XRP is presently buying and selling at $3.12, with a market capitalization of $179 billion, a 24-hour buying and selling quantity of $3.29 billion, and an intraday value vary of $3.08 to $3.14, indicating crucial ranges for merchants to observe.

XRP

XRP’s 1-hour chart reveals a consolidation section because the crypto asset trades in a slim vary between $3.10 and $3.20. The shortage of upper highs or decrease lows underscores weak momentum, whereas subdued quantity displays restricted market participation. Merchants ought to look ahead to a breakout above $3.15 to $3.20, supported by growing quantity, to verify a bullish transfer focusing on $3.25 to $3.30. Conversely, a breakdown beneath $3.10 might result in additional draw back danger.

XRP/USDT 1H chart on Jan. 25, 2025.

XRP/USDT 1H chart on Jan. 25, 2025.

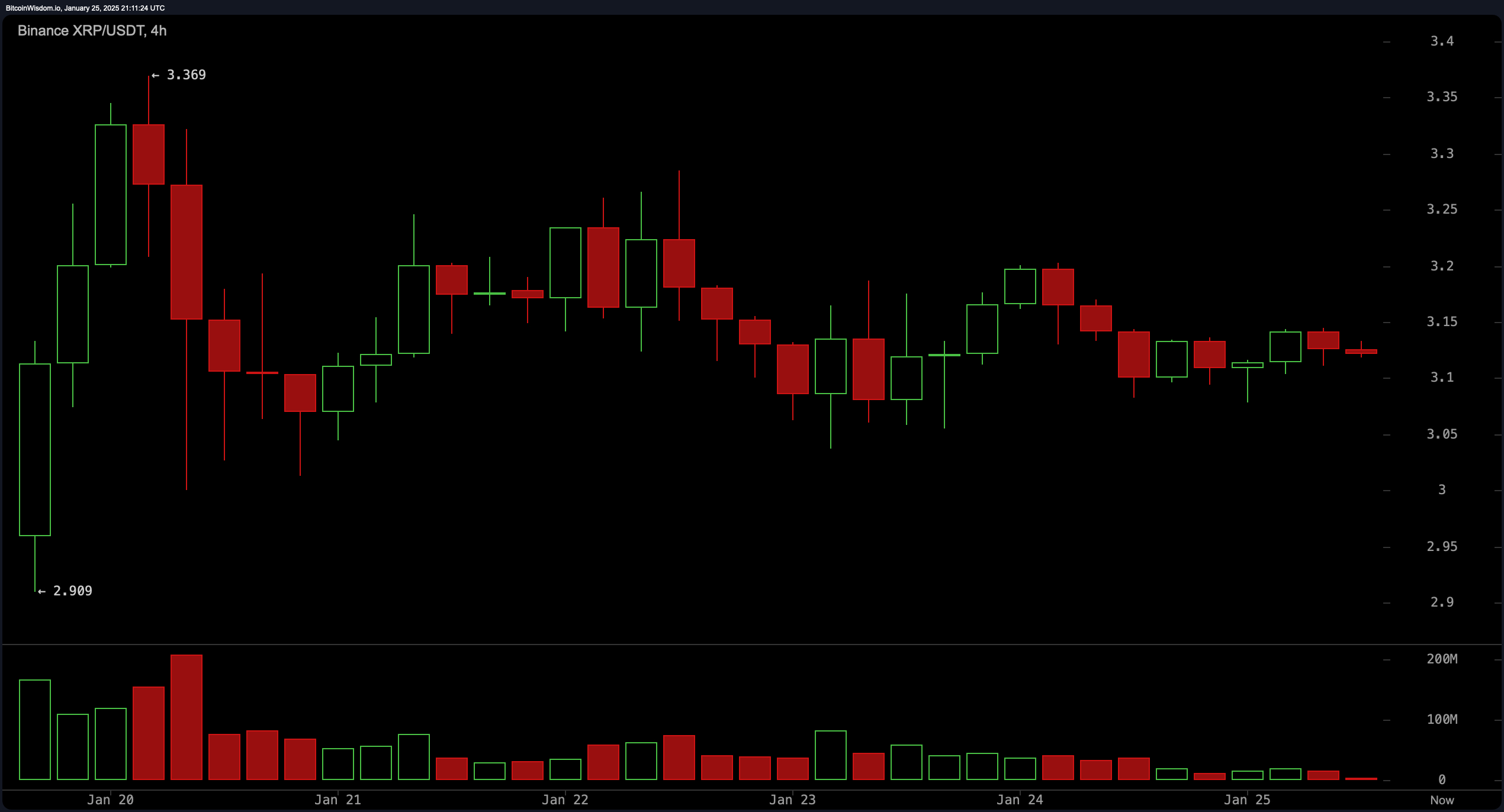

The 4-hour chart reveals a short-term downtrend after testing resistance at $3.40, with XRP forming decrease highs. Help at $3.10 has held agency, whereas resistance at $3.20 stays unbroken. Lowering quantity on the retracement suggests fading promoting stress, hinting at a possible base close to $3.10. A sustained breakout above $3.20 with rising quantity would sign a restoration, whereas a breach of $3.10 might push costs towards the decrease finish of the vary at $3.00.

XRP/USDT 4H chart on Jan. 25, 2025.

XRP/USDT 4H chart on Jan. 25, 2025.

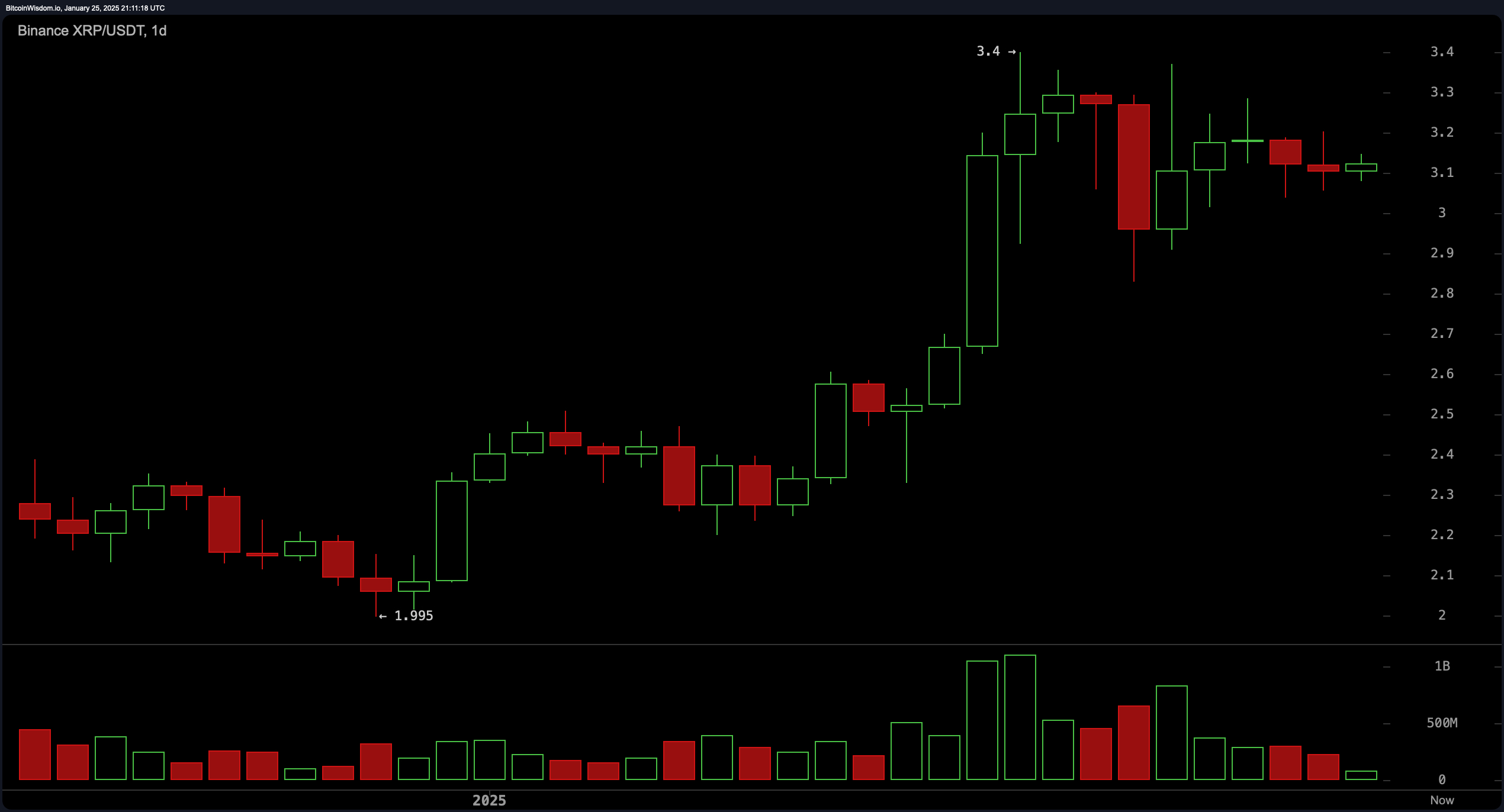

On the day by day chart, XRP maintains a bullish trajectory regardless of latest consolidation following a peak at $3.40. The $3.00 to $3.10 degree serves as crucial assist, whereas $3.40 represents a key resistance zone. Quantity patterns reveal a decline in momentum, which might both precede a reversal or an prolonged sideways motion. Merchants trying to capitalize on bullish traits ought to think about coming into close to $3.10 with an eye fixed on $3.40, supplied the assist holds and quantity will increase.

XRP/USDT 1D chart on Jan. 25, 2025.

XRP/USDT 1D chart on Jan. 25, 2025.

Oscillators point out blended indicators, with the relative energy index (RSI) at 63.61 (impartial), stochastic %Okay at 73.93 (impartial), and the commodity channel index (CCI) at 56.40 (impartial). The typical directional index (ADX) at 20.08 suggests an absence of sturdy pattern path, whereas the superior oscillator displays impartial momentum at 0.56. Momentum at -0.023 indicators a possible draw back bias, whereas the transferring common convergence divergence (MACD) at 0.225 helps a bullish outlook.

XRP’s transferring averages (MAs) spotlight a predominantly bullish setup, with the exponential transferring common (EMA) for 10, 20, 30, 50, 100, and 200 durations all signaling purchase, alongside the straightforward transferring averages (SMA) for 20, 30, 50, 100, and 200 durations. The SMA for 10 durations, nevertheless, signifies promote, reflecting short-term resistance. This alignment of longer-term transferring averages helps a bullish pattern, supplied XRP sustains its place above crucial assist ranges.

Bull Verdict:

If XRP efficiently defends the $3.10 assist degree and breaks above $3.20 with elevated quantity, it might pave the way in which for a bullish continuation towards $3.25 and past. A resurgence in shopping for stress, coupled with favorable momentum indicators like a rising MACD, would affirm the bullish trajectory, with $3.40 remaining the important thing resistance to overcome for sustained upside.

Bear Verdict:

Failure to carry the crucial $3.10 assist degree might expose XRP to additional draw back danger, with costs probably retreating to the $3.00 threshold or decrease. Subdued quantity and weakening short-term momentum recommend the potential for bearish dominance, notably if key oscillators proceed to lean towards destructive bias. A breach of assist would probably embolden sellers and problem the broader bullish construction.