Bitcoin (BTC) has rebounded to commerce above $99,000 following its important dip earlier this week. Whereas the newest US Client Worth Index (CPI) information seems to have contributed to this fast restoration, it has additionally drawn consideration from analysts, who’re carefully monitoring key metrics to know the market’s subsequent transfer.

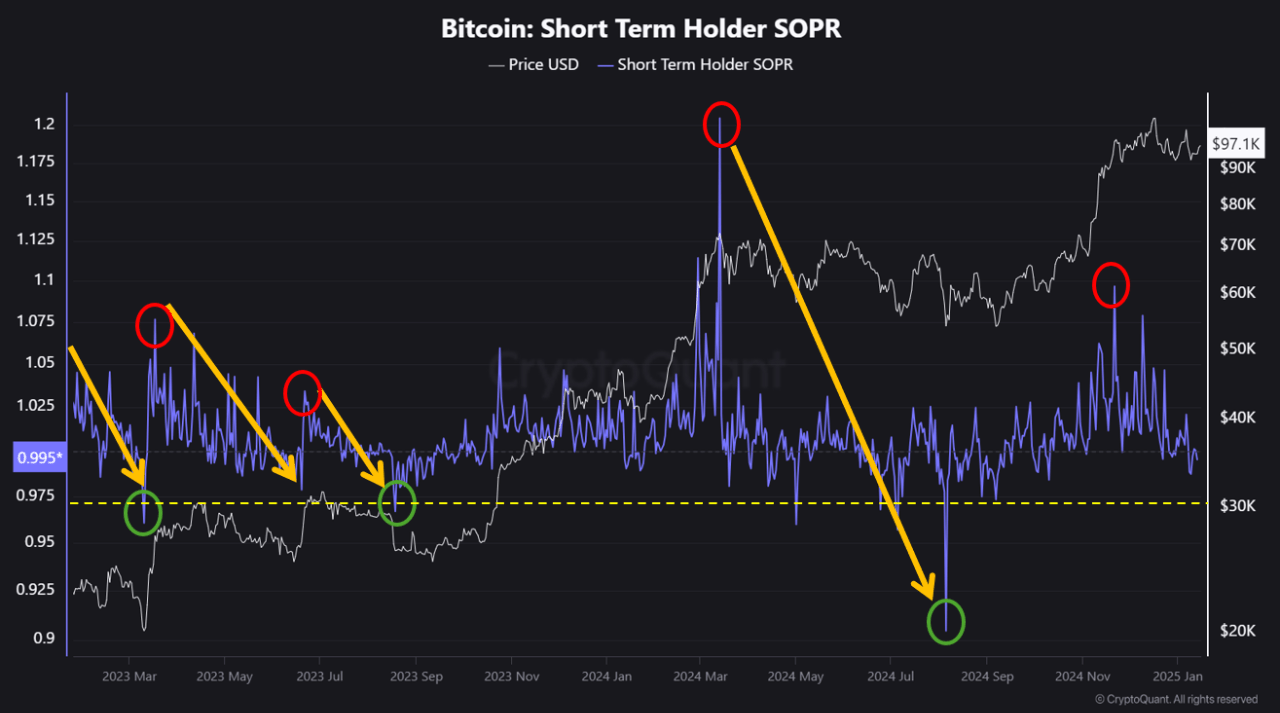

A CryptoQuant contributor often known as Crypto Dan lately supplied insights into Bitcoin’s present market conduct. Highlighting the Quick-Time period Spent Output Revenue Ratio (SOPR), Dan noticed that the metric has proven a recurring sample throughout correction phases.

This sample, he famous, usually dampens market optimism earlier than a subsequent rebound. Regardless of the latest correction, indicators level to the potential resumption of an upward cycle within the close to future.

Quick-Time period SOPR Evaluation And What It At the moment Suggests For BTC

The SOPR metric measures the profitability of spent outputs relative to their realized worth, offering insights into market contributors’ conduct throughout value corrections.

In accordance with Crypto Dan, throughout corrections, the SOPR oscillates between purple and inexperienced zones. The purple zone indicators elevated profit-taking, usually pushed by whale exercise, which may prolong correction intervals. Conversely, the inexperienced zone signifies lowered promoting stress, setting the stage for potential rebounds.

Dan reveals that the SOPR at present reveals a smaller quantity of profit-taking in comparison with earlier correction intervals, such because the seven-month correction earlier within the 12 months.

This development means that the latest correction, which has lasted over a month, could also be shorter in length. Dan speculates that Bitcoin might resume its upward development throughout the first quarter of 2025.

Nonetheless, he cautioned that short-term volatility stays a danger, with the opportunity of additional sharp drops earlier than a sustained reversal. The analyst wrote:

Nonetheless, within the quick time period, there should be one or two sharp drops that push SOPR beneath the yellow dotted line, probably crushing market contributors’ hope for a rally earlier than the market reverses upward. As such, aggressive short-term trades ought to be approached with warning.

Bitcoin Market Efficiency And Outlook

In the meantime, Bitcoin seems to now be making its method again above the $100,000 mark because the asset at present trades at a value of $99,494, on the time of writing marking a 2.7% enhance prior to now day.

This enhance in Bitcoin’s value apart from being attributed to the underlying constructive metrics on the BTC community will also be linked to the newest replace on the US CPI.

In accordance with the newest experiences, the US CPI rose by 0.4% in December—this information has resulted within the US Greenback seeing a notable plunge whereas different monetary property noticed the other development recording an uptick.

Featured picture created with DALL-E, Chart from TradingView