Eleven months and 13 days in the past, the U.S. welcomed its first spot bitcoin exchange-traded funds (ETFs) into the fold of conventional finance (tradfi). Since their debut, these ETFs haven’t solely damaged data however have additionally amassed greater than one million bitcoins.

Surging Spot ETFs Spark Energy Shift in Crypto Investments

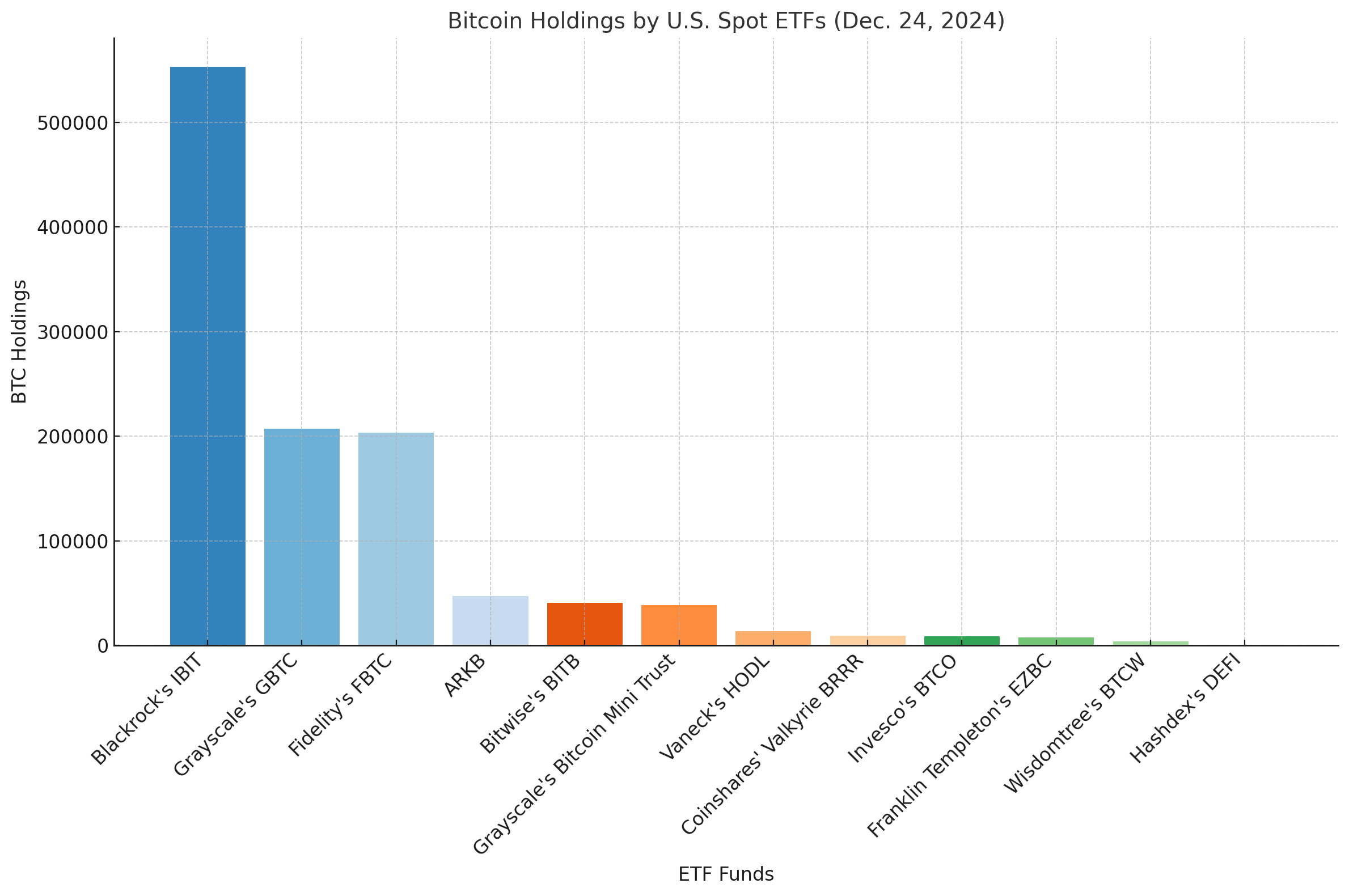

The launch of those spot bitcoin ETFs was a groundbreaking occasion, with ten funds immediately leaping into the fray, though eleven had obtained the go-ahead. Hashdex’s DEFI fund needed to pivot from a futures ETF to a spot bitcoin fund, not making the change till the tip of March. Equally, Grayscale’s Bitcoin Mini Belief didn’t see the sunshine of day till the tip of July. As of Dec. 24, 2024, these funds collectively maintain a powerful 1,132,727.50 BTC, in line with their respective web sites.

Blackrock stands tall because the titan amongst these funds, clutching 553,055.27 BTC, which is valued at roughly $54.4 billion at this time. This colossal holding represents a whopping 48.82% of the 1.13 million BTC shared among the many twelve funds. Subsequent up, we’ve acquired Grayscale’s GBTC, which as of Dec. 24, boasts a powerful 207,100.18 BTC, valued at roughly $20.3 billion. Blackrock’s IBIT trades on the Nasdaq, whereas GBTC does its dance on the New York Inventory Trade (NYSE).

Over at Cboe, Constancy’s FBTC takes the third spot, commanding 203,194.05 BTC, which interprets to a cool $20 billion. It’s completely mind-blowing that Blackrock’s IBIT and Constancy’s FBTC have amassed such a stash this 12 months, and much more fascinating is that about 400,000 BTC have vanished from GBTC’s treasure chest for the reason that 12 months kicked off. Earlier than it went public on the NYSE, GBTC was an OTC darling with over 600,000 BTC.

Regardless of this outflow, with GBTC and FBTC neck-and-neck of their BTC reserves, there’s no comparability to the colossal measurement of those three giants. Nevertheless, IBIT has zoomed previous them each. Subsequent in line, when it comes to bitcoin holdings, is Ark Make investments’s and 21shares’ ARKB fund, which has gathered 47,013 BTC, equating to $4.6 billion at this time – a determine that pales compared to the $20 billion of GBTC and FBTC, and the large $54.4 billion of IBIT.

Following intently, Bitwise’s BITB holds 40,909.86 BTC, and Grayscale’s Bitcoin Mini Belief secures 38,275.49 BTC. Collectively, ARKB, BITB, and Grayscale’s Bitcoin Mini Belief type their very own elite membership with their hefty reserve sizes. Vaneck’s HODL isn’t far behind, with 13,716.827 BTC, valued at round $1.3 billion. Only a notch under, Coinshares’ Valkyrie BRRR holds 9,069.3 BTC, amounting to $892 million. Invesco’s BTCO claims round 8,780 BTC, and Franklin Templeton’s EZBC sits at roughly 7,624.52 BTC, whereas Wisdomtree’s BTCW holds a gentle 3,841 BTC.

Lastly, Hashdex’s DEFI rounds up the checklist with a modest 148 BTC, value $14.5 million. This historic accumulation of over one million bitcoins by U.S. spot ETFs inside their first 12 months indicators a seismic shift in cryptocurrency funding accessibility. The dominance of three main gamers – Blackrock, Grayscale, and Constancy – controlling over 85% of the overall holdings demonstrates each the concentrated nature of institutional crypto adoption and the aggressive dynamics shaping these rising monetary autos.

The stark distinction between the top-tier funds and smaller gamers suggests a possible consolidation development within the bitcoin ETF house, whereas concurrently highlighting how conventional monetary powerhouses have rapidly established dominance. As these funds proceed to evolve, their collective holdings signify a good portion of Bitcoin’s circulating provide, doubtlessly influencing future market dynamics and institutional adoption patterns going ahead.