 2024, XRP holders could possibly be an approval timeline that extends to July 2025 within the best-case state of affairs, because the SEC sometimes has 240 days to reply.