This can be a phase from the Ahead Steering publication.

Ever since COVID closed international economies in 2020, gauging the place we stand within the enterprise cycle has been a really tough act.

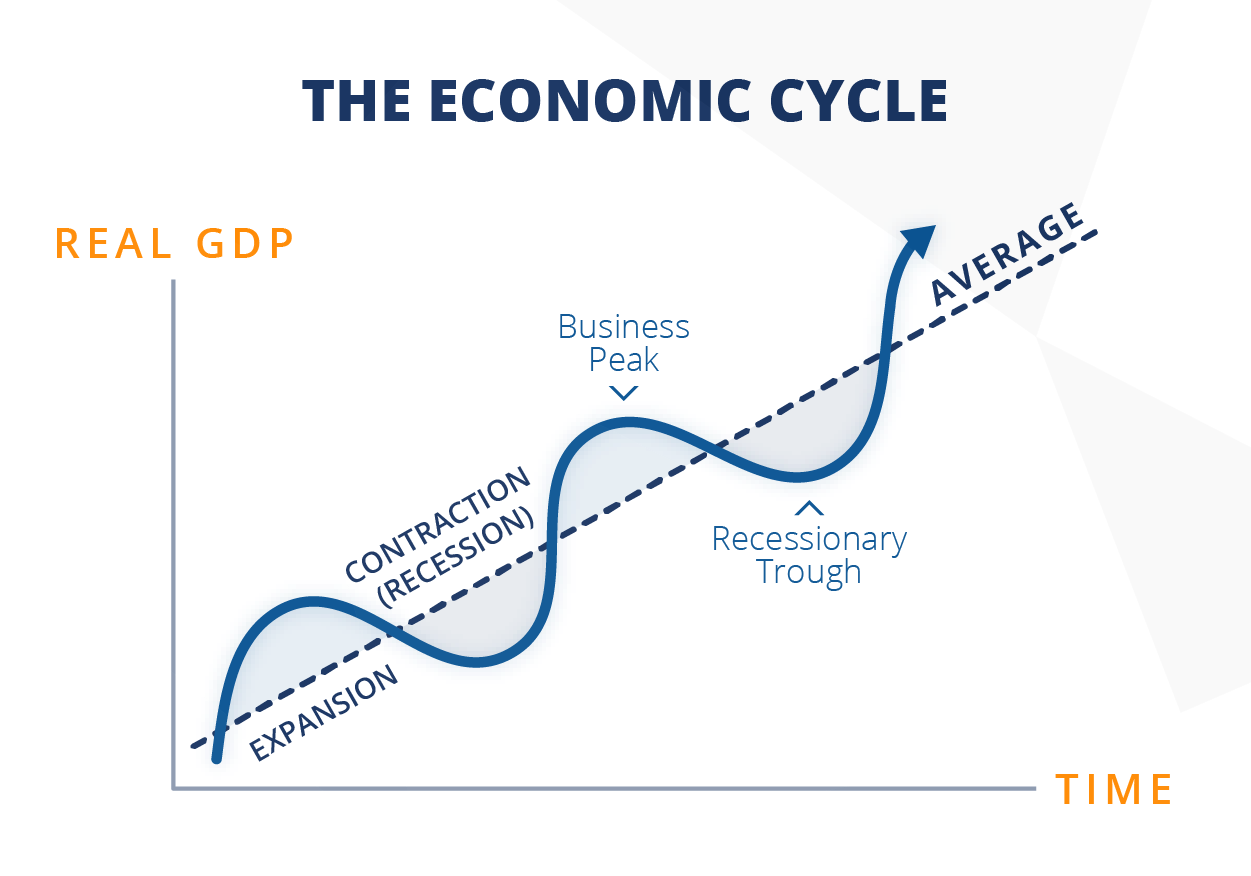

The standard enterprise cycle seems to be as follows, and traditionally, it’s been pretty simple to have a common concept of the place we stood by contrasting it with rates of interest and financial coverage:

Nonetheless, every thing has been considerably the other way up in recent times, leaving many economists befuddled.

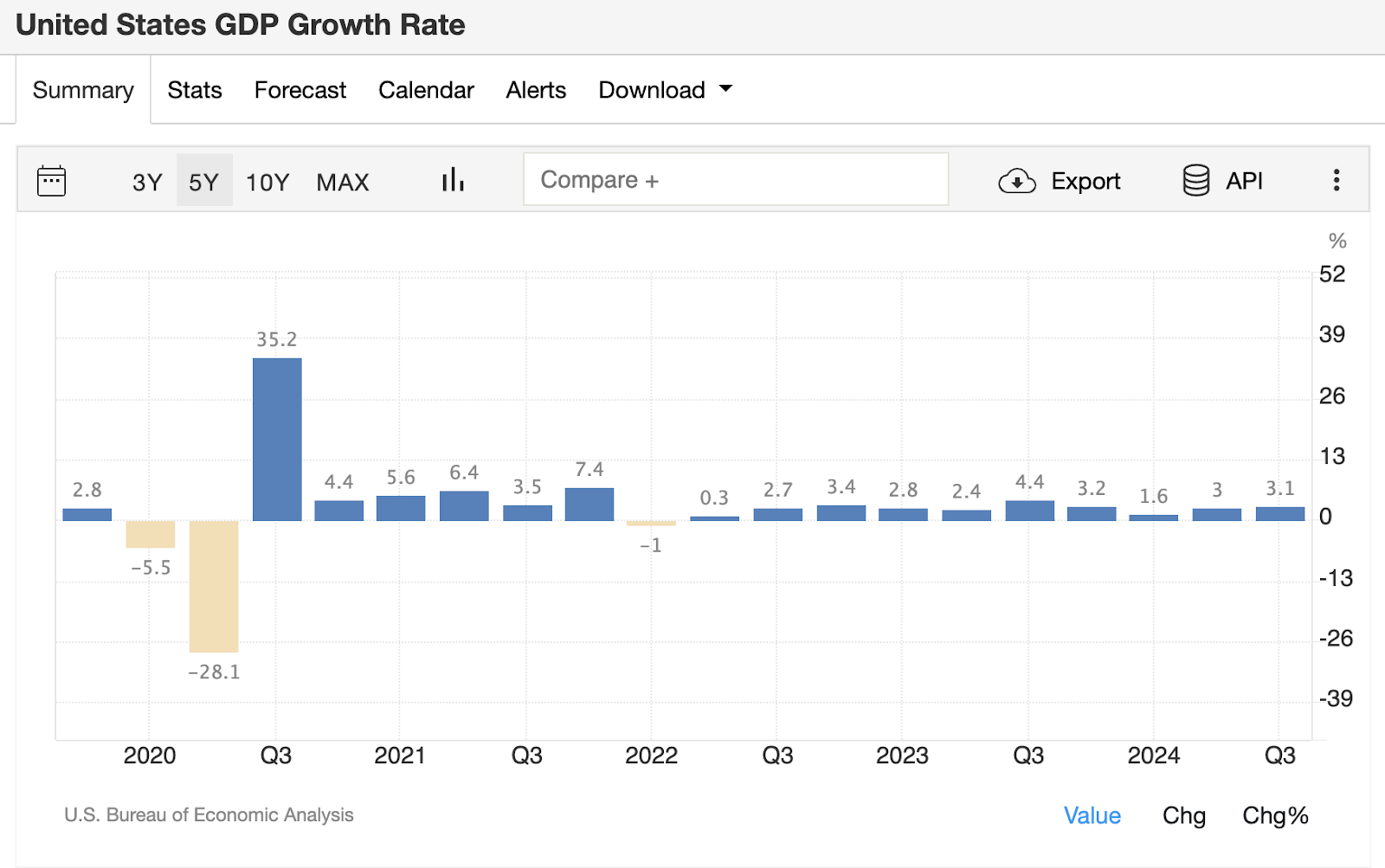

For instance, in 2022 we noticed destructive actual GDP prints (initially at two however then revised down to 1):

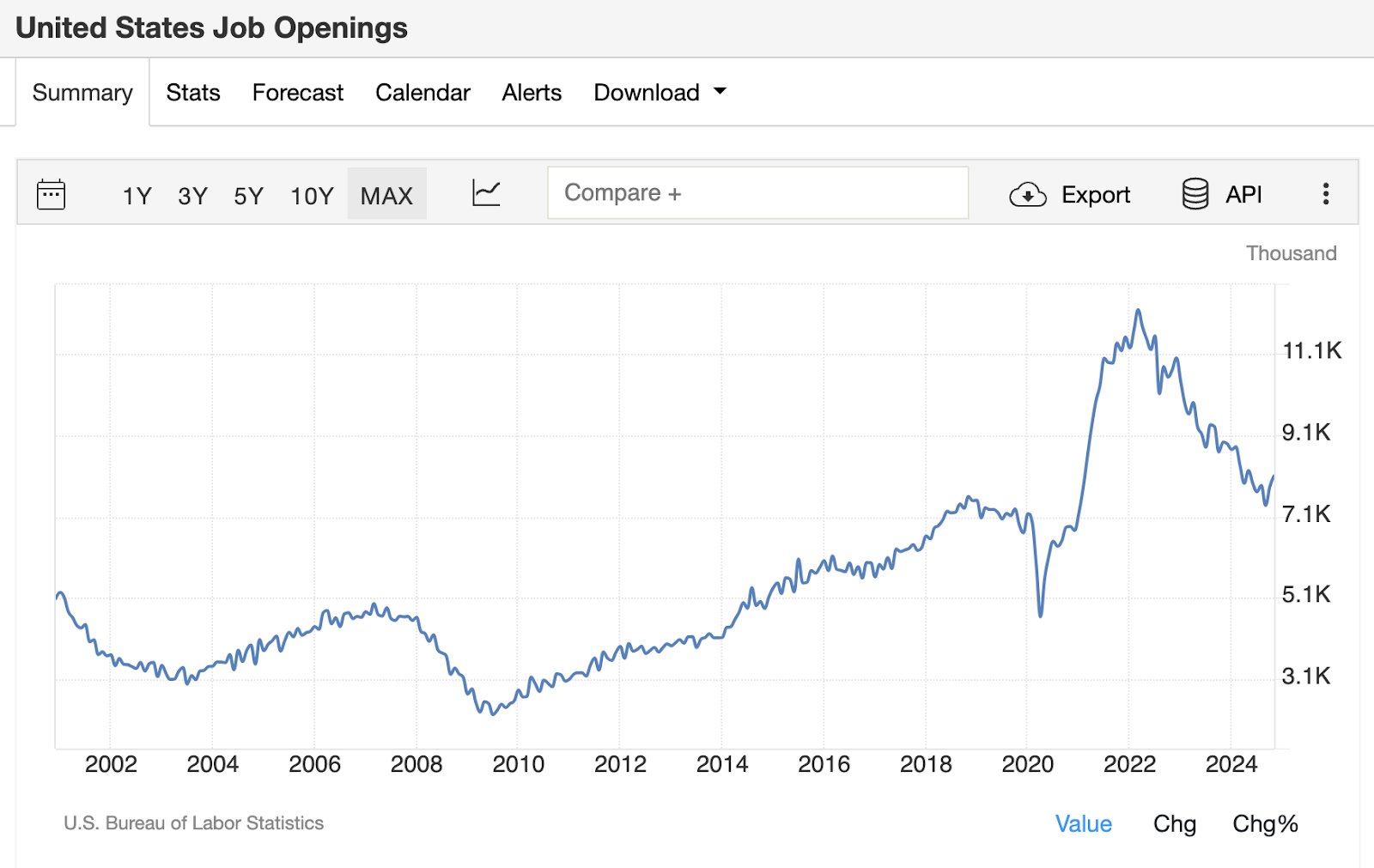

Nonetheless, throughout that very same time we noticed one of many hottest labor markets we’ve ever seen, as per JOLTS information.

It’s exhausting to imagine in a recession with a labor market that sturdy:

Since 2022, we’ve seen a significant price mountaineering cycle from the Fed that one way or the other additionally didn’t tilt the financial system right into a recession when it on an combination foundation. Shares hit new highs on a regular basis, the labor market cooled however remained resilient, and GDP development powered forward.

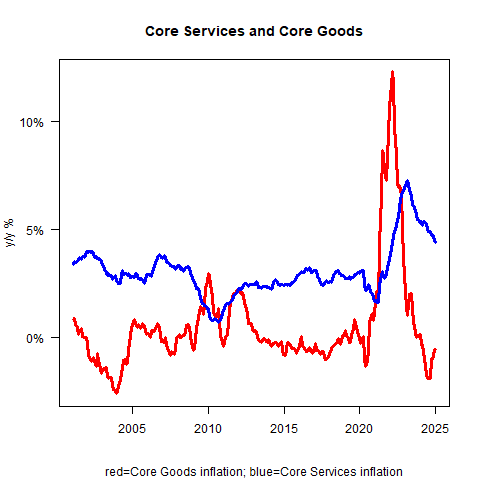

Throughout that very same time, nonetheless, when you honed in on the manufacturing and items sector and put aside the companies financial system, it virtually seems to be like we’ve simply been by a producing recession.

ISM Manufacturing PMIs have been in contraction territory for a pair years now:

Throughout that point, we noticed important disinflation resulting in outright deflation within the items sector of the financial system:

Supply: inflationguy.weblog

Supply: inflationguy.weblog

Quick ahead to at this time, and we’ve seen the Fed lower charges to frontrun issues concerning the labor market and proceed making an attempt a delicate touchdown of the financial system the place we transfer into a brand new enterprise cycle with out a recession.

We’re now seeing main indicators hinting that the manufacturing sector may be exiting the doldrums and heading towards a brand new upswing.

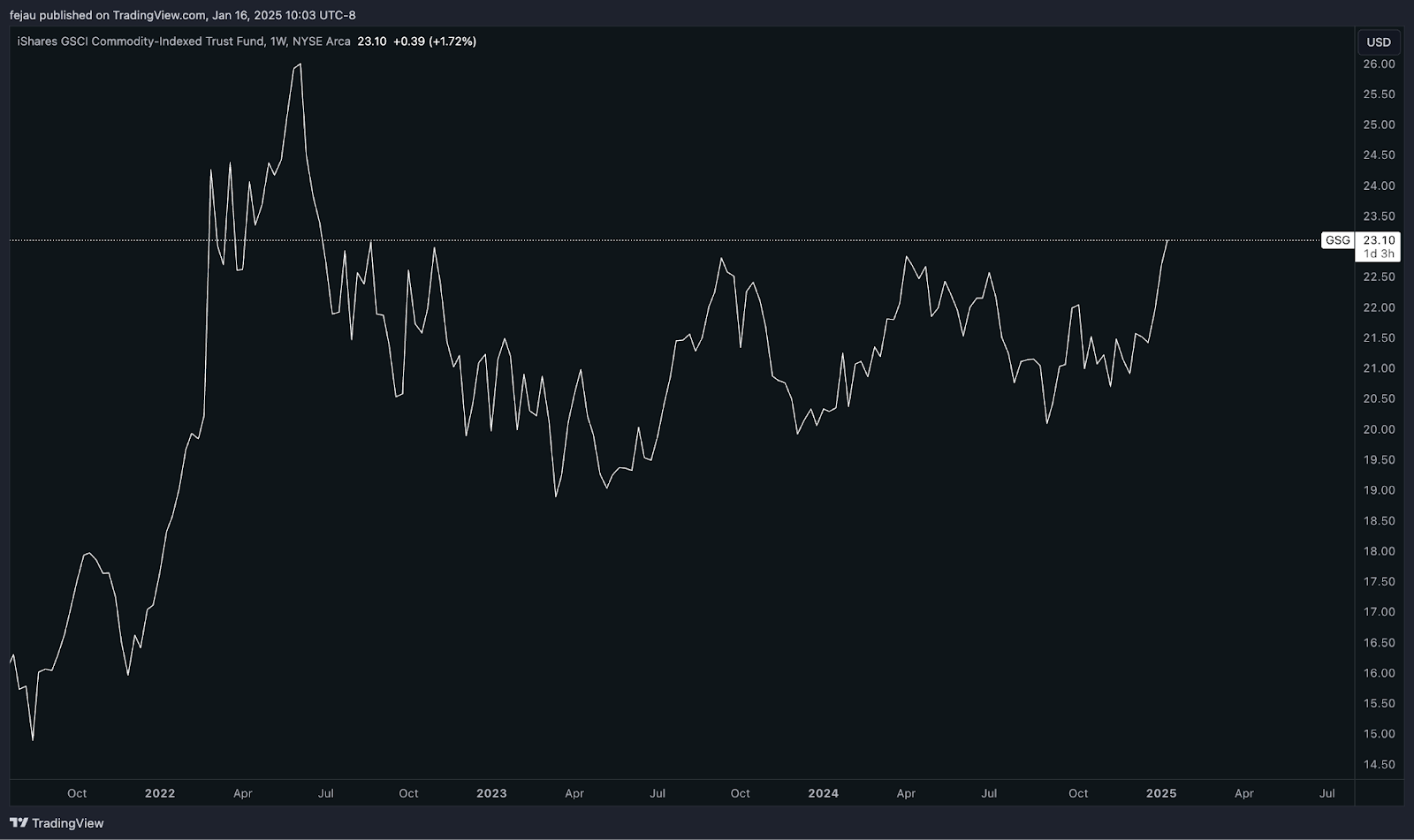

We’re beginning to see commodities start to interrupt out after two years of consolidation, hinting at an upswing in financial development:

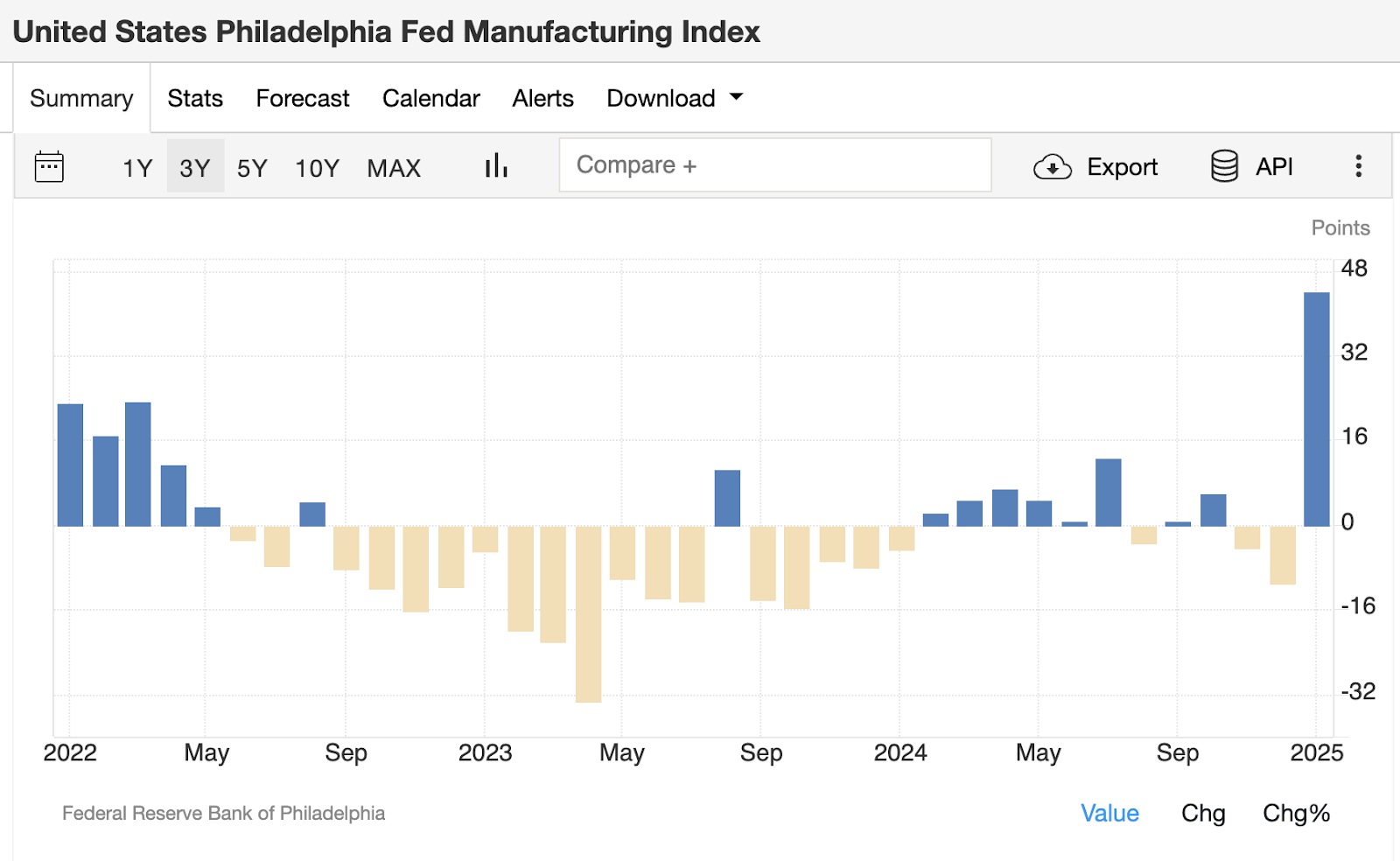

ISM new orders look to be breaking out, in addition to the Philly Fed manufacturing index:

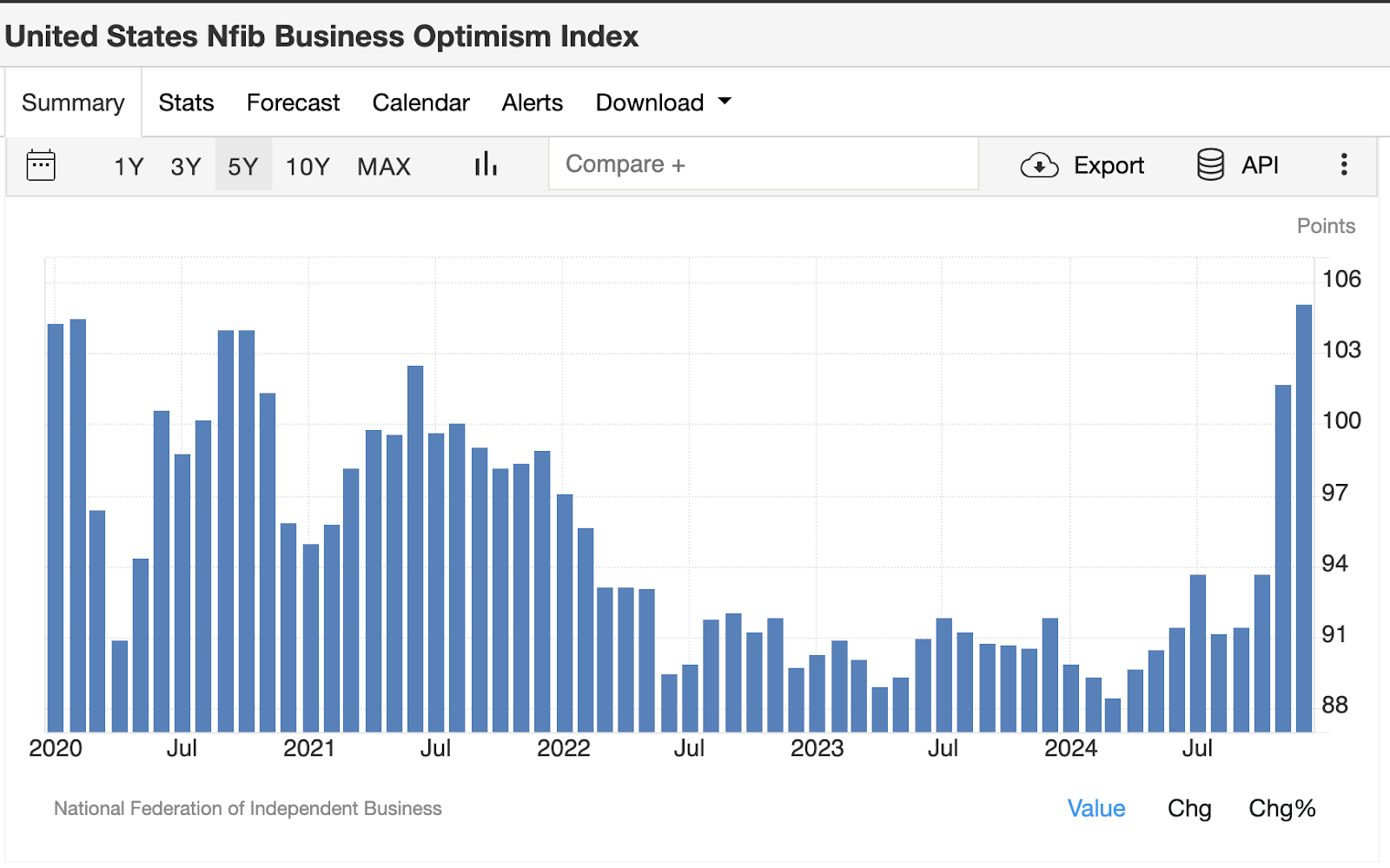

Per the survey information, it’s trying like a lot of that is being led by optimism from the enterprise sector ever because the election:

So the place does this chart-geeking journey lead us?

I believe it’s secure to say we’re not late within the cycle. It more and more seems to be like we’re actually within the early innings of a brand new enterprise cycle that prevented a recession because of the large fiscal stimulus and deficits over the past couple of years.