The share of crypto buying and selling volumes throughout US hours accelerated once more in January. The sudden spike in exercise follows a protracted development of rising affect for the US markets, but additionally short-term enthusiasm forward of Donald Trump’s second presidency.

Bitcoin (BTC) and Ethereum (ETH) exercise spiked throughout North American enterprise hours.

The latest spike in exercise displays the keenness for Donald Trump’s second presidency, which is predicted to be beneficial to crypto buyers.

Whereas crypto is traded 24/7, probably the most lively hours take cues from conventional inventory alternate openings. Some researchers present most cryptocurrencies commerce through the enterprise hours of the most important market facilities world wide.

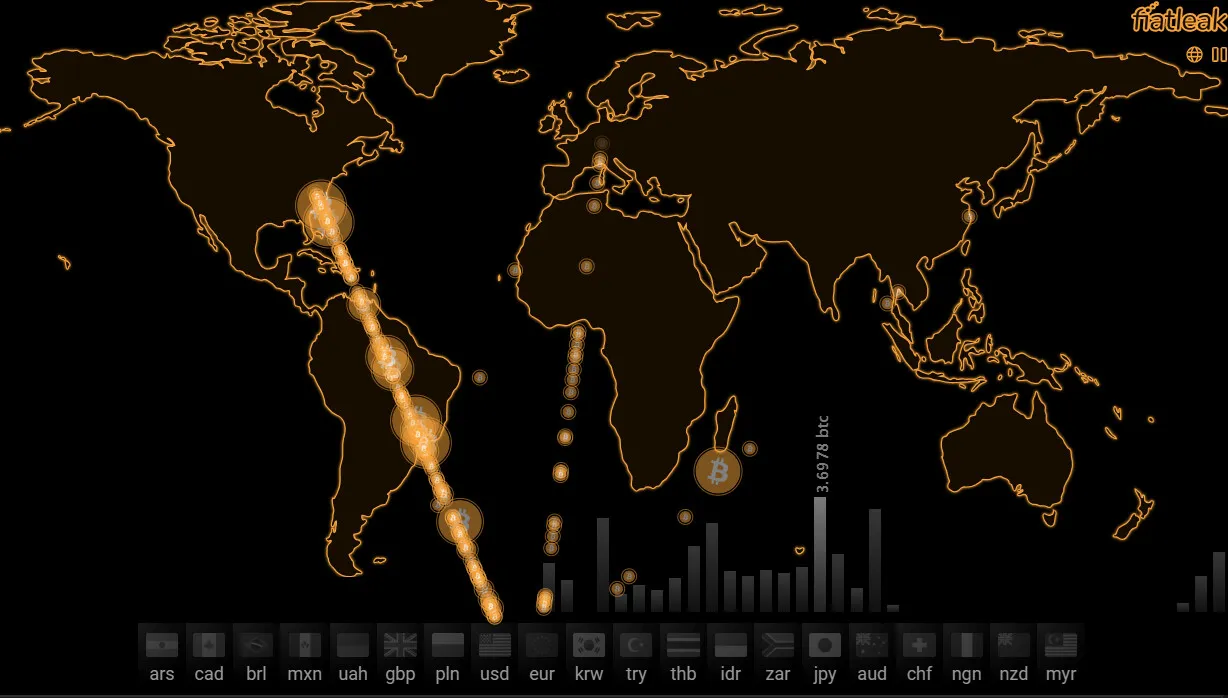

The remark of extra lively US buying and selling coincides with the patterns of FiatLeak, the place the USA is the most important purchaser of BTC at nearly all hours.

Many of the BTC shopping for is in US {dollars}, with US-based merchants main the demand. | Supply: Fiatleak

Many of the BTC shopping for is in US {dollars}, with US-based merchants main the demand. | Supply: Fiatleak

Crypto markets stay dollarized for his or her intuitive pricing, with just a few exceptions for the Euro and several other nationwide currencies. Close to-peak M2 cash provide can be boosting demand for speculative investments, selecting BTC and ETH for his or her relative liquidity. The 2 belongings even have strong by-product markets, which additionally invite localized exercise.

The overlap of buying and selling hours between Europe and the USA additionally interprets into peak exercise for BTC. The time for dramatic worth strikes roughly coincides with the opening hours of the London and New York inventory exchanges.

The shift to conventional opening hours can be an indicator of institutional exercise, the place BTC shopping for additionally occurs by means of ETF. The dominance of US-based buying and selling volumes precedes the development of specializing in ‘Made in USA’ crypto, starting from native startups to domestically mined BTC.

DEX exercise preserves time zone correlation

The exercise for BTC and ETH was primarily based on information from centralized exchanges. Nonetheless, DEX additionally preserves the development for increased US-based volumes, which was already seen final 12 months.

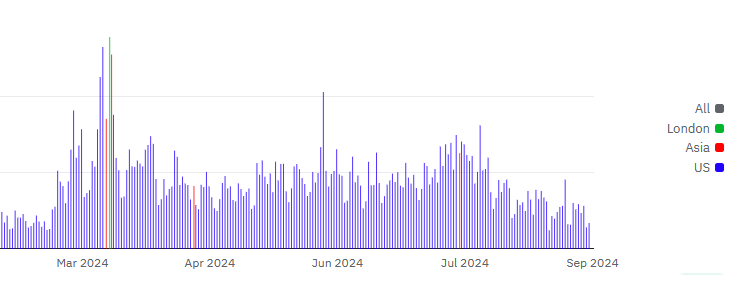

Solana is one indicator that the market is skewed towards US-based exercise. Many of the buying and selling days in 2024 confirmed a dominance of US volumes on Solana DEX.

On the Solana chain, most days noticed a predominance of US-based DEX volumes. | Supply: Dune Analytics

On the Solana chain, most days noticed a predominance of US-based DEX volumes. | Supply: Dune Analytics

The Solana development produced meme tokens from a number of areas. Nonetheless, solely a handful of days noticed a spike in exercise throughout Asian working hours. London time and EU buying and selling may additionally shift towards US-based exercise, to faucet the rising liquidity.

Solana DEX volumes on different markets have been additionally vital, however US exercise was all the time the biggest on any given day. The English language meme tradition and communities translated right into a shift to US-based merchants for Pump.enjoyable and Raydium tokens.

With a market as dynamic as Solana’s DEX, the provision of different merchants is vital. Whereas DEX are open 24 hours, and a number of the trades may be automated, nonetheless actual merchants saved to their native enterprise hours.

One other proxy for US-based exercise is the charges on Ethereum. Gasoline costs instantly react to increased DEX utilization, particularly on the Uniswap common router contract.

US establishments increase demand

The buying and selling volumes of BTC and ETH additionally mirror the influx of establishments. One other metric, Coinbase Prime’s exercise, is without doubt one of the footprints of establishments.

Important inflows to Coinbase Prime point out heightened OTC buying and selling exercise.

That is the popular $BTC accumulation methodology for US establishments.

When the whales transfer, the market feels it. pic.twitter.com/5WCDHxMVhs

— Grazi (@grazi) January 17, 2025

The OTC buying and selling volumes are separate from the on-chain and open market exercise. Coinbase’s metrics mirror the habits of each retail and institutional buyers. The centralized market, brokerage and custody are able to serving whale-sized shoppers.

With over 40% of crypto mining exercise tied to US-based swimming pools and bodily information facilities, OTC markets on Coinbase are one of many key venues for realizing income. Coinbase has proven it has the capability to soak up high-grade crypto trades. Not too long ago, a whale deposited over $1B price of BTC to one of many Coinbase addresses, with the potential to comprehend good points. The whale purchased BTC in Q3, 2024, at charges between $54K and $57K per BTC.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap