Virtuals Protocol (VIRTUAL) is without doubt one of the hottest recovering tokens, boosting a number of different AI brokers. Nevertheless, on-chain information exhibits VIRTUAL has shifted to whale wallets, which management many of the provide.

Virtuals Protocol (VIRTUAL) has seen extra funds from whales, signaling accumulation prior to now weeks. VIRTUAL recovered together with different AI agent tokens and is now about 63% down from its peak after weeks of good cash inflows.

The shopping for curiosity of VIRTUAL led to a focus of the token within the fingers of prime merchants and whales. Primarily based on Solana on-chain information, round 93% of VIRTUAL tokens are held within the prime 100 wallets.

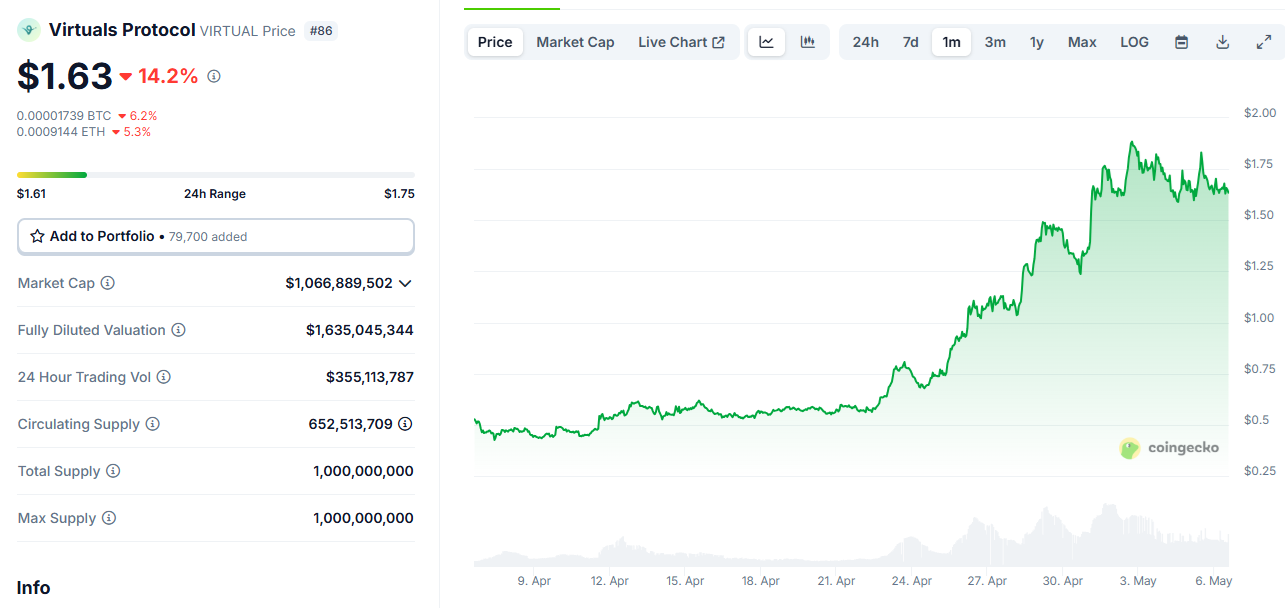

VIRTUAL trades close to its higher vary for the previous month, with elevated open curiosity on by-product markets and spot accumulation from whales. | Supply: Coingecko

VIRTUAL trades close to its higher vary for the previous month, with elevated open curiosity on by-product markets and spot accumulation from whales. | Supply: Coingecko

On-chain information from Bubblemaps additionally exhibits heightened exercise on the Gate.IO trade, with a cluster of wallets linked to the centralized marketplace for high-frequency transfers.

Open curiosity grows for Virtuals Protocol

Virtuals Protocol has drawn in good cash wallets, additional solidifying the positioning of whales. A complete of 63.7% of VIRTUAL tokens are unlocked, leaving a major half in massive wallets, ready for long-term unlocks and neighborhood rewards. Prior to now few weeks, new whale accumulation shifted the token distribution towards the bigger wallets.

Virtuals Protocol raised $16.6M in numerous funding rounds, with the most important share of fundraising within the type of an IDO on Fjord Foundry. The protocol additionally held a number of smaller VC-funded rounds, with no vital staff or contributor allocations.

VIRTUAL went by means of a interval of elevated shopping for curiosity, pushing the value to a one-month excessive above $1.80. The token stepped again to $1.66, nonetheless main the final restoration of the AI agent narrative.

Spinoff buying and selling for VIRTUAL rose prior to now month from its current lows of $15M. Spinoff positions at the moment are price greater than $111M, displaying renewed bets within the token’s efficiency.

At present, lengthy positions are barely dominant, although there have been makes an attempt to quick the asset. Spinoff buying and selling is unbiased of the buildup of VIRTUAL. Merchants are nonetheless making a speculative guess that the platform will get well and commerce in a better vary.

VIRTUAL rose on elevated exercise in April

Prior to now month, exercise on Virtuals Protocol picked up after two months of extraordinarily low exercise.

Exercise on Solana remained nearly unchanged, however Base customers picked up once more. In April, energetic wallets creating and interacting with agent tokens reached 10K each day as soon as once more.

The AI agent ecosystem can also be concentrated in a number of prime tasks, together with AIXBT, GAME, SAM, VADER, and LUNA. AVA is one other trending token, although with a smaller market capitalization. In complete, the worth of AI agent tokens is again above $570M.

AI agent tokens are additionally comparatively concentrated in a small neighborhood. Regardless of resembling memes, a a lot smaller circle of householders is purchased into these property.

On-chain information exhibits simply 9,792 particular person wallets maintain AI agent tokens, suggesting whale and insider accumulation. Virtuals Protocol goals at increasing the power to create brokers, but the ecosystem appears to be made from large-scale tasks and can also be managed by whales.