Circle’s Euro-based stablecoin expanded its exercise in April, monitoring the foreign money’s positive factors in opposition to the greenback. EURC expanded its buying and selling volumes on a mixture of rising provide and speculative buying and selling in opposition to dollar-based stablecoins.

The Euro foreign money rally prior to now month is getting mirrored on the crypto market. EURC is at the moment matching the $1.14 USD worth, with a mixture of centralied and decentralized buying and selling.

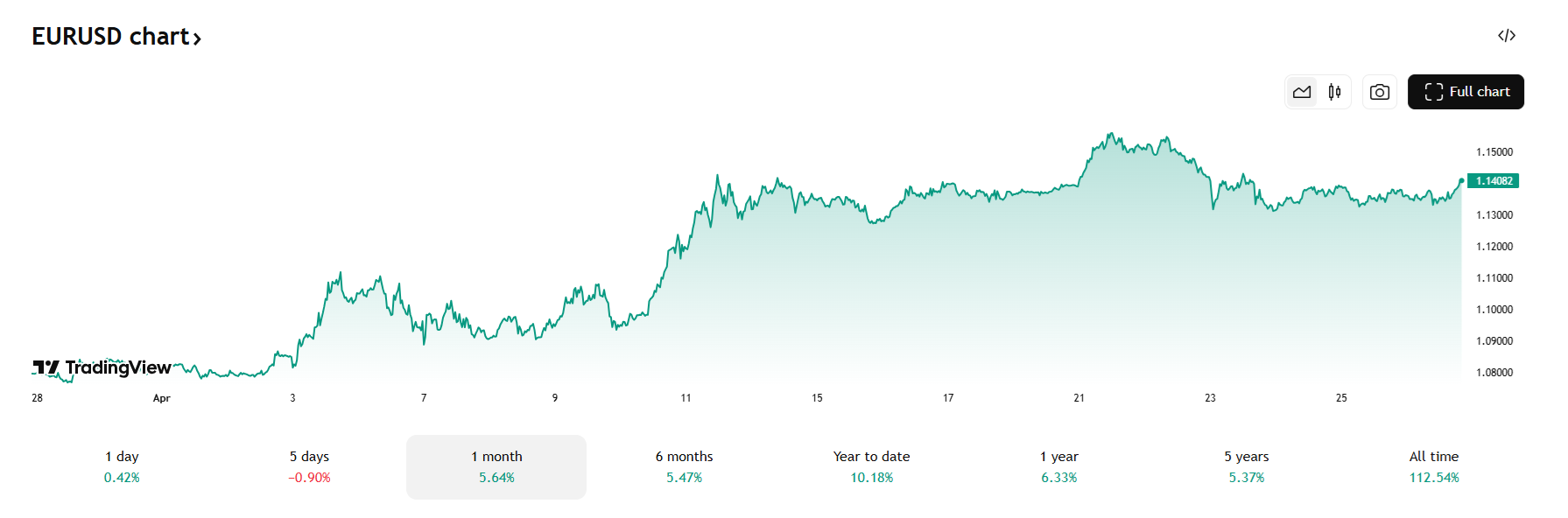

The Euro made its largest positive factors prior to now month, quickly peaking at $1.15 USD.

The EUR/USD pair made its largest positive factors in April, reflecting the US tariff conflict information and doubts concerning the US financial system. | Supply: Tradingview

The EUR/USD pair made its largest positive factors in April, reflecting the US tariff conflict information and doubts concerning the US financial system. | Supply: Tradingview

Within the meantime, the stablecoin markets stay closely dollarized. Nevertheless, different stablecoins are steadily rising in provide and affect.

Circle’s EURC is likely one of the most influential EUR-derived stablecoins, with an equal provide of over $240M. The token’s circulating provide is above $211M, including over 50M tokens prior to now month.

Circle additionally closely marketed its stablecoins in April by increasing its Fee Community. Circle goals to make use of all minted stablecoins as each tradable belongings and options to fintech cost programs.

April’s volumes ranged between $70,000 and over $120M day by day, with a mixture of centralized and decentralized markets. EURC is represented on Coinbase and paired in opposition to the USDC.

EURC has all of the options of USDC, together with compliance with EU rules and compatibility with the Dubai monetary authorities. The token began with a distinct segment provide of simply $30M in 2024, with probably the most fast provide development coming in March and April.

The token’s enlargement coincided with the rising provide of USDC on Solana. EURC is a multi-chain asset with illustration on Avalanche, Base, Ethereum, and Solana. Over 70M of the tokens are on Solana. Over 37M of the EURC provide continues to be held by Circle and is awaiting distribution.

Euro buying and selling shifts to decentralized markets

The elevated volatility of the EUR on the foreign money markets is boosting DEX exercise. Meteora is the largest EURC market, carrying over 33% of EURC volumes.

Since EURC can also be represented on Base, Aerodrome is yet one more extremely lively market, with 11% of the volumes. The decentralized exchanges signify a makeshift foreign exchange market, making use of the EUR path in opposition to the greenback.

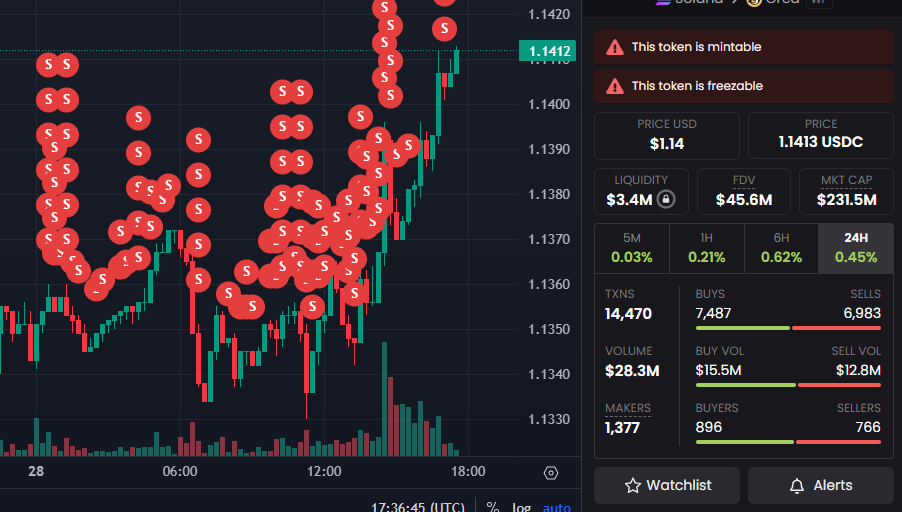

Whale merchants used the EURC rally in opposition to USDC to appreciate positive factors within the newly rising DEX liquidity swimming pools. | Supply: DexScreener

Whale merchants used the EURC rally in opposition to USDC to appreciate positive factors within the newly rising DEX liquidity swimming pools. | Supply: DexScreener

EURC is traded by whales, with indicators of promoting into the newest rally to $1.13. The stablecoin is behaving equally to different decentralized belongings, with arbitrage and buying and selling alternatives between DEX.

Among the EURC pairs have been created prior to now month, increase liquidity because the EUR foreign money appreciated. EURC has one extremely lively pair for EURC/USDC, tapping the merchants on the Orca DEX.

Based mostly on knowledgeable observations, the EUR/USD pair continues to be not stopping in its path. The most important issue for the worth of EUR stands out as the European Central Financial institution’s determination on rates of interest. The ECB is intently monitoring the positive factors of the EUR, probably trying into elevating the Euro Space rate of interest.

As a complete, EUR-based stablecoins have a complete provide of over $536M, with a day by day buying and selling quantity of above $100B. EURC has the largest market cap share and covers 80% of the day by day volumes.