- Ethereum’s Q1 2025 noticed a steep decline of -45.41%, however Q2 exhibits indicators of restoration.

- Traditionally, Ethereum performs strongly in Q2, with notable previous good points in 2019 and 2020.

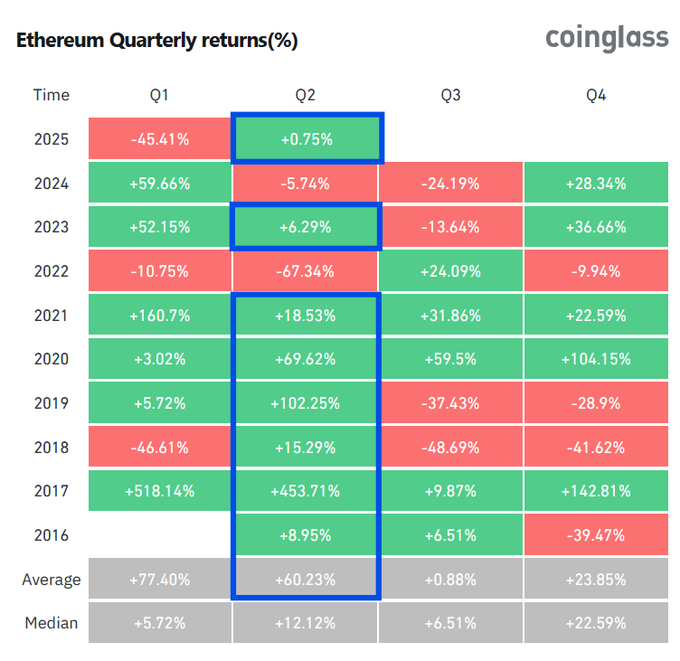

- ETH’s common Q2 return of +60.23% helps a bullish outlook for the second quarter of 2025.

Ethereum skilled a major drop of -45.41% in Q1 of 2025. Nonetheless, consultants stay optimistic about its future efficiency, on condition that the preliminary decline occurred early within the 12 months. Analyst Carl Moon highlighted that traditionally, Q2 is a robust interval for Ethereum, and the constant pattern helps his constructive outlook for Ethereum’s potential development within the upcoming months.

Supply: X

Supply: X

Historic knowledge exhibits that Q2 tends to generate constructive prospects for Ethereum. Based on CoinGlass knowledge, the cryptocurrency market witnessed substantial returns in a number of second-quarter durations. Furthermore, Ethereum’s efficiency reached +102.25% throughout Q2 of 2019, whereas its 2020 return amounted to +69.62%.

Ethereum’s Robust Q2 Development

The market confirmed elevated restraint throughout 2021, but Ethereum it managed to realize a strong +18.53% development throughout Q2. The cryptocurrency’s historic sample of Q2 restoration serves as a foundation for validating Moon’s bullish place on ETH for 2025.

Throughout Q2 of 2025, Ethereum demonstrated a minimal restoration with a rise of +0.75% in worth. The modest constructive return alerts a restoration pattern following Q1’s intense unfavourable efficiency. This minimal constructive achieve in Q2 follows its established sample of Q2 rebound, which creates hope for buyers about future restoration potential.

Nonetheless, some distinctive instances have additionally occurred. In Q2 of 2022, Ethereum declined considerably by -67.34%, although this end result proved to be a uncommon exception. Historic knowledge exhibits that the second quarter has produced constructive returns for Ethereum, strengthening speculations about its continued robust efficiency all year long.

Associated: Ethereum (ETH) Value Prediction Could 2025: Will ETH Break $2,100 or Face Rejection?

On common, Ethereum has yielded +60.23% throughout 9 years whereas sustaining +12.12% as its median worthwhile end result. The information reveals that Ethereum tends to realize higher ends in its Q2 efficiency than throughout different quarters, offering a robust basis for Moon’s bullish forecast.

In the meantime, the constructive efficiency originally of Q2 has renewed optimism amongst buyers. Though the development of Ethereum is closely influenced by the outcomes of its Q2 section, buyers will likely be intently observing Ethereum’s restoration to find out its efficiency within the remaining months.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.