On Feb. 2, 2025, XRP oscillated at $2.57 to $2.61 over the past hour, its market valuation eclipsing $150 billion alongside a $12.19 billion each day turnover. Intraday fluctuations spanned $2.52 to $2.95 per XRP, mirroring intense volatility as provide overwhelmed demand.

XRP

XRP’s hourly chart reveals a dominant bearish trajectory, with costs faltering in makes an attempt to keep up upward progress. Provide-side forces have dictated motion, illustrated by sequential declines in peaks and troughs. Resistance solidifies at $2.75, whereas $2.50 anchors tentative help. A failure to breach resistance could catalyze a descent towards the Fibonacci extension at $2.40. The relative power index (RSI) lingers close to equilibrium, hinting at attainable deterioration if sell-offs persist. In the meantime, the transferring common convergence divergence (MACD) stays entrenched in unfavourable alignment, amplifying XRP’s pessimistic forecasts.

XRP/USD 1H chart through Bitfinex on Feb. 2, 2025.

XRP/USD 1H chart through Bitfinex on Feb. 2, 2025.

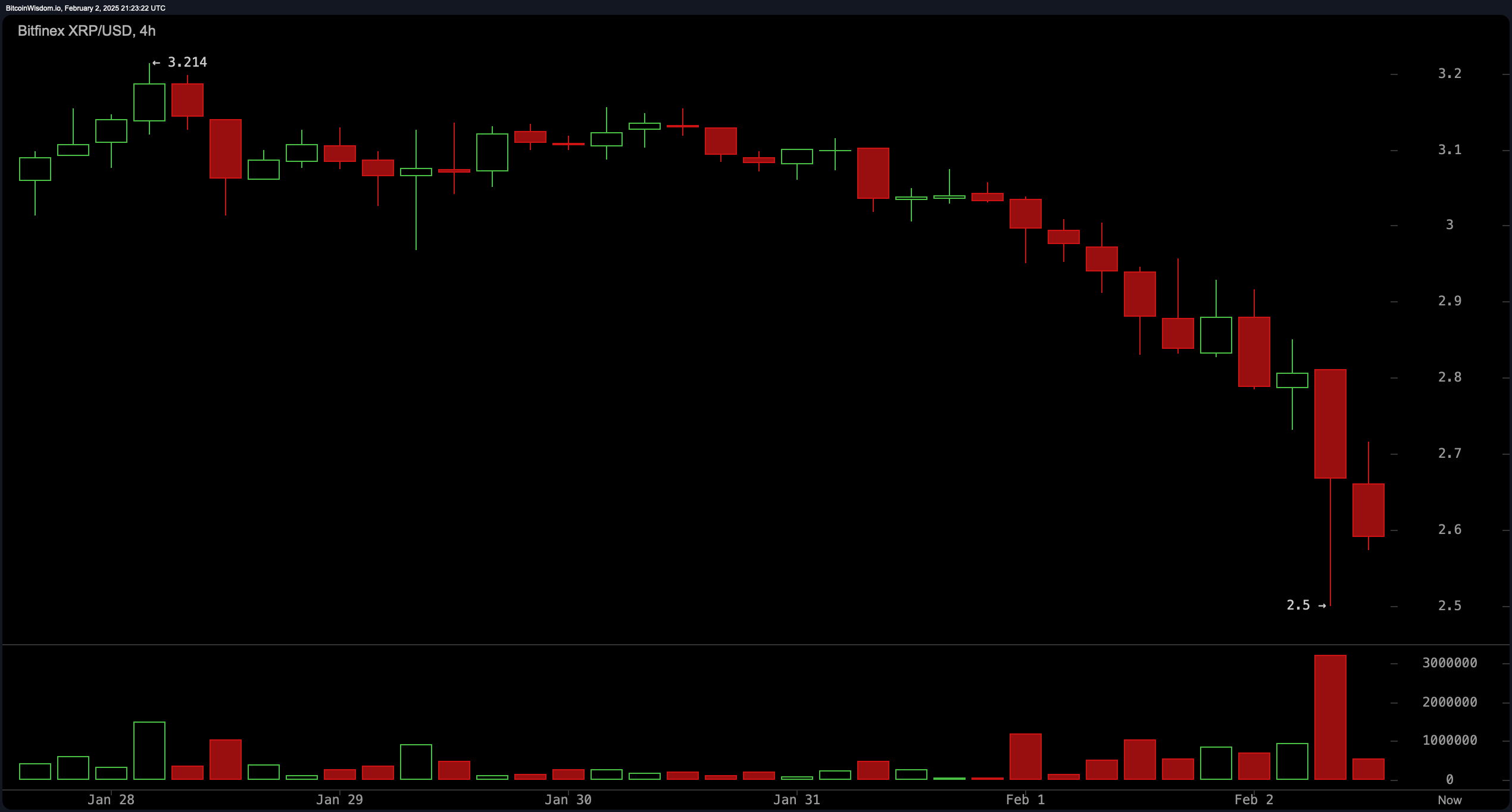

Increasing to the four-hour timeframe, XRP has persistently underperformed important exponential transferring averages (EMA) and easy transferring averages (SMA), validating sustained downward momentum. A forceful rejection at $2.75 underscores consumers’ lack of conviction, with costs gravitating towards deeper corrections. The $2.50 help zone now acts as a linchpin; a violation of this threshold may hasten a retreat to $2.40. Resistance crystallizes on the 38.2% Fibonacci retracement ($3.05), necessitating a decisive shut above this barrier to counsel restoration. Till then, bearish methods maintain attraction, with merchants monitoring resistance zones for tactical entries.

XRP/USD 4H chart through Bitfinex on Feb. 2, 2025.

XRP/USD 4H chart through Bitfinex on Feb. 2, 2025.

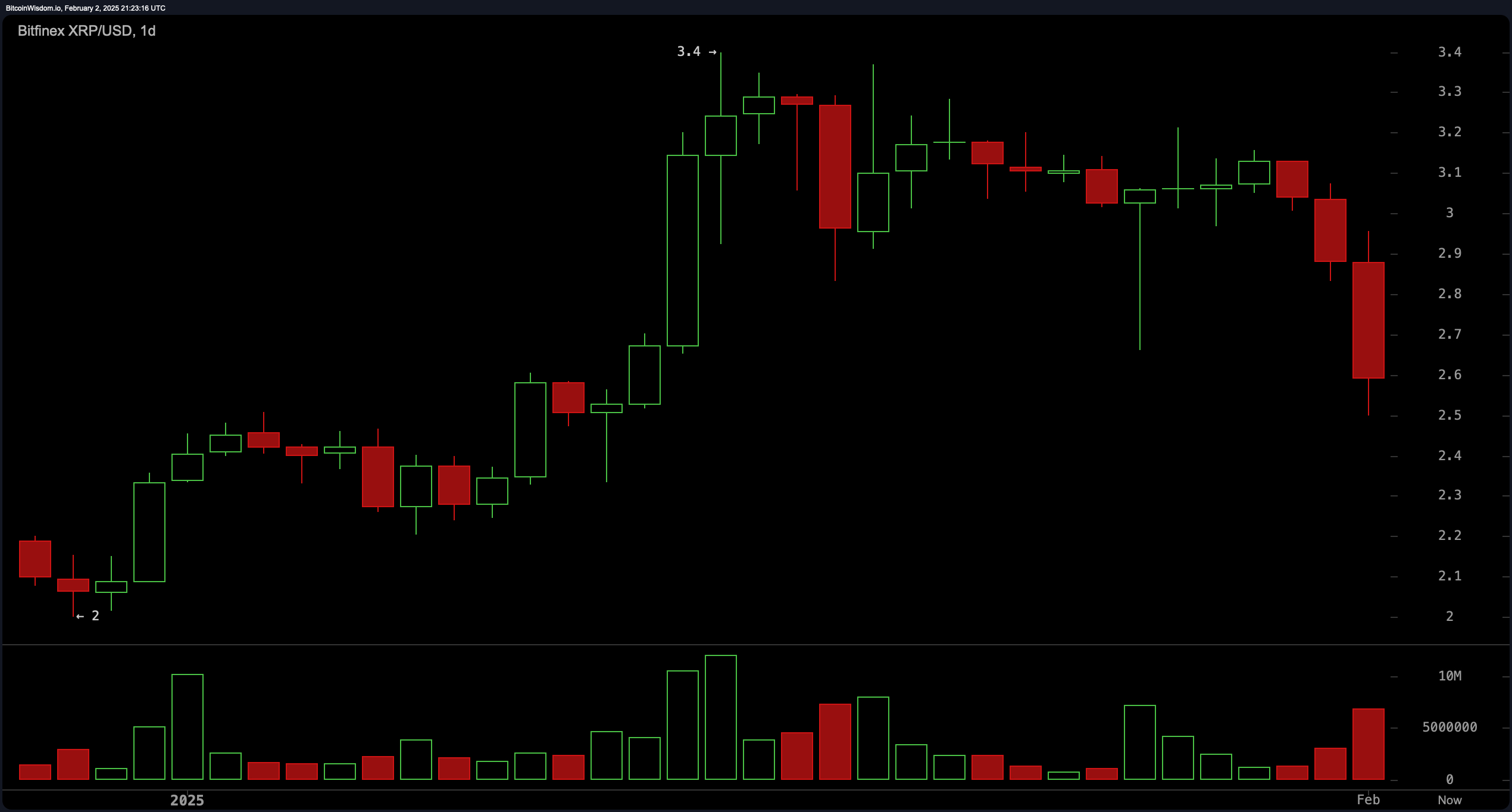

Zooming out, the each day chart paints an prolonged bearish framework. XRP struggles to recapture prior peaks it as soon as noticed, stymied by the 50-day EMA and SMA, which now perform as ceilings. These limitations bolster expectations of additional depreciation, whereas the 100-day and 200-day averages provide distant cushions at $2.14 and $1.59, respectively. A breach beneath $2.50 would possibly provoke a descent towards these ranges. Conversely, a each day settlement above $2.75 may foreshadow a reversal, although affirmation calls for constant demand and an advance past the 50% Fibonacci marker at $2.91.

XRP/USD 1D chart through Bitfinex on Feb. 2, 2025.

XRP/USD 1D chart through Bitfinex on Feb. 2, 2025.

Oscillators emit ambiguous indicators: the RSI (38.83) hovers in impartial territory, approaching oversold thresholds, whereas the Stochastic (31.52) and commodity channel index (-215.76) mirror indecision. The common directional index (18.91) implies tepid pattern efficiency. Although the superior oscillator (0.208) hints at marginal upward impetus, the MACD (0.081) reinforces the dominant bearish inclination.

Transferring averages (MAs) uniformly advocate for bearish positions, with the 10-, 20-, 30-, and 50-day EMAs and SMAs aligned downward. Solely the 100- and 200-day averages flash purchase indicators, suggesting longer-term foundations retain stability. A sustained drop under $2.50 per XRP could check these deeper helps, whereas a clearance of important resistance at $2.75 and $2.91 is important for bullish momentum. Presently, the scales tip decisively towards warning, with downward dangers eclipsing fragile optimism.

Bull Verdict:

Whereas prevailing sentiment skews bearish, latent optimism sparkles in XRP’s technical tapestry. A decisive shut above $2.75—and subsequently the 50% Fibonacci stage at $2.91—may ignite a reversal, buoyed by the Superior Oscillator’s faint bullish whisper and the 100-/200-day transferring averages’ steadfast help. Merchants eyeing contrarian performs could discover strategic entries if demand resurges to overpower provide.

Bear Verdict:

The symphony of technical proof resounds with warning. Persistent failures to breach resistance, coupled with transferring averages’ downward refrain and the MACD’s bearish chorus, tilt risk-reward decisively south. A breakdown under $2.50 dangers unraveling towards $2.14 or decrease, with oscillators’ impartial ambivalence providing little protection. Till consumers orchestrate a structural shift, prudence favors bearish alignment.