On April 20, Dogecoin lovers worldwide united to mark Dogeday, a community-driven vacation celebrating the world’s most recognizable meme coin.

Whereas the festivities showcased the coin’s loyal fanbase and cultural relevance, the celebration did not spark any significant market motion.

Dogeday Fails to Elevate Dogecoin Value as Merchants Face $2.8 Million in Liquidations

As a substitute of driving a wave of optimistic sentiment, Dogecoin was the worst-performing asset among the many high 20 cryptocurrencies through the previous day.

In line with knowledge from BeInCrypto, the token dropped over 2.5% through the reporting interval in comparison with the muted efficiency of the overall market.

This disappointing efficiency led to roughly $2.8 million in liquidations, with merchants betting on an upward worth motion shedding greater than $2 million, per Coinglass figures.

Dogecoin 24-Hour Liquidation. Supply: CoinGlass

Dogecoin 24-Hour Liquidation. Supply: CoinGlass

Nonetheless, even with the lackluster worth motion, Dogecoin’s relevance within the crypto ecosystem stays plain. Launched in 2013 as a parody of Bitcoin, DOGE has grown far past its meme origins.

The digital asset is now the ninth-largest cryptocurrency by market capitalization, at present valued at roughly $22.9 billion, in keeping with CoinMarketCap.

A lot of its progress might be attributed to high-profile endorsements. Tesla CEO and presidential advisor Elon Musk has repeatedly voiced assist for Dogecoin, as has billionaire entrepreneur Mark Cuban. Their backing helped shift public notion of DOGE from a joke to a respectable digital asset and fee possibility.

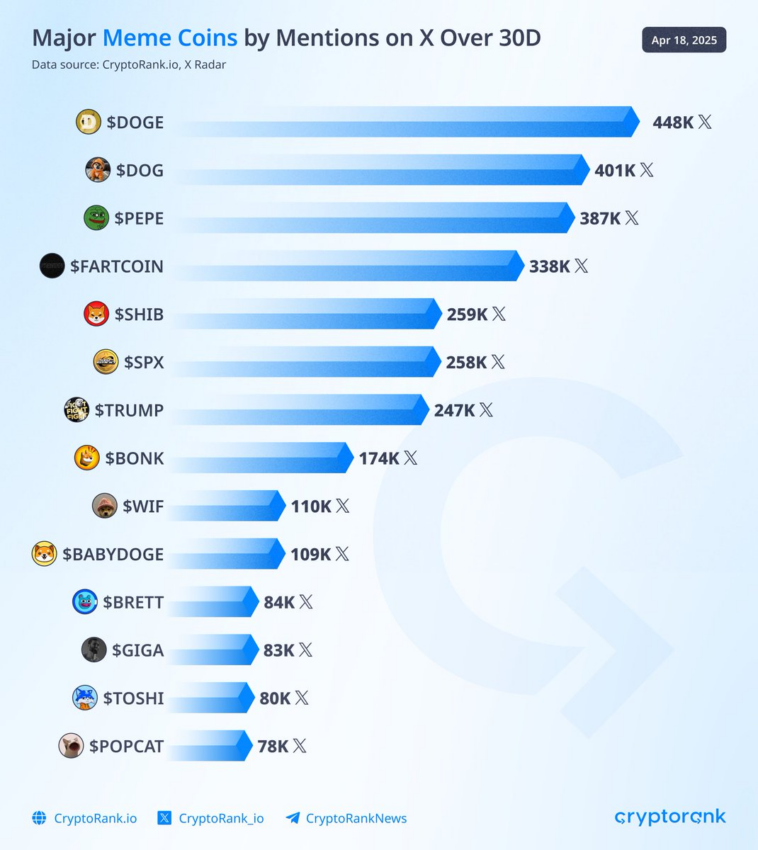

On social media, Dogecoin continues to guide the memecoin narrative. In line with CryptoRank, it was probably the most talked about memecoin ticker on X (previously Twitter) up to now month. This visibility continues to gasoline each neighborhood engagement and investor curiosity.

High Meme Cash on X. Supply: Cryptorank

High Meme Cash on X. Supply: Cryptorank

Furthermore, institutional curiosity in Dogecoin can also be on the rise. Main asset managers, together with Bitwise, Grayscale, 21Shares, and Osprey, have submitted filings to the US Securities and Change Fee (SEC) searching for to launch spot Dogecoin ETFs.

If granted, these monetary funding automobiles might turn out to be the primary exchange-traded funds centered totally on a meme coin.

Contemplating this, crypto bettors on Polymarket put the chances of those merchandise’ approval above 55% this 12 months. This optimism displays a rising perception that Dogecoin might quickly safe a spot in mainstream monetary markets.