Ethereum not too long ago confronted a minor rejection on the vital $4K resistance zone, underscoring the presence of sellers at this stage.

A pullback towards the $3.5K assist space might comply with, offering a possibility for consumers to re-enter the market with the purpose of reclaiming the $4K threshold.

Technical Evaluation

By Shayan

The Each day Chart

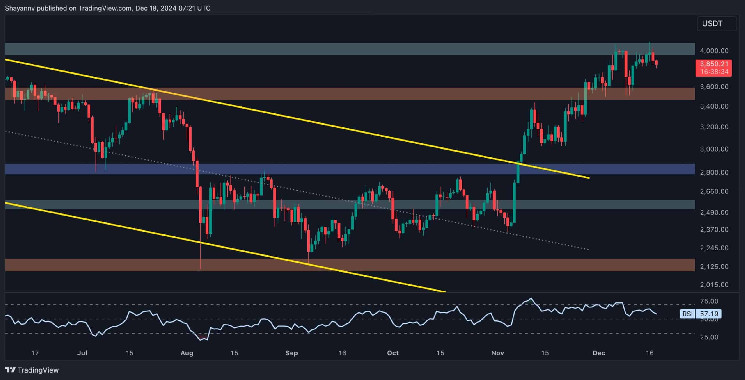

Ethereum not too long ago confronted one other rejection on the pivotal $4K resistance stage, highlighting the sturdy presence of sellers on this zone. This has created a difficult surroundings for consumers making an attempt to maintain the uptrend towards a brand new all-time excessive.

The worth motion suggests the formation of a double-top bearish reversal sample, signaling the potential for a retracement towards the $3.5K assist zone. Ethereum stays range-bound between $3.5K and $4K, with a breakout seemingly after the consolidation section. A bullish breakout above $4K would pave the best way for additional upward momentum.

The 4-Hour Chart

On the 4-hour timeframe, ETH confirmed renewed power after consumers stepped in close to the ascending channel’s decrease boundary. This shopping for exercise sparked a recent rally, driving the value towards the channel’s center boundary, aligning with the vital $4K resistance stage.

Nonetheless, the asset encountered a rejection at this zone, resulting in a decline. Ethereum is now oscillating between the decrease boundary of $3.7K and the $4K resistance. Within the mid-term, additional bearish retracement towards the decrease boundary, adopted by a renewed try to reclaim the $4K resistance, seems seemingly. A profitable breakout above $4K may sign the continuation of Ethereum’s bullish pattern.

Onchain Evaluation

By Shayan

This chart illustrates Ethereum’s Binance liquidation heatmap, highlighting potential value ranges the place important liquidation occasions may happen. The clustering of liquidation ranges inside a selected vary means that the value will seemingly transfer towards that zone. These ranges function useful indicators for predicting value path and figuring out areas of potential convergence.

As proven, there’s a notable focus of liquidity simply above the vital $4K resistance, representing the liquidation ranges for brief positions. This makes the $4K area a sexy goal for whales and enormous institutional gamers, rising the chance of a bullish breakout within the mid-term.