The broader cryptocurrency market entered a bull run following the conclusion of the US presidential election in November. Nonetheless, the surge hit its first velocity bump fairly shortly — in mid-December, the Federal Reserve introduced that it might put fewer fee cuts in place in 2025 than was initially anticipated.

Bitcoin (BTC) noticed costs crash from an all-time excessive (ATH) of roughly $106,000 to only $92,000, and altcoins predictably adopted swimsuit. December 20 turned out to be the worst day, with as a lot as $310 billion exiting the market. Nonetheless, by press time, the value of Bitcoin had recovered to $96,551.

Whereas analysts largely stay bullish, there may be an rising variety of voices that at the moment are predicting a short-term correction. With these new developments in thoughts, Finbold has consulted OpenAI’s most superior giant language mannequin (LLM) to assemble a $1,000 cryptocurrency portfolio for the approaching yr.

Blue-chip cryptocurrencies (70%)

A overwhelming majority of GPT’s proposed portfolio is devoted to blue-chip cryptocurrencies — specifically, Bitcoin and Ethereum (ETH). With an preliminary stability of $1,000, the AI mannequin would make investments $700 in two flagship digital belongings.

Within the case of Bitcoin, which accounts for 40% of your entire portfolio, ChatGPT cited rising institutional adoption, widespread world demand, and more and more acknowledged utility as a retailer of worth and hedge towards inflation as bullish catalysts.

Then again, 30% of the portfolio was allotted to Ethereum, owing to its already dominant and increasing ecosystem, widespread adoption by enterprises, and strong improvement neighborhood.

Excessive-potential altcoins (25%)

Surprisingly sufficient, ChatGPT solely allotted 1 / 4 of the portfolio — 25%, to altcoins. Readers ought to observe that all kinds of cryptocurrency analysts, reminiscent of Michaël van de Poppe, predict that altcoins will outperform BTC in 2025.

The AI mannequin set a ten% allocation for Solana (SOL). An energetic and quickly rising developer base, quick and reasonably priced transactions, and all kinds of use instances had been singled out as tailwinds.

Up subsequent, Polygon (MATIC) accounts for a similar proportion of ChatGPT’s portfolio, at 10%. As Ethereum’s go-to scaling resolution, Polygon is uniquely positioned to profit from the rise of one of many cryptocurrency market’s most notable listings and has already secured quite a few strategic partnerships with main enterprises.

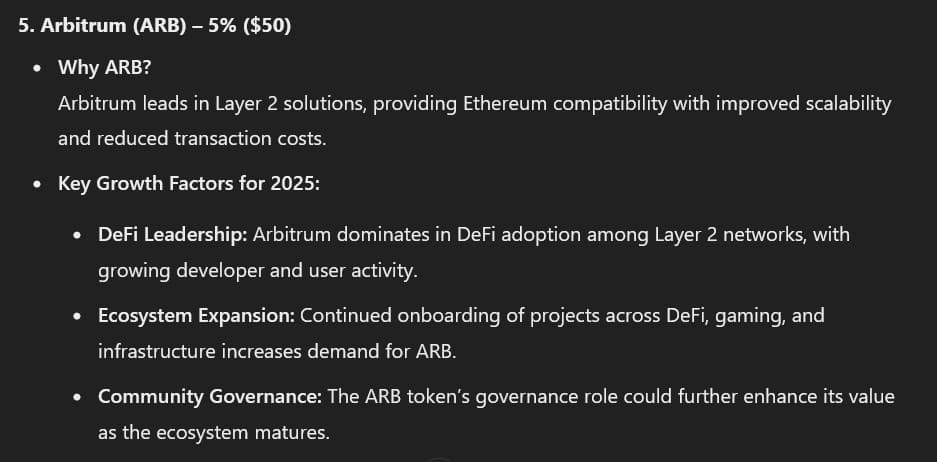

Lastly, Arbitrum (ARB) represents 5% of the AI mannequin’s portfolio — OpenAI’s mannequin mirrored on the challenge’s dominant place amongst Layer 2 networks and persevering with growth within the DeFI area as key drivers for progress in 2025.

Stablecoins (5%)

Final however not least, ChatGPT instructed that buyers ought to put aside 5% of their portfolio for stablecoins — ideally Tether (USDT) or USD coin (USDC).

In contrast to the opposite belongings that had been picked, the position of those stablecoins is to not safe returns — fairly, this allocation is supposed to offer a level of stability to the portfolio, in addition to the choice to reap the benefits of any alternatives that may pop up over the course of 2025.

As attention-grabbing because the AI mannequin’s outputs are — they’ll definitely present a point of perception, buyers ought to do not forget that the responses given by ChatGPT can’t function an acceptable substitute for due diligence and private analysis.

Maybe extra importantly, ChatGPT can’t account for private circumstances — and whereas this portfolio does seem like broadly relevant, readers ought to all the time be cautious of ‘one dimension matches all’ options in the case of investing.

Featured picture by way of Shutterstock