It is a section from the Ahead Steerage e-newsletter. To learn full editions, subscribe.

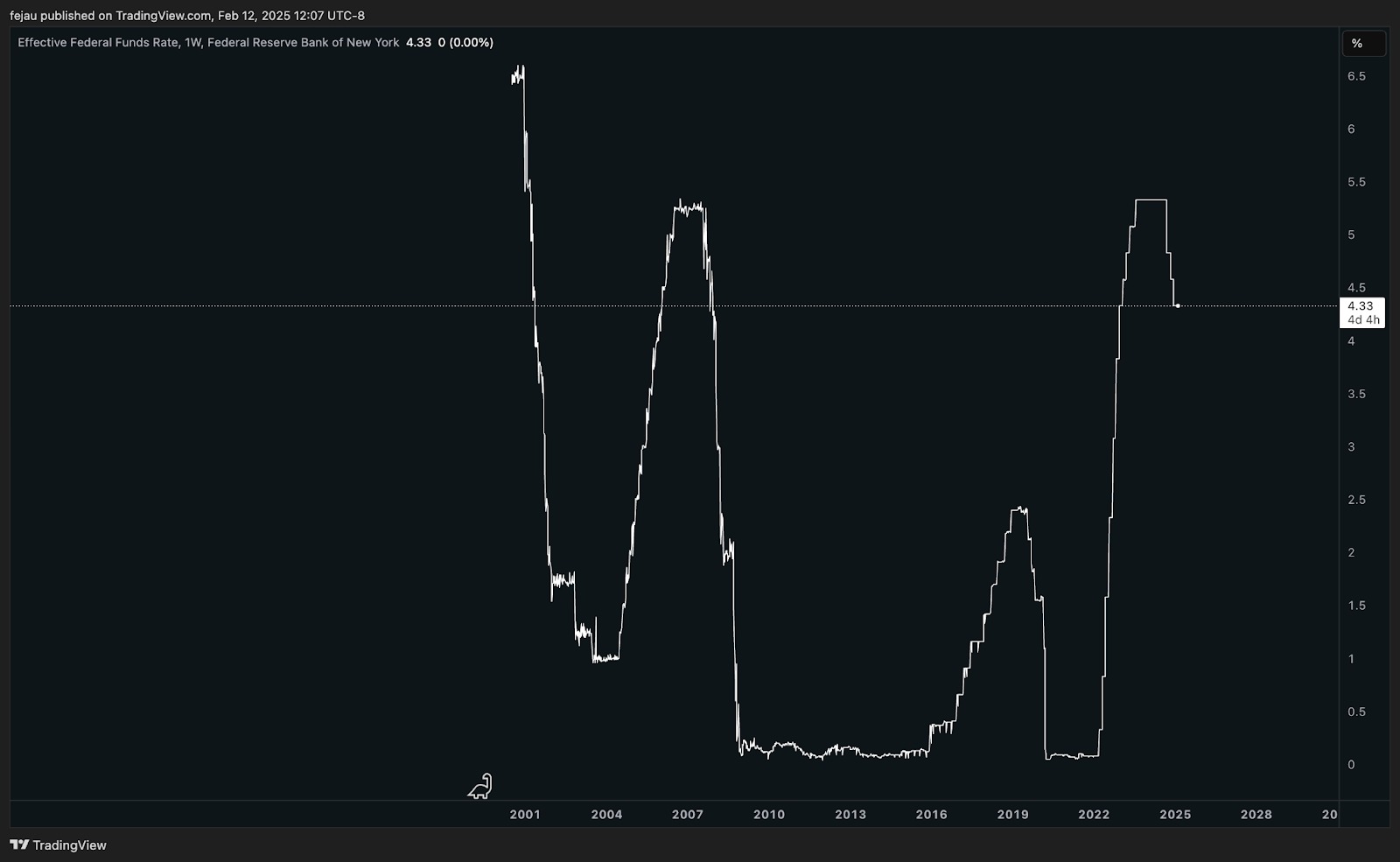

Lots has modified within the six months because the Fed determined to chop charges.

If we rewind again to September, issues appeared very completely different:

- The unemployment fee was trying weak and had surged to 4.2%, triggering the Sahm rule and inflicting a cacophony of issues {that a} recession was imminent.

- On the similar time, inflation appeared prefer it was shut sufficient to the Fed’s 2% goal that it may forego issues about steady costs and hone in on supporting the labor market by starting to chop the fed funds fee.

With this steadiness in thoughts, the Fed went forward and reduce 100 foundation factors in that point up till at the moment:

Throughout these months, it turned simple to be complacent that we had been set into an easing cycle and it was time to experience that wave.

Nevertheless, coming again to the current day, the atmosphere couldn’t be extra completely different. For all intents and functions, the slicing cycle is over.

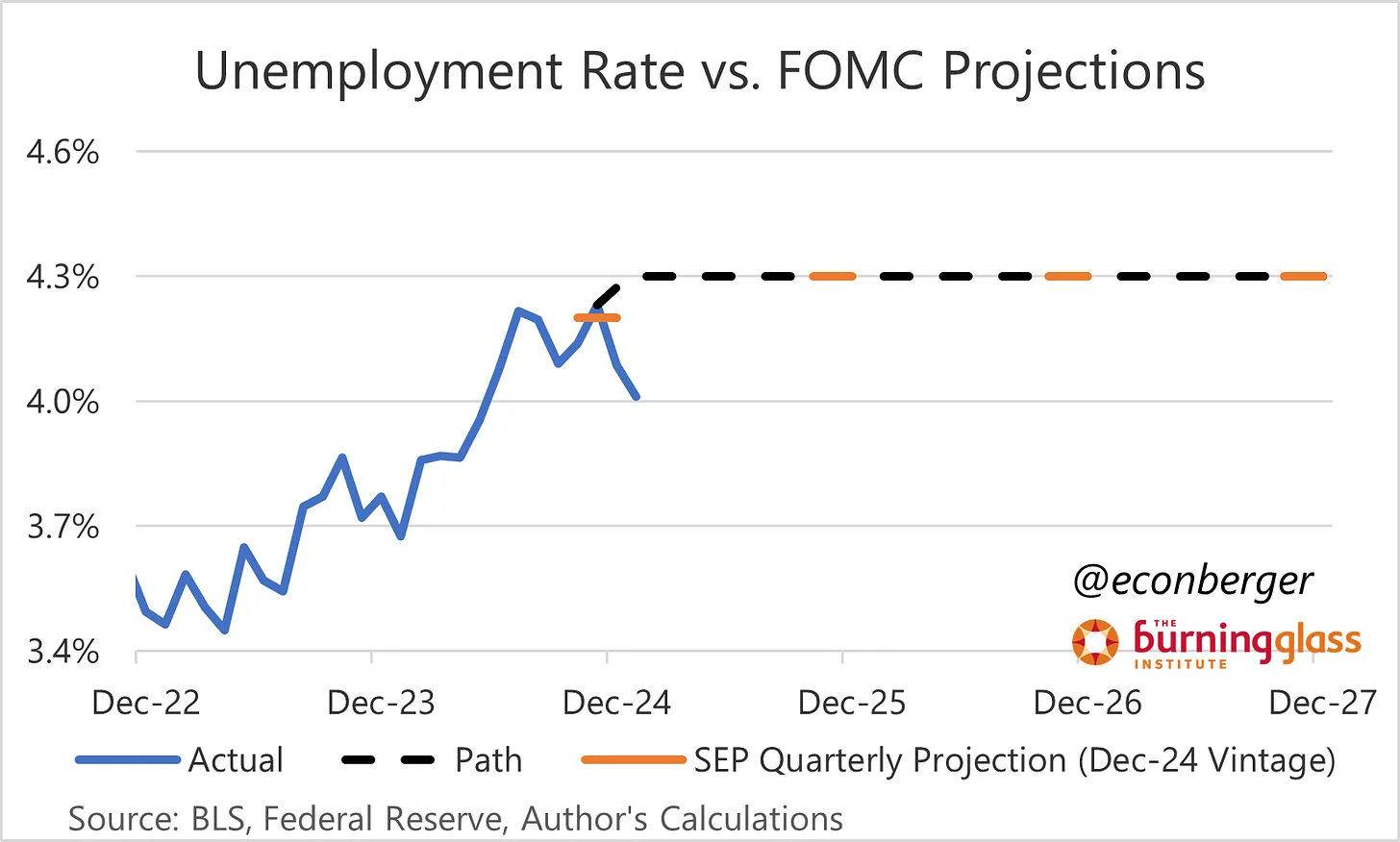

Wanting on the labor market, it has improved considerably. Evaluating the unemployment fee to the Fed’s forecast from solely December, we will see that it has come down considerably.

Subsequently, if one is seeking to the employment aspect of the Fed’s twin mandate, there isn’t a cause in anyway for it to be easing at this juncture.

And so, the onus for any marginal easing from the Fed falls to the inflation aspect of the twin mandate.

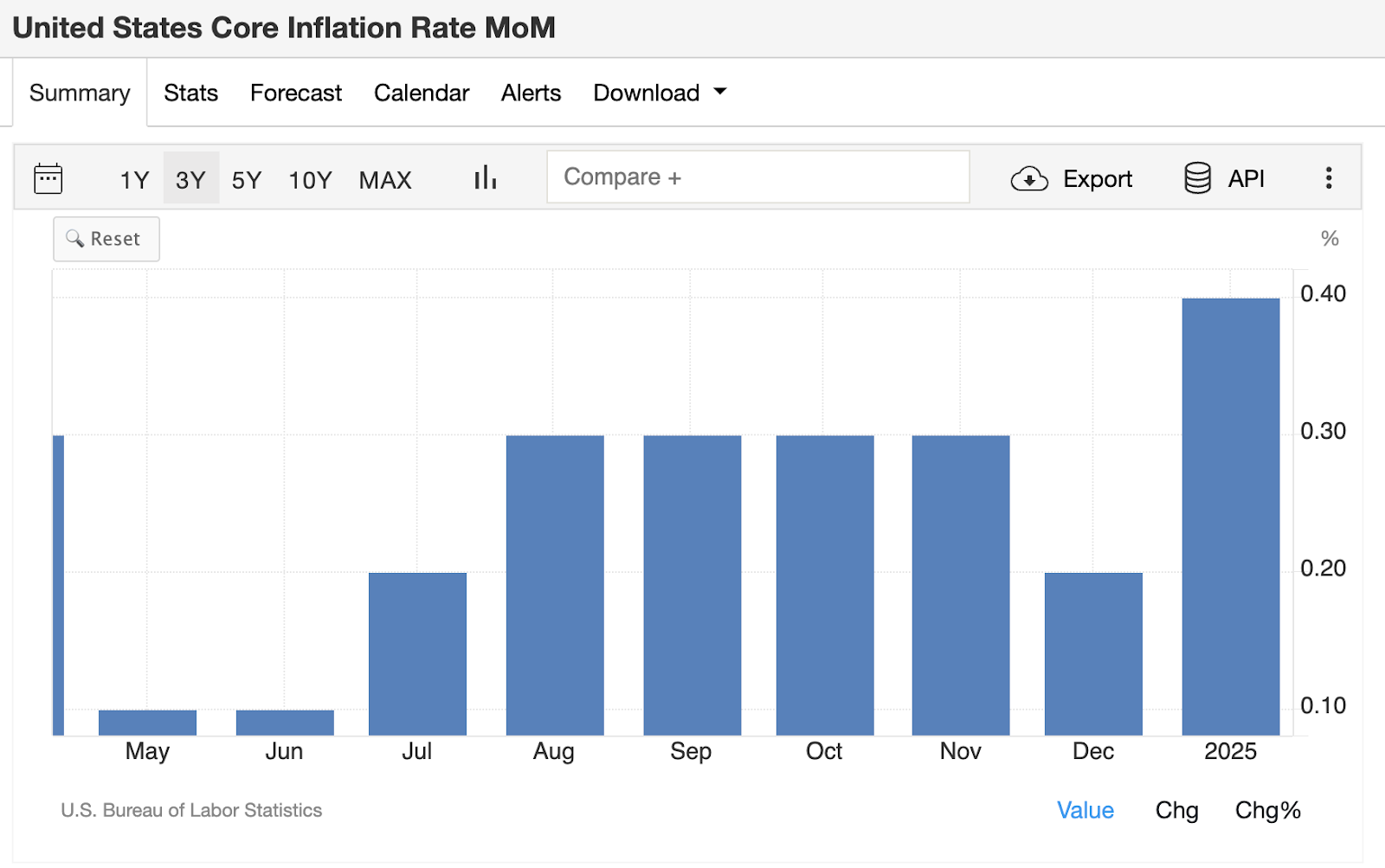

This week we obtained the CPI print for January, and it was a sizzling one by all accounts.

Core CPI got here in at 0.4%, a notable leap greater from latest information.

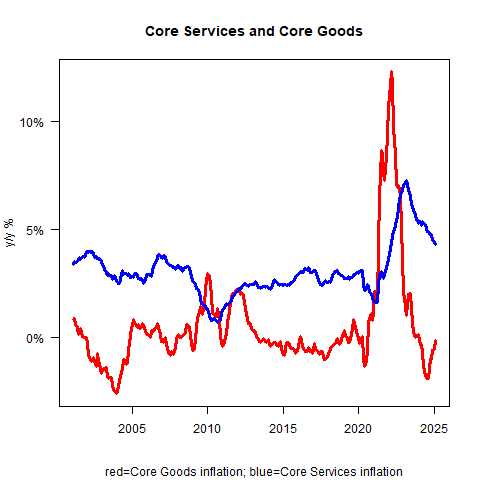

The theme of the inflation story over the past two years has been items disinflating whereas companies stay stubbornly excessive. As seen within the chart beneath, the most important subject at the moment is that items are inflating once more and companies are refusing to take the baton of disinflation:

The straightforward takeaway from this granular information is that inflation is remaining above the Fed’s 2% goal and bouncing across the 3-4% degree. So long as that is occurring, there’s little cause for the Fed to chop charges when either side of its twin mandate are seeing such power.

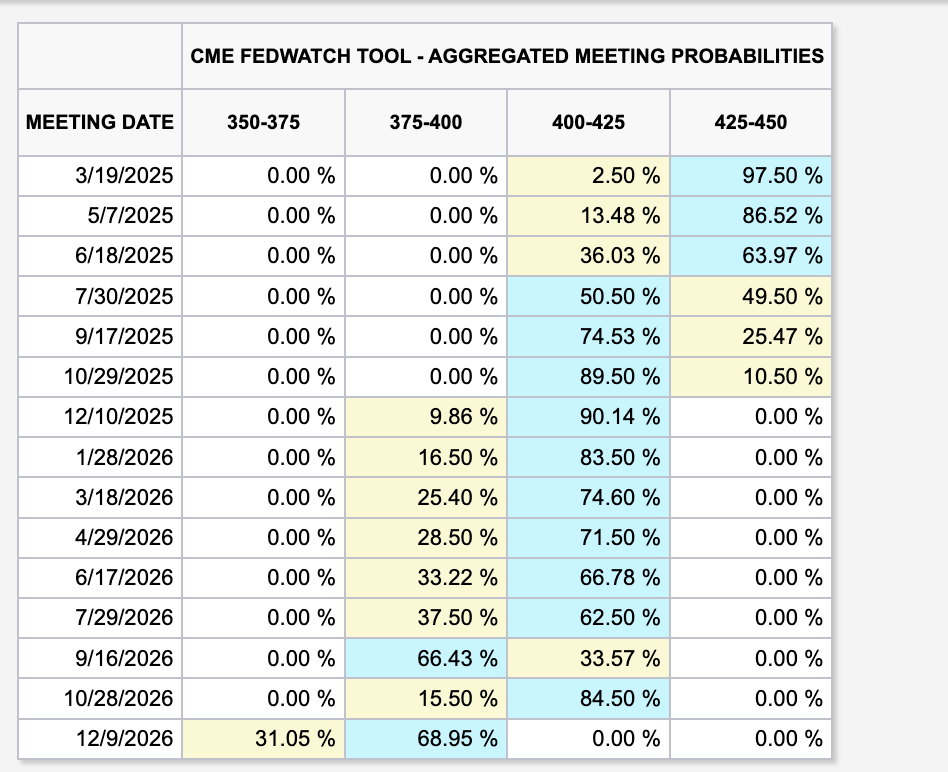

Placing all of it collectively, we are actually seeing a rate-cutting cycle that’s seemingly over. Because it stands at the moment, the market has moved from anticipating a fee reduce in March to the tip of this yr as an alternative:

If the information continues to come back in above the Fed’s targets, it’s affordable to assume that these cuts will proceed to get pushed out till they now not exist.