Ripple’s XRP has managed a 3% worth enhance over the previous week, according to the broader crypto market rally that has lifted a number of main cash.

Nevertheless, regardless of the bullish momentum, a key technical indicator is flashing a warning sign that would undermine XRP’s latest beneficial properties.

XRP’s Rally on Skinny Ice

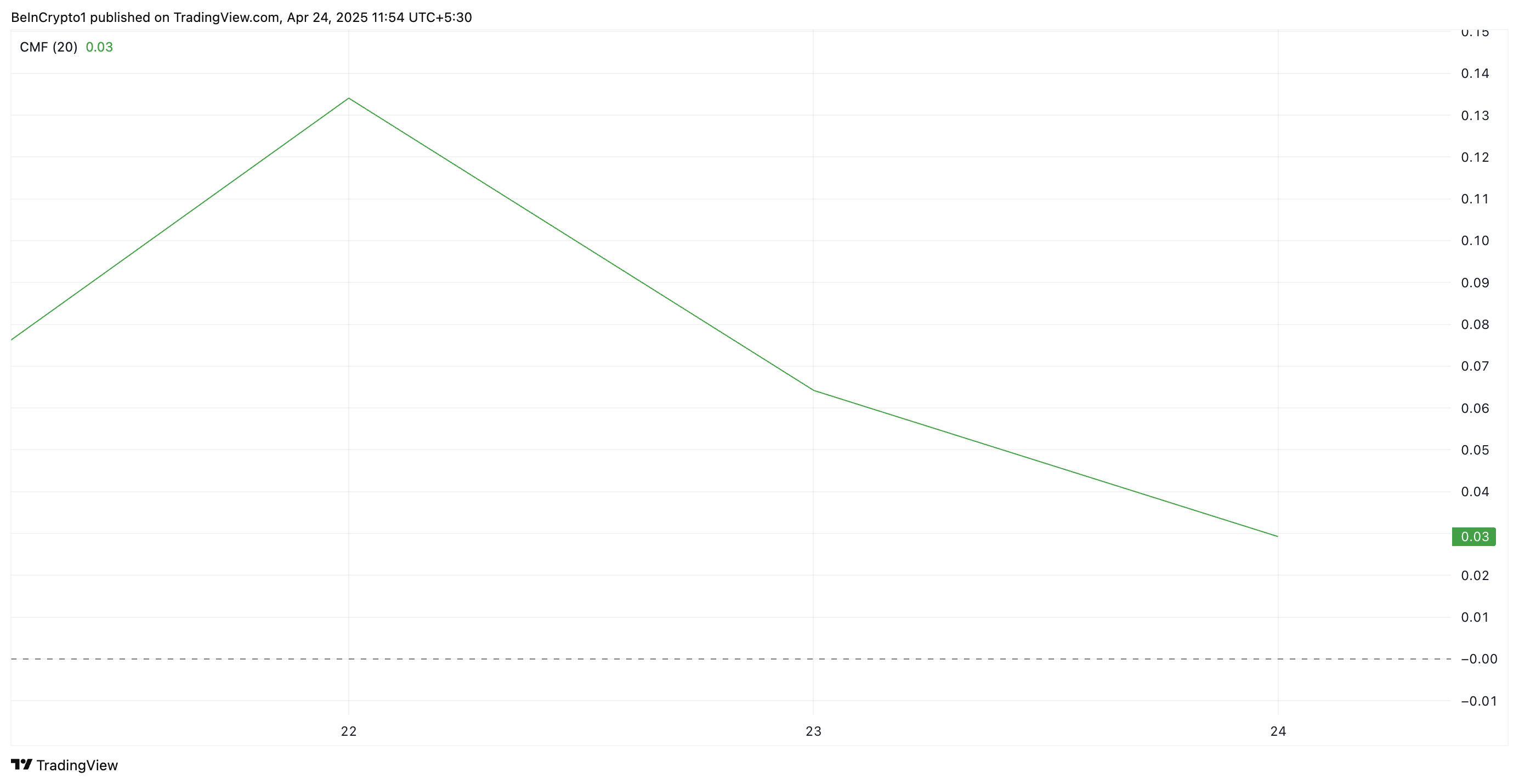

XRP’s Chaikin Cash Stream (CMF)—an indicator that measures the volume-weighted move of cash into and out of an asset—has been trending downward even because the token’s worth has continued to rise. This momentum indicator is at present at 0.03 and trending towards the middle line.

XRP CMF. Supply: TradingView

XRP CMF. Supply: TradingView

The pattern kinds a bearish divergence between XRP’s worth motion and CMF, a warning signal of weakening momentum. Usually, the CMF tracks the move of capital into an asset, so when it declines whereas costs rise, it means that the rally lacks strong assist from sustained demand.

In different phrases, XRP merchants could also be shopping for based mostly on short-term hype reasonably than long-term conviction. This implies its latest beneficial properties are susceptible to being erased, particularly if broader market sentiment shifts or profit-taking units in.

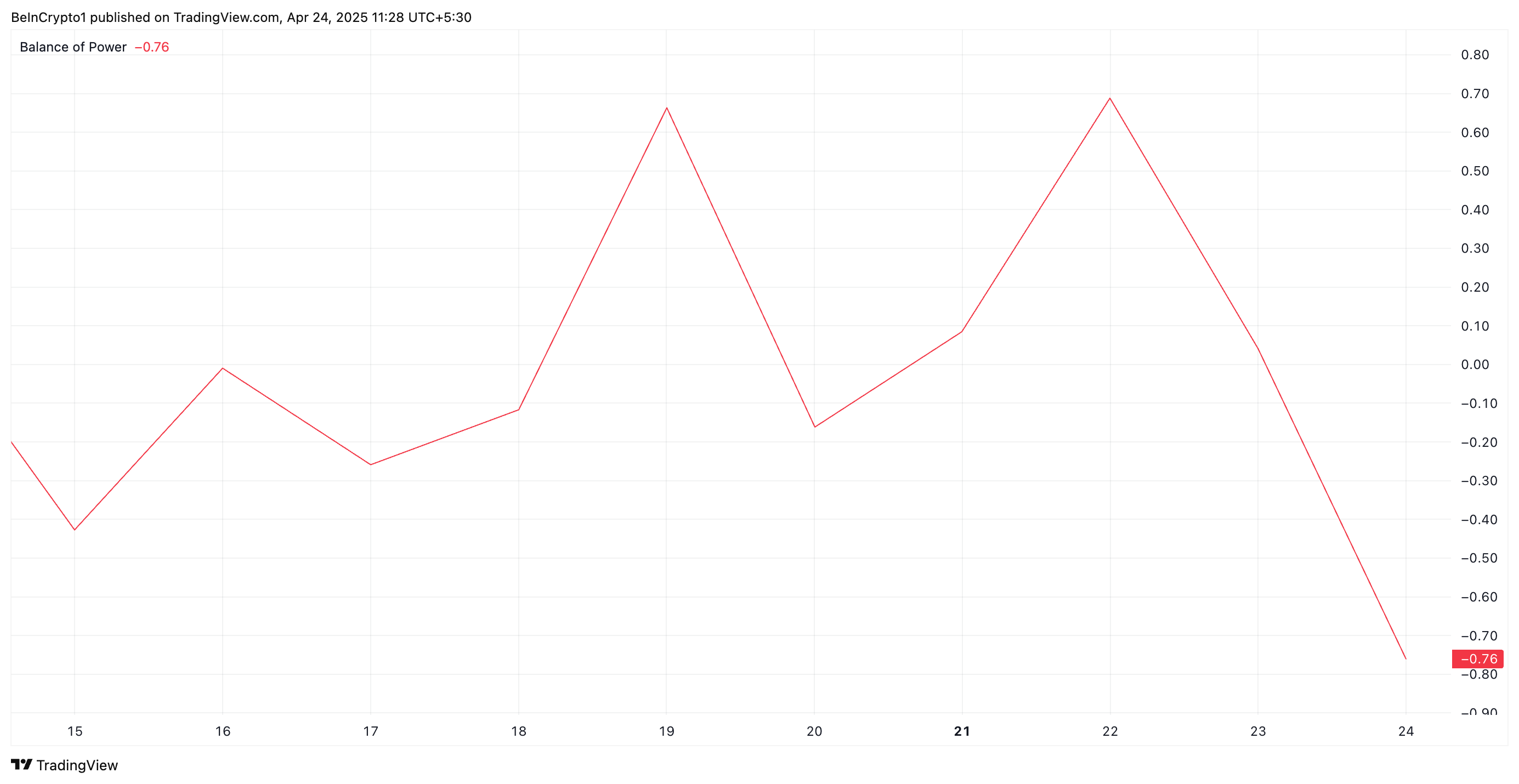

Additional, the altcoin’s adverse Steadiness of Energy (BoP) helps this bearish outlook. As of this writing, the indicator is at -0.76, highlighting the weakening demand for XRP.

XRP BoP. Supply: TradingView

XRP BoP. Supply: TradingView

When an asset’s BoP is adverse like this, sellers exert extra affect over worth motion than consumers. It’s a bearish sign that signifies additional draw back strain on XRP if the pattern continues.

XRP Faces Essential Take a look at at $2 Help

XRP at present trades at $2.18, holding above assist fashioned at $2.03. If demand weakens additional, XRP bulls could be unable to defend this assist degree, inflicting the altcoin to fall again under $2, to commerce at $1.61.

XRP Value Evaluation. Supply: TradingView

XRP Value Evaluation. Supply: TradingView

Nevertheless, a resurgence in new demand for XRP will invalidate this bearish outlook. In that state of affairs, its worth may rally to $2.29 and cost towards $2.50.