Bitcoin ($BTC) fell from its all-time high of $126,000 in October to around $87,000 by the end of the year, and from approximately $87,000 at the beginning of the year to around $68,000.

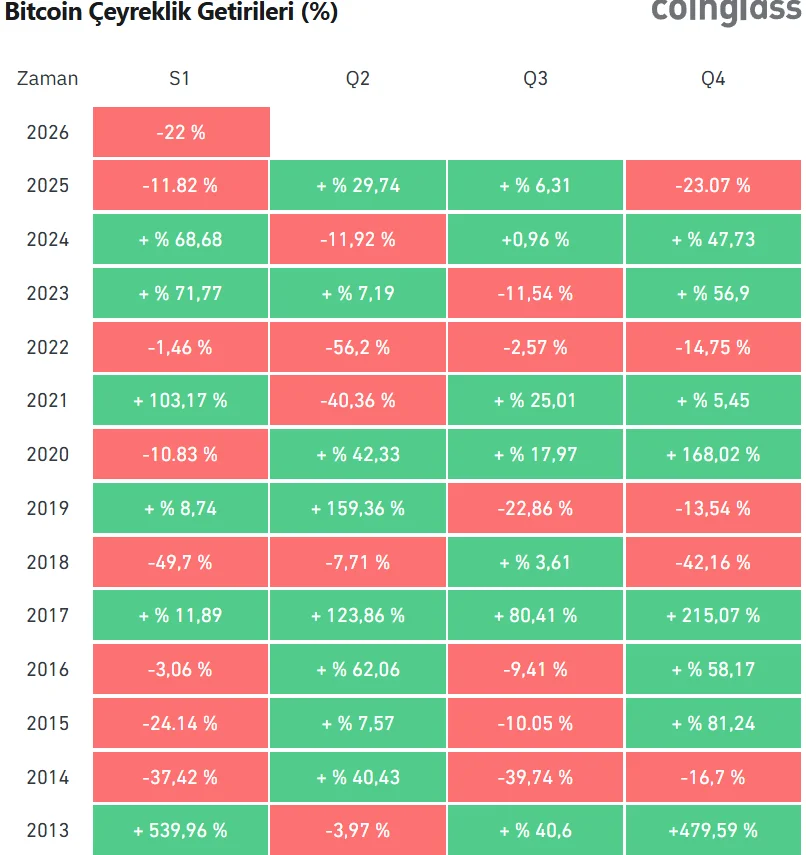

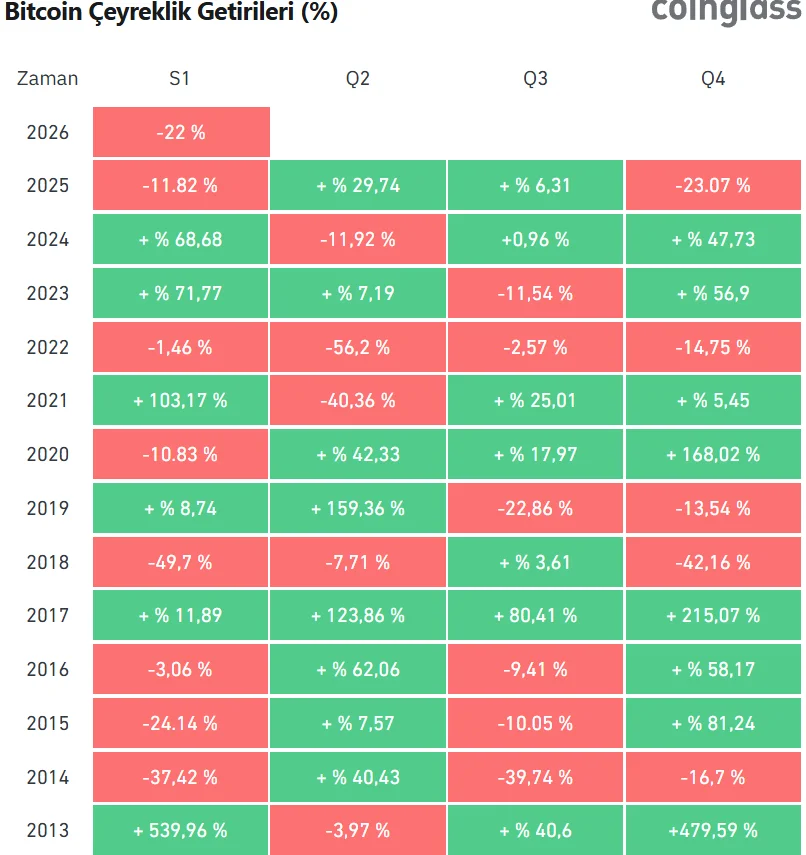

At this point, Bitcoin has fallen by 22% since the beginning of the year, and it is predicted that this quarter could be the worst for Bitcoin’s price in the last 8 years.

According to the data, Bitcoin is on track for its worst first-quarter performance in eight years since the 2018 bear market, having fallen 22.3% since the beginning of the year.

This marks the weakest performance since the 49.7% drop seen in the first quarter of the 2018 bear market. If this month also ends in a decline, it will be the first time in history that $BTC has recorded consecutive losses in both January and February.

Bitcoin, which experienced a 10.2% drop in January, lost more than 13% of its value in February. To make February a positive month, it needs to regain the $80,000 level.

Furthermore, Bitcoin has closed seven of the last 13 first quarters with a decline. Recent examples include declines of -11.8% in 2025 and -10.8% in 2020.

Market analyst Daan Trades Crypto said, “The first quarter is traditionally a very volatile period. Historically, first-quarter performance has not reflected the overall trend of the year.”

While Bitcoin is experiencing sharp declines, some analysts view these drops as a correction rather than a structural collapse. In this regard, LVRG research head Nick Ruck characterized the declines as a typical correction phase amidst global macroeconomic uncertainty.

Like Bitcoin, the largest altcoin, Ethereum ($ETH), is also performing poorly. According to the data, $ETH also fell by more than 34% in the first quarter, and is on track to record the third weakest first quarter in its history.

*This is not investment advice.