Bitcoin's rise displays shifting market dynamics amid stabilizing geopolitical tensions and altering investor sentiment.

Key Takeaways

- Bitcoin surged previous $93,000 after President Trump introduced no intention to fireplace Fed Chair Jerome Powell.

- President Trump's softened stance on China commerce relations additionally contributed to Bitcoin's rally.

Bitcoin broke by means of $93,000 on Tuesday night and edged towards $94,000 after President Trump stated he had “no intention” of firing Fed Chair Jerome Powell, knowledge from TradingView exhibits.

“By no means did,” Trump spoke to reporters. “The press runs away with issues. No, I’ve no intention of firing him. I want to see him be somewhat extra energetic when it comes to his concept to decrease rates of interest.”

The president has stirred markets in latest weeks by overtly criticizing the Fed’s financial coverage. His repeated jabs at Powell sparked discuss of a possible dismissal, sufficient that individuals began asking whether or not it was even legally doable.

With every Trump push, worries in regards to the Fed’s independence grew, and so did investor anxiousness.

This, together with lingering commerce tensions, despatched cash flowing into gold. Spot gold climbed nearer to $3,500 on Tuesday on account of market unease.

Nonetheless, the highlight was on Bitcoin. The digital asset had already been gaining all through the day, crossing $90,000 earlier than Trump’s remarks. His statements gave the rally contemporary legs, pushing Bitcoin previous $93,000 in a pointy late-day transfer.

Market analysts say Bitcoin’s latest worth actions point out it may be beginning to decouple from tech shares. For many of its run, Bitcoin has tracked alongside the Nasdaq. However now, it’s starting to behave extra independently.

Trump on Tuesday additionally softened his stance on China’s tariffs. He stated they’d be coming down considerably and that he wasn’t seeking to play hardball, one other headline that additional fed into Bitcoin’s rise.

Institutional urge for food returns as Bitcoin ETFs submit main positive factors

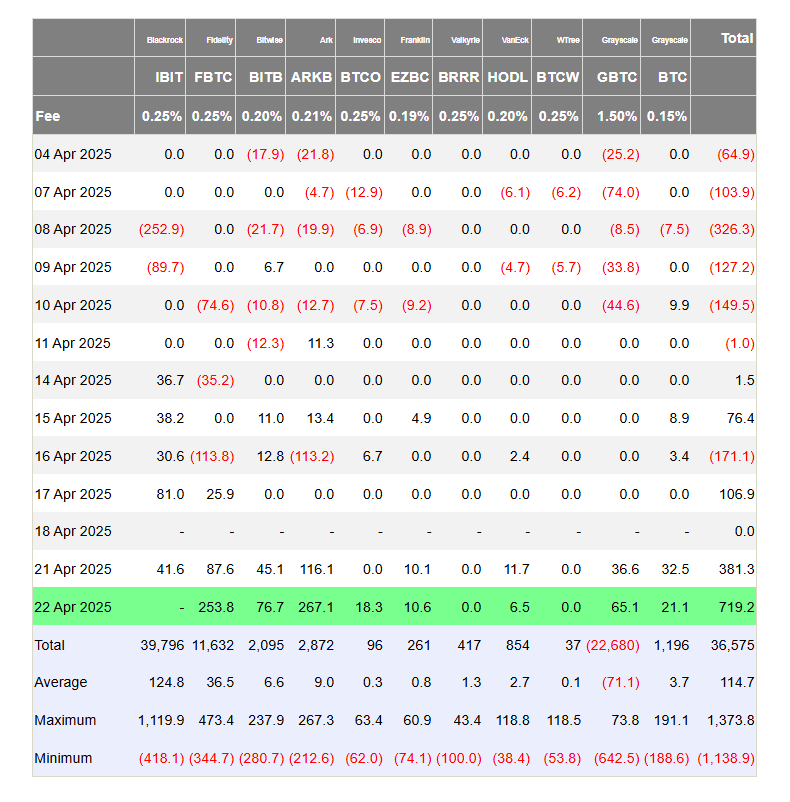

Elsewhere, within the ETF market, US-listed spot Bitcoin ETFs have rebounded with sturdy positive factors following a stretch of outflows. On Monday, the group recorded $381 million in internet inflows, with no funds posting losses, in line with knowledge from Farside Traders.

As of the most recent replace from Tuesday’s buying and selling session, whole internet inflows throughout all spot Bitcoin ETFs had climbed to $719 million.

Nonetheless, knowledge from BlackRock’s iShares Bitcoin Belief remains to be pending. If the fund additionally studies contemporary inflows, the group might see its strongest single day since January.

After hitting $93,900, Bitcoin has retreated to $92,700 at press time, up practically 5% within the final 24 hours.