Amid the anticipation of Donald Trump’s inauguration final week and the flurry of exercise that adopted this week, U.S. spot Bitcoin ETFs have recorded a six-day influx streak.

With President Donald Trump’s meme coin launch and up to date government orders to look into making a nationwide crypto stockpile, the crypto house has been awash with exercise over the previous week, permitting some key metrics to fly beneath the radar. For one, Bitcoin exchange-traded funds have had an unbelievable run during the last six days, culminating in file volumes previously 24 hours.

Bitcoin ETFs Gobble up Almost $4B, Volumes Break $10B

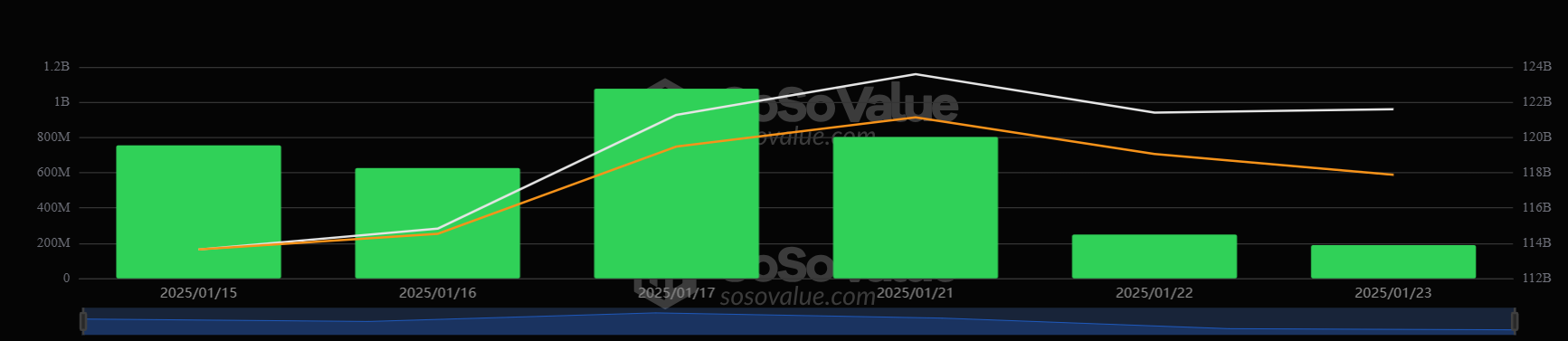

Particularly, these funding autos have raked in $3.7 billion in internet inflows within the six buying and selling days between January 15 and January 24, per SoSoValue information. This information consists of the over $1 billion in internet inflows recorded on Friday, January 17, and the over $800 million from Tuesday, January 21.

Chart exhibiting Bitcoin ETF internet inflows between January 15 and January 24 Supply SoSoValue

Chart exhibiting Bitcoin ETF internet inflows between January 15 and January 24 Supply SoSoValue

Reacting to information on Friday, January 24, ETF Retailer President Nate Geraci described the $3.7 billion determine as “ridiculous.”

Whereas every little thing else is occurring, spot bitcoin ETFs have quietly taken in $3.7bil over previous 6 days…

*$3.7bil*

That’s a ridiculous quantity.

— Nate Geraci (@NateGeraci) January 24, 2025

In the meantime, culminating this run, these ETFs traded over $10 billion in volumes for the primary time since March 2024 on Thursday, January 23, per CoinGlass information.

New All-Time Excessive Incoming?

The final time Bitcoin ETF volumes crossed $10 billion in a single buying and selling day was March 6, 2024. This preceded a 17% run-up to new all-time highs close to the $74,000 value level every week later.

Whether or not Bitcoin can replicate such a transfer will doubtless rely on the progress of Trump’s pro-crypto coverage efforts and the end result of subsequent week’s Federal Open Market Committee assembly.

On the time of writing, nonetheless, the asset’s value continues to idle across the $105,000 value level, under its not too long ago fashioned all-time excessive of $109,600.