Company treasury Bitcoin holdings have doubled within the final 12 months, in keeping with information shared by Bitwise govt Bradley Duke. Duke, the co-founder of ETC Group and Head of Europe for Bitwise, famous that that is just the start of Bitcoin adoption.

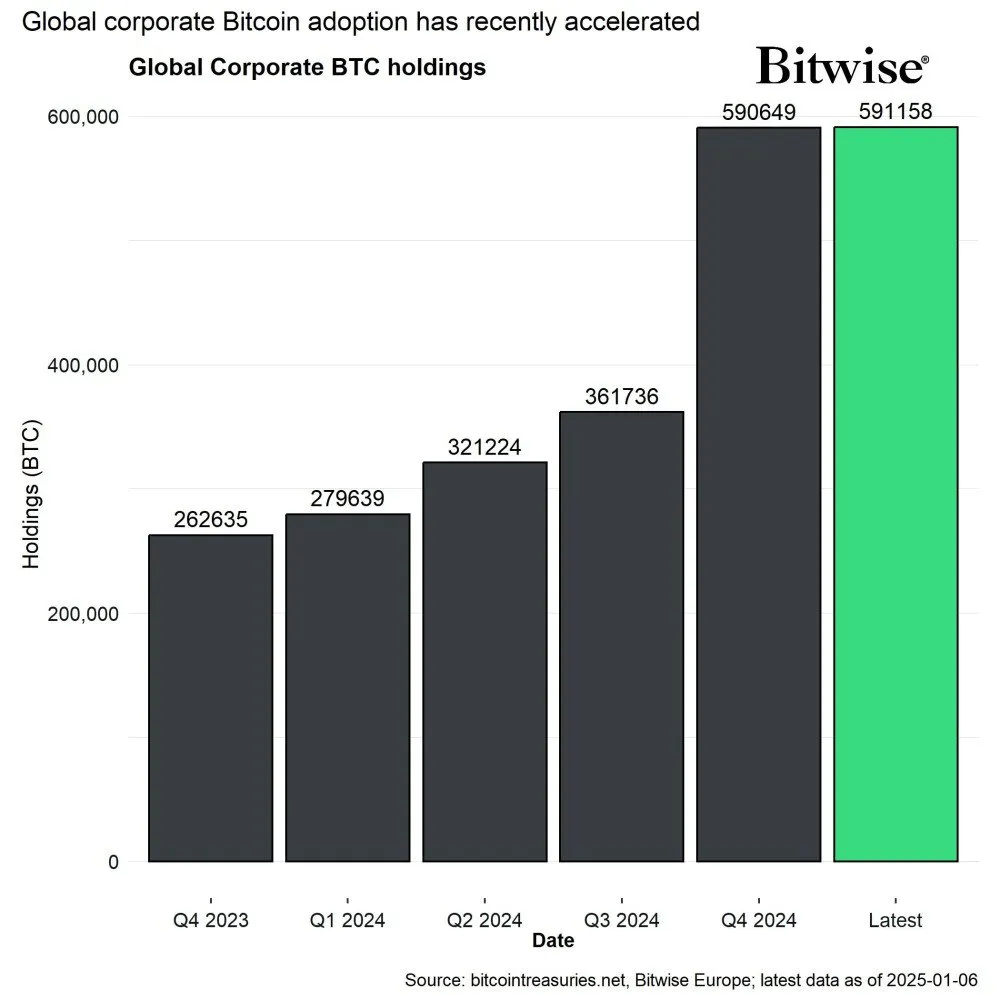

In accordance with the info, BTC holdings in company treasury went from 262,632 BTC as of 2023 This autumn to 590,649 by 2024 This autumn. It has now elevated to 591,158 BTC, and Duke expects the adoption fee to extend considerably in 2025.

Company Bitcoin Treasury (Supply: Bitwise)

Company Bitcoin Treasury (Supply: Bitwise)

He stated:

“I imagine we’re simply in the beginning of company treasury adoption and totally anticipate large progress on this space in 2025.”

His expectations won’t be removed from actuality, given what number of corporations have deliberate to extend their holdings this yr. Japan’s Metaplanet, which at present holds round 1,762 BTC, has already stated it’ll enhance its holdings to 10,000 BTC in 2025.

In the meantime, different corporations have already acquired BTC to satisfy their 2025 goal. Vitality administration agency Kurltechnologg just lately purchased a further 213.43 BTC for $21 million and elevated its Bitcoin holdings to 430.61 BTC.

MicroStrategy leads company Bitcoin holdings

Regardless of a number of different corporations’ acquisitions, MicroStrategy accounts for many of the company Bitcoin purchases in 2024. It just lately introduced its final Bitcoin buy in 2024, an acquisition of 1,070 BTC for $101 million at a mean worth of round $94,000 per BTC. The corporate now holds 447,470 BTC, which it purchased for $27.97 billion.

General, MicroStrategy spent $22 billion final yr to purchase over 258,000 BTC. This implies the Michael Saylor-led firm alone was liable for round 80% of all company BTC acquisitions in 2024, creating $14.06 billion in shareholder worth for the yr.

Though the corporate seems to have paused Bitcoin acquisition for some time, many anticipate it’ll quickly resume its shopping for spree, significantly after it introduced a $2 billion capital increase. The MicroStrategy acquisition is a part of its goal to spend $42 billion buying BTC over the subsequent few years.

In the meantime, many anticipate the corporate’s Bitcoin stockpile to offer it an enormous benefit now that the brand new Monetary Accounting Requirements Board (FASB) Truthful Worth accounting guidelines will turn into relevant. Underneath the foundations, corporations can measure crypto at its present worth and replace it for every reporting interval.

In accordance with Bitcoin advocate Bitcoin Overflow, the huge appreciation within the worth of MicroStrategy Bitcoin holding will now be evident beneath this rule.

He wrote:

“Assuming $MSTR’s current purchase was accomplished by Dec thirty first, its 447,470 complete bitcoin have at present appreciated $3.85B to date in Q1. With FASB FV accounting kicking in, that’s $642M per day in earnings for Q1 to date.”

Maybe on account of this cause and the resurgence within the worth of BTC, MSTR inventory can be rebounding after falling 45% from its peak. It’s already up 30% yr up to now, with its market cap now reaching $93 billion, sufficient to ship it again into the record of the highest 100 corporations by market cap.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap