Ethereum (ETH) value has remained under expectations in December, disappointing many who anticipated it will maintain above $4,000. Regardless of this, ETH has managed to realize almost 6% during the last seven days, exhibiting some indicators of resilience.

The RSI has been impartial for per week, reflecting a scarcity of sturdy momentum, whereas whale exercise has stabilized close to its highest ranges since September. With the worth consolidating between $3,523 and $3,220, ETH’s subsequent transfer hinges on breaking key resistance or holding important help ranges.

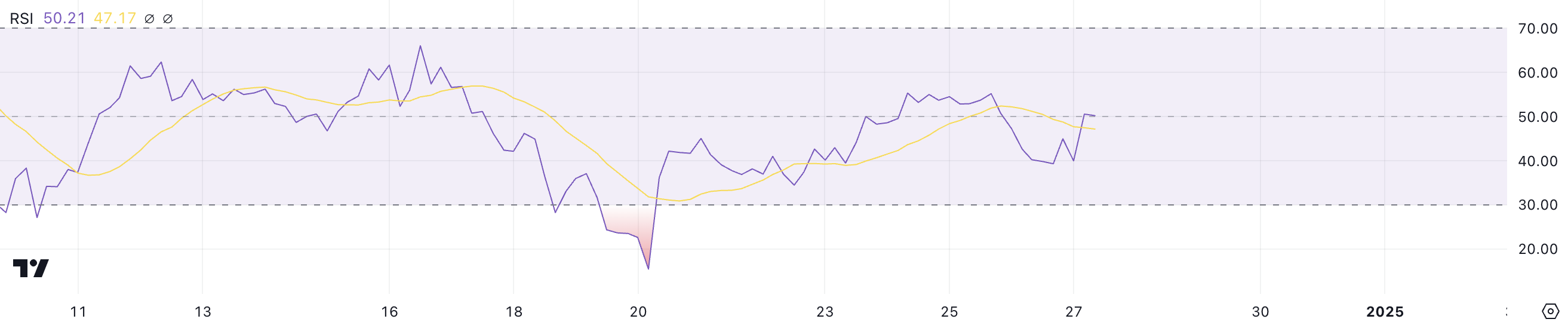

ETH RSI Has Been Impartial For a Week

Ethereum Relative Energy Index (RSI) is at present at 50.21, remaining within the impartial zone the place it has fluctuated between 35 and 55 since December 20.

This means that ETH value motion has lacked vital momentum in both route over the previous week, reflecting a interval of consolidation.

ETH RSI. Supply: TradingView

ETH RSI. Supply: TradingView

The RSI is a momentum indicator used to measure the power of value adjustments, with values starting from 0 to 100. Readings above 70 sometimes point out overbought situations, signaling potential value corrections, whereas readings under 30 recommend oversold situations, which may result in value recoveries.

Ethereum RSI at 50.21 suggests a balanced market, with neither consumers nor sellers exerting sturdy management.

Ethereum Whales Dropped a Little, However Are Nonetheless at Excessive Ranges

On December 25, the variety of addresses holding not less than 1,000 ETH reached 5,634, the best degree since September. This was adopted by a slight decline to five,631 on December 26.

The rise comes after a month-low of 5,565 on November 28, highlighting a gradual restoration in massive holders’ exercise.

Addresses with Steadiness >= 1,000 ETH. Supply: Glassnode

Addresses with Steadiness >= 1,000 ETH. Supply: Glassnode

Monitoring the habits of ETH whales is vital as a result of their holdings and actions typically affect the market as a result of vital quantities of liquidity they management.

The present stabilization at increased ranges suggests that enormous holders are sustaining confidence in ETH, doubtlessly supporting its value within the brief time period. Nonetheless, the slight decline additionally signifies warning, which means ETH value may stay range-bound except there’s a decisive shift in whale habits.

ETH Worth Prediction: Consolidation Earlier than a New Breakout?

Ethereum value is at present buying and selling inside a spread, with resistance at $3,523 and help at $3,220. Its EMA traces point out a downtrend, with short-term averages positioned under the long-term ones.

Nonetheless, the weakening power of this pattern means that ETH could be getting into a section of consolidation somewhat than persevering with its decline.

ETH Worth Evaluation. Supply: TradingView

ETH Worth Evaluation. Supply: TradingView

If ETH value breaks above the resistance at $3,523, it may goal for increased ranges at $3,827 and doubtlessly $3,987.

Conversely, if the help at $3,220 is examined and fails to carry, the worth may drop additional to $3,096, marking a important degree for potential stabilization.