The cryptocurrency market has witnessed a precipitous contraction, with $350 billion exiting the market within the final 48 hours.

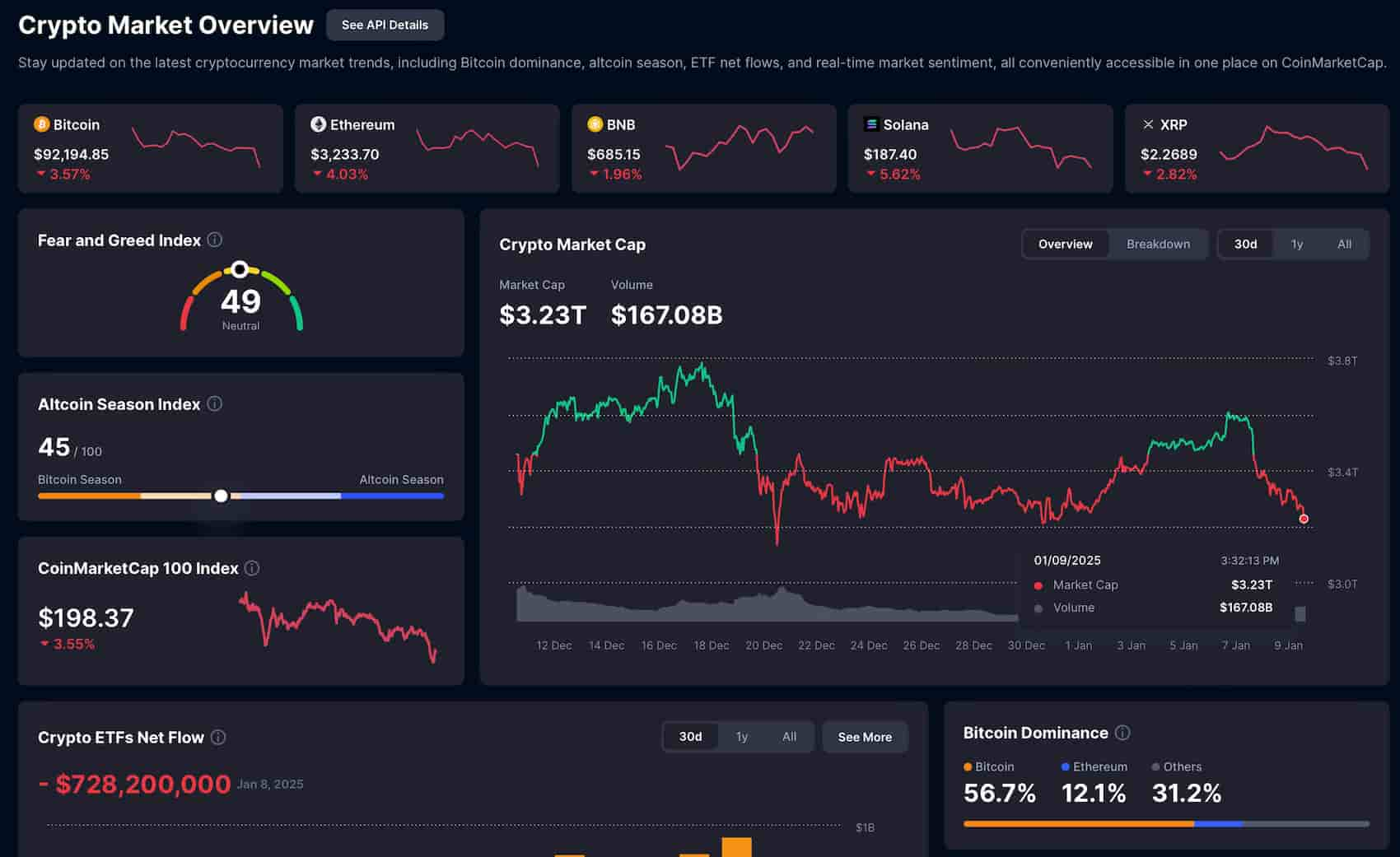

Information retrieved by Finbold from CoinMarketCap on January 9 reveals that the whole market capitalization has plummeted from $3.58 trillion to $3.23 trillion, marking a stark reminder of the asset class’s inherent volatility.

On the epicenter of this decline is Bitcoin (BTC), whose market capitalization eroded from $2.03 trillion to $1.83 trillion throughout the identical interval.

Bitcoin’s worth, now hovering at $92,203, displays a dramatic 10% decline over two days, compounded by a 3.12% slide previously 24 hours alone.

Crypto market sentiment

Investor sentiment, measured by the Crypto Concern and Greed Index, now rests at a precarious 49, reflecting a market caught in a state of ambivalence. The Altcoin Season Index, presently positioned at 45, underscores Bitcoin’s reassertion of dominance as risk-averse capital migrates towards the market’s perceived bellwether asset.

Curiously, the turbulence has additionally reverberated throughout institutional channels. Crypto-focused ETFs have seen a pronounced exodus, with web outflows reaching $728.2 million as of January 8.

What might trigger concern for buyers is the retreat of institutional capital is commonly a harbinger of deeper systemic unease, signaling that capital preservation has briefly supplanted threat urge for food.

Bitcoin and macroeconomics

The macroeconomic backdrop has undeniably intensified crypto market fragility. Hypothesis surrounding central financial institution financial coverage, notably the potential for price changes, has sowed apprehension throughout risk-sensitive markets.

The current dip in Bitcoin is most definitely tied to the opportunity of a Federal Reserve rate of interest hike, pushed by optimistic U.S. financial knowledge, making digital belongings much less interesting, with the prospect of tighter financial coverage amplifying market corrections.

Market analysts at the moment are keenly observing pivotal help thresholds, with Bitcoin’s $90,000 stage rising as an important psychological marker.

Two factors of curiosity stay the identical on #Bitcoin.

I anticipated the markets to interrupt out and begin the bull at $100K, however nope.

Doubtless taking liquidity beneath the lows and revert again upwards.

$90-92K is the area. pic.twitter.com/ZrPmrkyFlf— Michaël van de Poppe (@CryptoMichNL) January 8, 2025

A breach of this stage may catalyze an additional cascade of liquidation, whereas a sturdy protection may invigorate market sentiment and spark a aid rally.

Featured picture through Shutterstock