Circle, the company behind USDC, the second-largest stablecoin by market capitalization, is applying to the Office of the Comptroller of the Currency (OCC) to create a national bank trust in the United States, according to a report from Reuters.

If approved, Circle would be allowed to act as a custodian for its own reserves under the name First National Digital Currency Bank, N.A. – but would not be allowed to take cash deposits or make loans.

The license would also allow Circle to custody digital assets for institutional clients, who are increasingly becoming a larger portion of the crypto market, given the success of Bitcoin ETFs and ETH ETFs, as well as the upcoming launch of REX-Shares' SOL-Staking ETF.

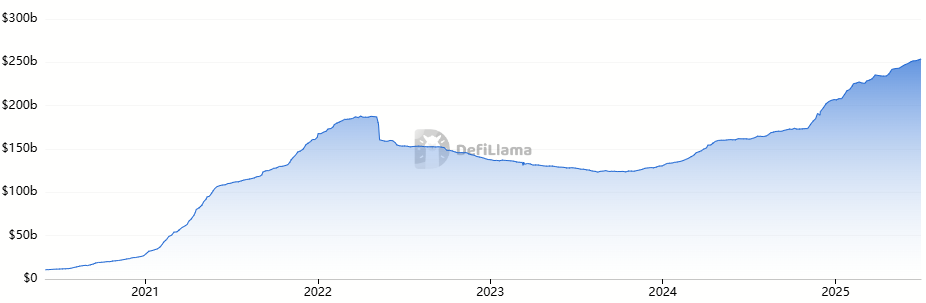

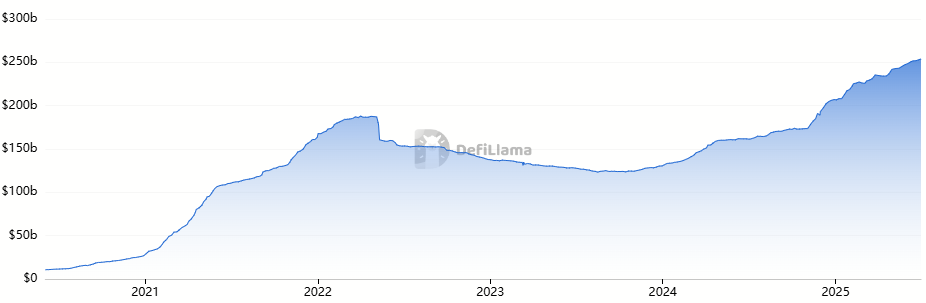

Circle, perhaps strategically, is applying for the license after its wildly successful IPO, which appreciated by roughly 1000% to $298 per share from its IPO price of $27-$31. The USDC supply is also within shouting distance of all-time highs, boasting a $61 billion market capitalization that accounts for nearly 25% of the $253 billion stablecoin market.

Total Stablecoin Market Capitalization – DeFiLlama

Total Stablecoin Market Capitalization – DeFiLlama

The only other digital asset company with a US Trust Bank License in the United States is Anchorage Digital, which collaborates with traditional finance giants such as Cantor Fitzgerald.

The U.S. government is rapidly navigating the stablecoin space. Less than six months into the Trump administration, the Senate notably passed the GENIUS Act on June 17.

While the bill still needs to find its way through the House of Representatives to become a law, its passing would establish a licensing regime for payment stablecoins, and would also establish regulations surrounding stablecoin reserves, which proponents believe would make stablecoins a more viable option for large transactions while reinforcing the U.S. dollar’s global dominance.